Every year in August, the Jackson Hole conference in Wyoming, USA, stands out as one of the most important events for the global economy. This year, all eyes are once again on Federal Reserve (FED) Chair Jerome Powell and the messages he will deliver.

What is the Jackson Hole Meeting?

The Jackson Hole meeting is a highly anticipated event in the global financial world, where central bankers, leading economists, and policymakers come together. Key topics such as monetary policy, global economic balance, and market expectations are discussed during the conference.

In particular, signals regarding interest rate decisions and liquidity policies make the meeting highly significant for investors. That’s why Jackson Hole is considered a guide not only for the U.S. but also for global markets.

Powell’s Speech This Year

Powell’s speech is scheduled for Friday, August 22, around at 10 a.m. Eastern Time. Investors are especially focused on whether Powell will give a clear signal about an upcoming rate cut ahead of the Fed’s September policy meeting.

This year’s speech carries extra weight for Powell personally, as his term ends next year—meaning this could be one of his last major appearances at Jackson Hole. Markets are eager to see how he will balance signs of a weakening labor market with persistent inflation pressures.

Weakness in the Labor Market

Recent data show signs of a slowdown in the U.S. labor market. Non-farm payrolls came in well below expectations, and previous months’ numbers were revised downward. The unemployment rate rose to 4.2%, while weekly jobless claims climbed to their highest level since 2021.

This situation raises concerns regarding the Fed’s “full employment” mandate. As a result, markets are closely watching whether Powell will highlight this weakness and signal a stronger possibility of a rate cut.

Inflation Risks Still Persist

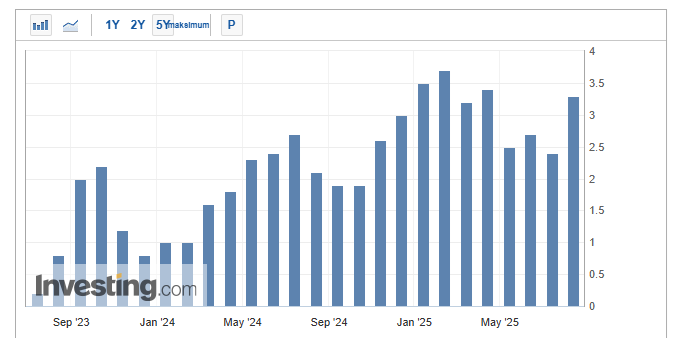

On the other hand, the inflation picture remains challenging. The Producer Price Index (PPI) reached a three-year high, and while CPI came in line with expectations, core inflation continues to trend upward. This makes Powell’s job more complicated, as it limits the Fed’s room to cut rates aggressively.

Possible Scenarios

Analysts point out three potential scenarios for Powell’s Jackson Hole remarks:

-

Signal a rate cut: He may cite labor market weakness as justification, boosting expectations for a September cut.

-

Stress inflation risks: Powell could dampen market expectations by emphasizing, “We are not yet aligned with our inflation target.”

-

Stay data-dependent: He may refrain from strong guidance, instead highlighting that upcoming labor and inflation data will shape the Fed’s decisions.

Rate Cut Expectations

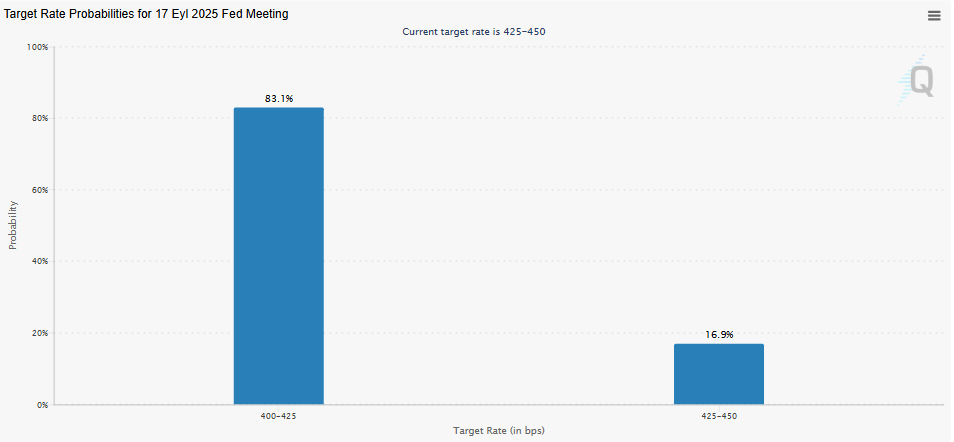

Market expectations have already become clear. According to CME Group FedWatch Tool, 83.1% of investors expect the Fed to deliver a 25 basis point cut at its next meeting. The probability of keeping rates unchanged stands at 16.9%, while a more aggressive 50 basis point cut is currently priced at 0%.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.