The recent volatility in the crypto market has ushered in a new phase as Bitcoin (BTC) fell below $118,000. Binance data reveals that this decline was driven by a massive wave of liquidations and the closure of leveraged positions. Traders using high leverage rushed to exit their trades, creating heavy market pressure that fueled the drop.

Sharp Decline in Binance Open Interest

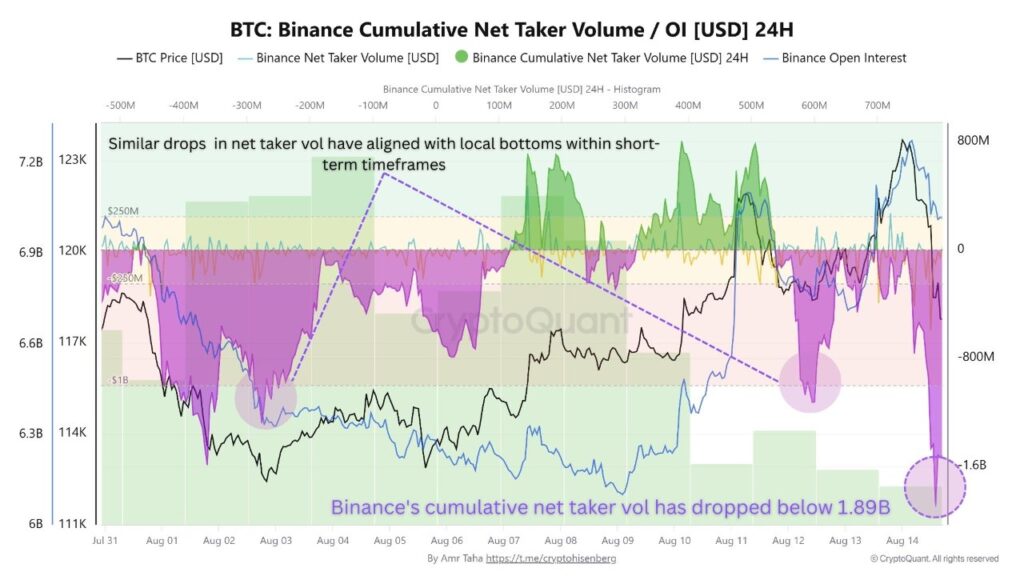

Binance’s Open Interest (OI) data clearly shows the shift in market sentiment. As Bitcoin dropped from $124,000 to $118,000, Open Interest on Binance fell by nearly 5%. This sharp decline indicates that traders either exited the market or closed their positions. In uncertain conditions, investors tend to remain cautious. Such declines often occur after significant price moves, highlighting that market participants are steering away from risk.

Additionally, Binance’s cumulative net taker volume decreased by $1.89 billion. This sharp decline signals the presence of strong selling pressure. Historically, similar drops have coincided with short-term market bottoms. This suggests that the selling pressure might have peaked, potentially signaling a dip-buying opportunity.

Binance’s Cumulative Net Taker Volume Hits Rock Bottom

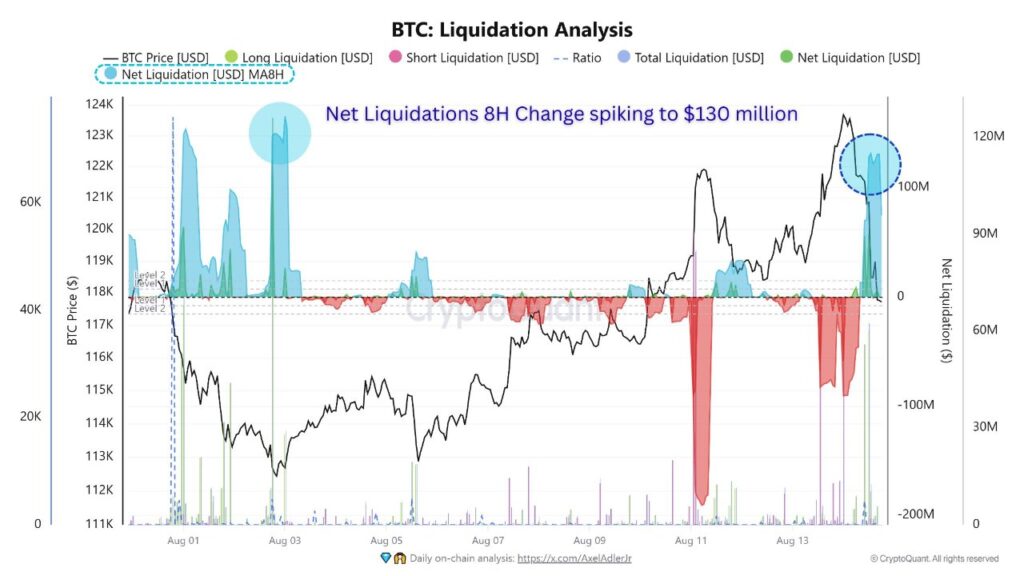

The latest data indicates that late long positions were largely closed. Traders who opened longs just before Bitcoin peaked are now exiting at a loss. This directly contributes to the drop in Open Interest and net taker volume, reflecting a “long squeeze” in the market. A long squeeze happens when falling prices trigger the liquidation of leveraged long positions, creating a domino effect that accelerates the decline.

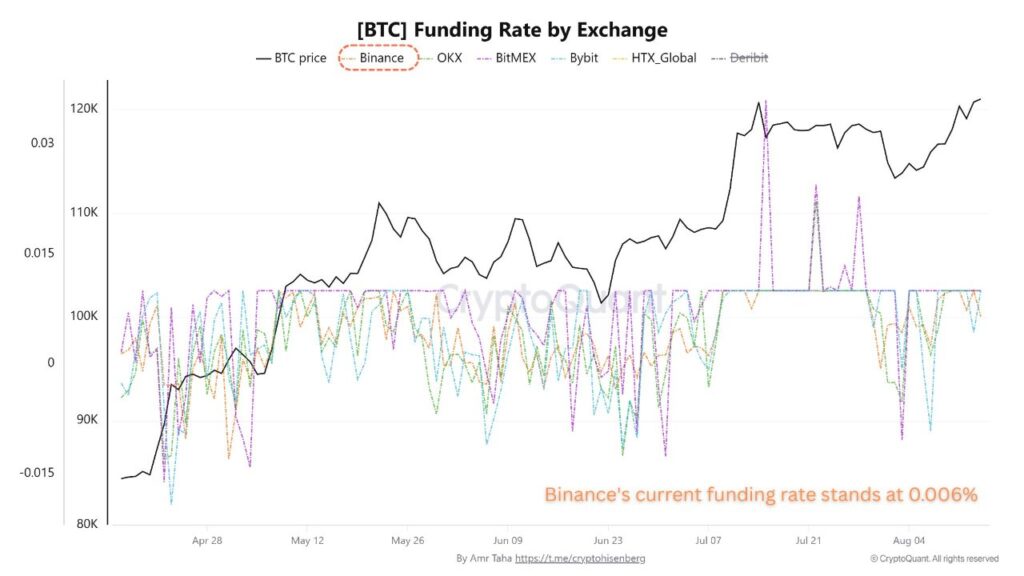

Liquidation analysis confirms this scenario. Net liquidations surged by $130 million within just 8 hours, showing mass long wipeouts. Meanwhile, Binance’s funding rate dropped to 0.006. Low funding rates signal weakened bullish appetite in leveraged positions, paving the way for liquidation cascades. Ultimately, all this data suggests a market reset, with overly leveraged positions being flushed out.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.