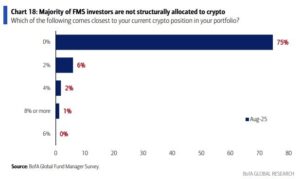

Bank of America’s (BofA) Global Fund Manager Survey has revealed institutional investors’ stance toward cryptocurrencies. According to data shared on August 17 by Nate Geraci, co-founder of the ETF Institute, the vast majority of global fund managers still operate with zero exposure to cryptocurrencies.

Zero Exposure Dominates in Crypto Investments

A significant portion of the investors surveyed reported holding no crypto assets in their portfolios. This indicates that, despite increasing institutional interest in recent years, traditional fund managers still exhibit considerable caution toward cryptocurrencies.

Among the small number of fund managers who do invest in crypto, the average allocation in their portfolios is only 3.2%. This figure demonstrates that, on a global scale, crypto assets still occupy a limited place in mainstream investment portfolios.

Reasons for Institutional Investors’ Hesitation

According to experts, there are several reasons why institutional fund managers show limited interest in cryptocurrencies:

- Regulatory uncertainties

- High volatility and perceived risk

- Search for safe havens in traditional markets

- Risk management constraints in investment policies

These factors are key elements that slow down large funds’ approach to crypto investments.

What It Means for the Crypto Market

The Bank of America survey shows that the crypto market has not yet gained broad acceptance among institutional investors. However, the growing demand for spot Bitcoin ETFs, accelerated regulatory developments in the U.S., and advancements in areas such as RWA (real-world assets) are seen as factors that could potentially change fund managers’ stance in the near future.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.