Overlay Protocol is a decentralized finance (DeFi) platform that enables users to build positions on markets or data streams without traditional counterparties (liquidity providers or market makers) taking the other side of the position.

What Is Overlay Protocol?

Built on the Arbitrum blockchain, this protocol offers markets based on non-manipulable and unpredictable numerical data feeds. This makes Overlay unique within the Ethereum ecosystem, providing deep liquidity and eliminating the need for traditional swap mechanisms.

Overlay Protocol Market Types

Overlay aims to offer various markets based on non-manipulable and unpredictable data feeds. These include:

- Non-traditional crypto markets: Hash rate, gas fees, BTC difficulty, NFT floor prices, social tokens, yield rates, etc.

- Non-crypto markets: E-sports and sports, sneaker prices, scalar social-political markets, nature and science markets, etc.

This broad scope allows Overlay to facilitate trading on digital data streams, setting it apart in the DeFi space.

How Does Overlay Offer Markets Without Counterparties?

In Overlay, users build positions directly against the protocol or, more precisely, against all OVL token holders simultaneously. This model provides deep liquidity without requiring liquidity providers or traditional swap-based counterparties. The dynamic minting or burning of OVL tokens is used to manage inflation risk. For more details, refer to the protocol’s official documentation.

Pricing and Oracle Usage

Pricing in Overlay markets is not dynamic in the traditional sense; it relies on data intermittently fetched from oracles. These values are adjusted by built-in protocol mechanisms. Overlay can integrate nearly any oracle, provided the feed is non-manipulable and unpredictable. For instance, Chainlink-like oracles support data streams like the Consumer Price Index (CPI), enhancing the platform’s flexibility.

How Does Trading Work? (Collateral and Profit/Loss)

To open a position in Overlay markets, users must lock OVL tokens as collateral. Profit and loss (PnL) are settled in OVL. If a position is profitable, the protocol mints OVL to pay the user; if it incurs a loss, the locked OVL is burned to the extent of the loss. This dynamic mint-and-burn mechanism supports the platform’s liquidity and community incentives.

Overlay Protocol (OVL) Tokenomics

OVL is the native ERC-20 token of Overlay Protocol, serving two primary functions:

- Trading Participation: Users lock OVL as collateral to open positions in Overlay markets. Profitable positions lead to OVL minting, while losses result in OVL burning.

- DAO Governance: OVL holders can vote on governance proposals, contributing to the community’s development.

Token Details:

- Symbol: OVL

- Initial Supply: 88,888,888

- Maximum Supply: 1,000,000,000 (per certain launch partner requirements; however, the protocol follows a deflationary trend and has no plans to reach this level).

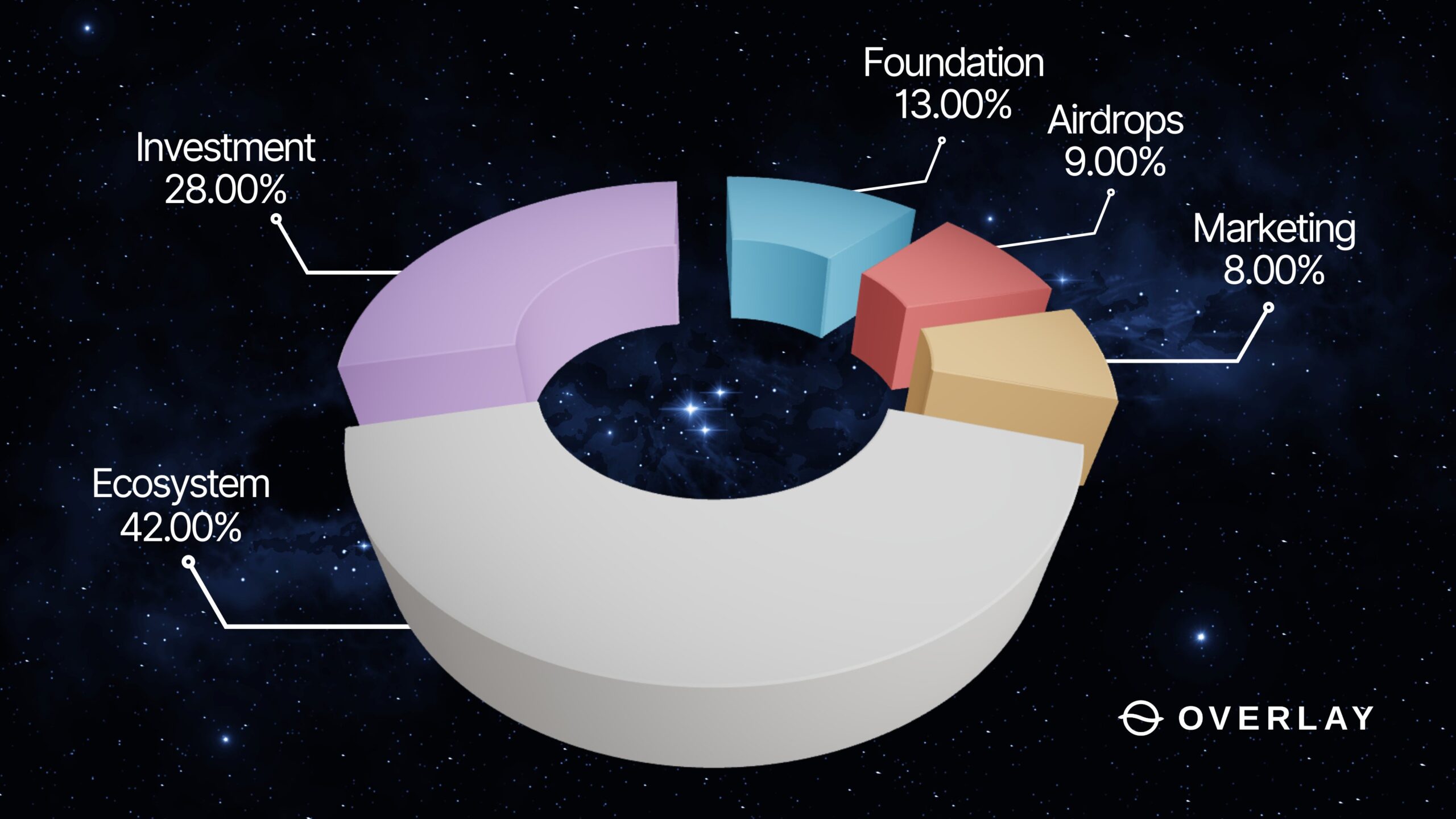

Token Allocation:

- Ecosystem: 42%

- Airdrop: 9%

- Marketing: 8%

- Strategic Partners: 28%

- Overlay Foundation: 13%

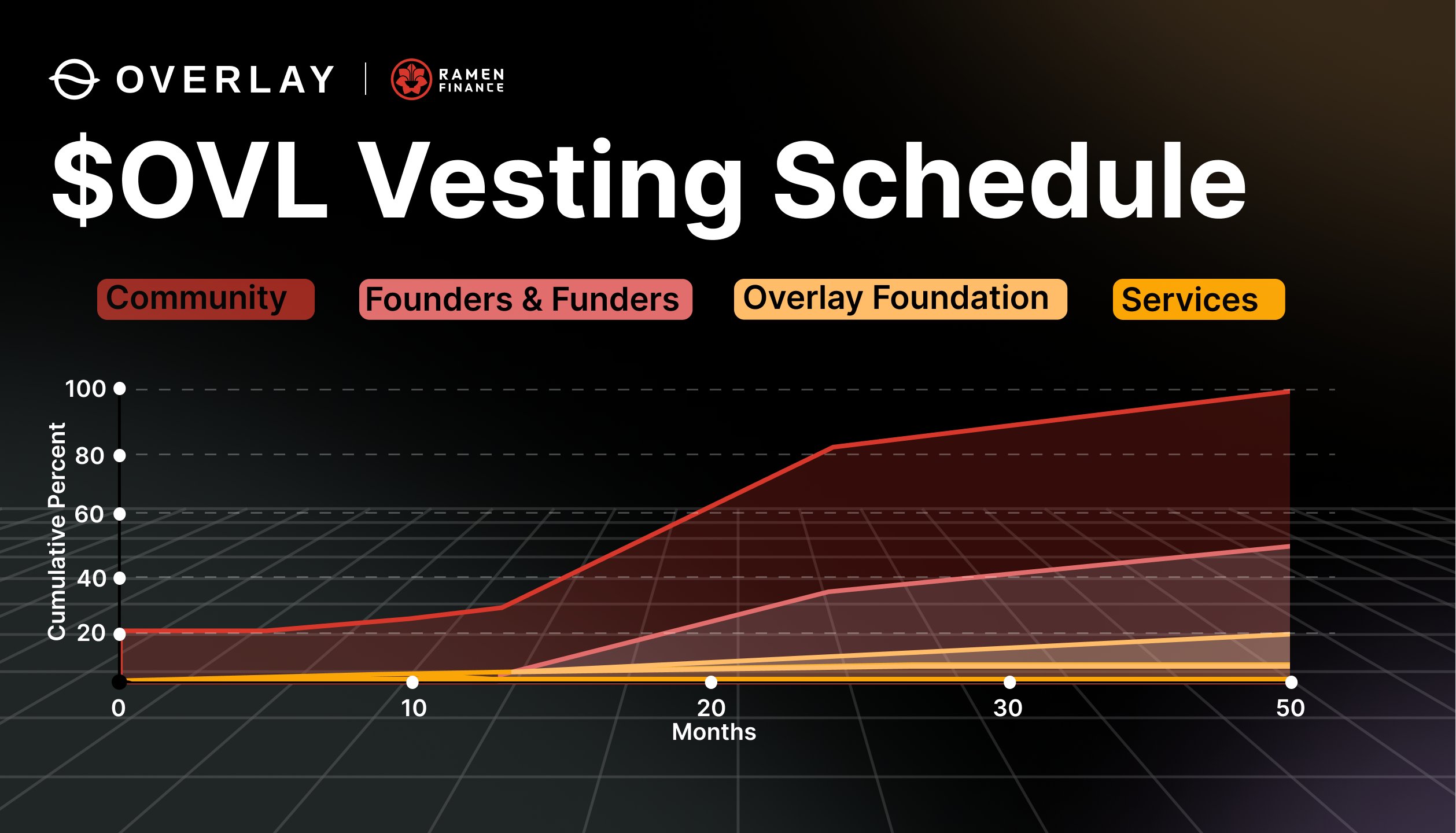

Overlay Protocol (OVL) Vesting Schedule

Nature of Contracts

Positions in Overlay markets resemble perpetual futures contracts (perps), with no expiration date or physical delivery, allowing contracts to roll over indefinitely. However, Overlay contracts have distinct features compared to traditional perps. For more details, refer to the protocol’s official documentation.

Governance

Overlay Protocol is governed by the PlanckCat DAO, and in the future, OVL token holders will have voting rights. Voting weights are as follows:

- 1 PCD NFT = 100,000 votes

- 1 OVL token = 1 vote

This balance may change in the future. The PlanckCat DAO enables Overlay contributors to participate in governance through PCD NFTs, playing a central role in decision-making, such as listing or delisting markets and setting risk parameters. Non-PCD NFT holders can still engage in discussions via Discord and the Governance Forum.

How Is Overlay Different?

What Are Perpetual Futures Contracts (Perps)?

Perps are a popular derivative contract type in crypto markets, allowing users to take long or short positions on an underlying asset without owning it, while paying or receiving funding based on market conditions. Unlike traditional futures, perps have no expiration date or asset delivery, rolling over indefinitely. Overlay market contracts share this structure but include unique features.

Oracle-Based Pricing

Overlay uses oracle-based data feeds and native mechanisms for pricing, avoiding centralized limit order books (CLOB) used by traditional exchanges, where prices are based on the last purchase. Other on-chain perp protocols like Perp Protocol and GMX also use oracle-based pricing.

Lack of Traditional Counterparties

Overlay does not require traditional counterparties to take the other side of a position. When a position is closed:

- Profitable positions prompt the protocol to mint OVL for payment.

- Loss-making positions result in the burning of the user’s OVL collateral.

While this carries inflation risk, Overlay mitigates it through risk management mechanisms.

No Limit Orders

Overlay v1 does not support limit orders; only market orders are executable. Traditional CLOB or liquidity pool-based exchanges typically support limit orders.

Funding Rates

Overlay calculates funding rates based on open interest imbalances rather than spot-futures price discrepancies. These rates incentivize users to balance long and short positions, reducing imbalances.

Pricing and Price Impact

Overlay relies on oracle data for pricing, using mechanisms like TWAP (Time-Weighted Average Price), bid-ask spreads, and price impact/slippage. TWAP prevents oracle manipulation, with short (e.g., 10-minute) or long (e.g., 1-hour) TWAPs selected based on price stability. Bid-ask spreads prevent frontrunning of short TWAPs and protect against sudden price spikes. Price impact is adjusted based on order size and market liquidity.

Risk Management: Payoff Caps, Open Interest Caps, and Circuit Breaker

Overlay manages OVL inflation risk with the following mechanisms:

- Payoff Caps: Per-position limits on profit/loss, set by the DAO for each market.

- Open Interest Caps (OI Caps): Per-market limits on total open interest, determined by the community to quantify inflation risk.

- Circuit Breaker: Temporarily adjusts OI caps to cool markets after large payouts, limiting new position sizes.

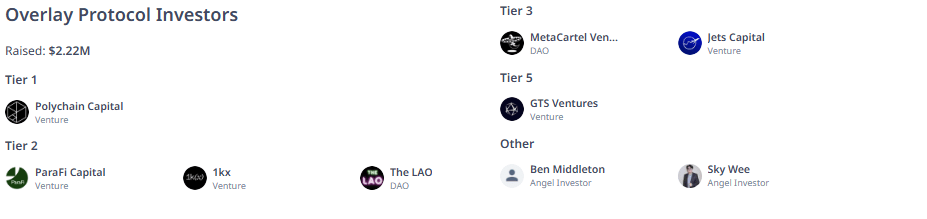

Overlay Protocol Investors

Protocol has raised $2.22 million, backed by prominent investors such as Polychain Capital, ParaFi Capital, 1kx, The LAO, MetaCartel Ventures, Jets Capital, GTS Ventures, Ben Middleton, and Sky Wee. This strong support underscores the project’s credibility in the DeFi community.

Official Links

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.