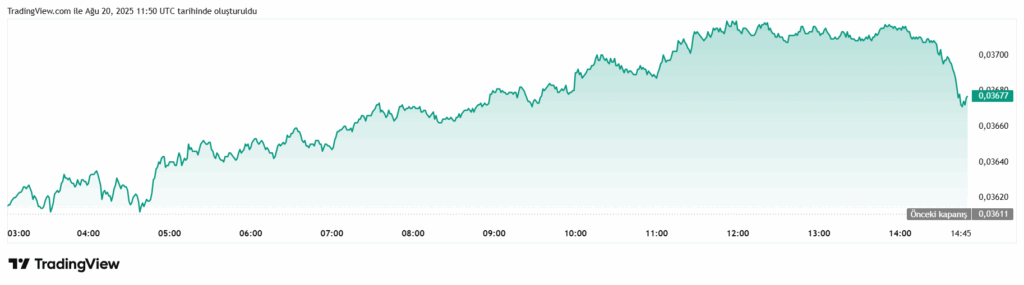

Ethereum has reached its highest levels in 2025, with the ETH/BTC ratio climbing to 0.037. The rise is driven by large inflows into spot Ethereum ETFs and corporate ETH purchases. According to K33 Research, Ethereum has gained approximately 70% since June 1, while Bitcoin rose only 9%.

As a result, the ETH/BTC ratio reached a yearly peak. Digital asset treasuries now hold 2% of circulating Ethereum, up from just 0.2% two months ago. This surge is supported by both spot ETF investments and corporate demand.

U.S.-based spot Ethereum ETFs have collected around $9.4 billion since June 2. Meanwhile, corporate digital asset treasuries now control over 2% of circulating ETH. Projects like Tom Lee’s BitMine Immersion and Joe Lubin’s SharpLink Gaming have absorbed approximately 3.7% of ETH supply since June. Considering Ethereum’s market value is about one-fifth of Bitcoin, this is a notable figure.

Additionally, VolatilityShares’ 2x Ether ETF has increased its exposure by roughly 456,000 ETH since June, representing 61% of CME ETH futures open interest. This demonstrates sustained investor interest in both spot and leveraged ETH products.

Bitcoin Positions Turn Cautious

On the Bitcoin side, listed derivatives cooled after last week’s higher-than-expected PPI release. July PPI rose 0.9% month-on-month versus 0.2% consensus. The data pushed BTC from roughly $121,000 to $117,700 within minutes. Over $1 billion in crypto liquidations occurred in a short period. CME Bitcoin futures premiums dropped from double digits to 5.5%, while notional CME open interest stands at around 143,000 BTC, and perpetuals near 300,000 BTC. K33 notes this setup may increase volatility in either direction.

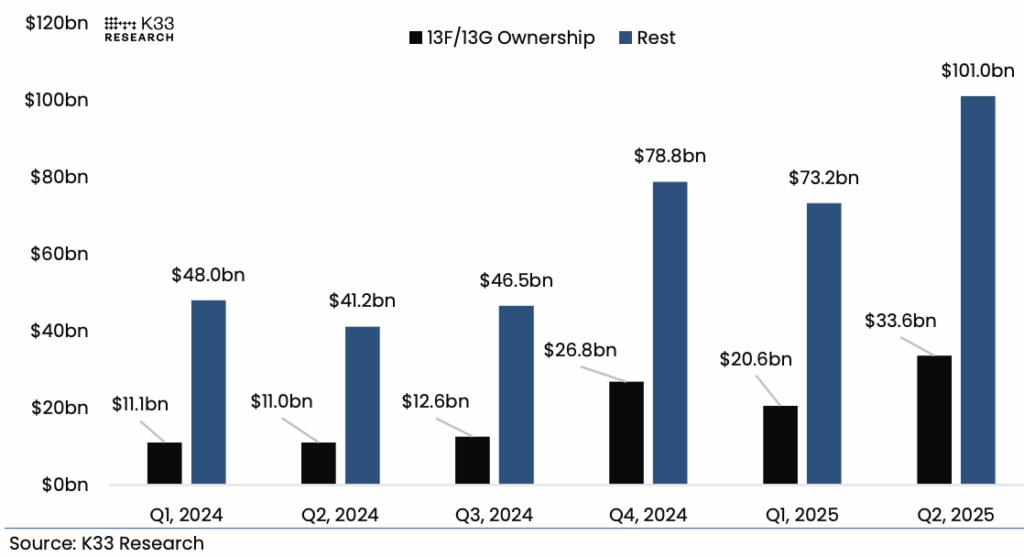

Spot Bitcoin ETF assets ended Q2 at a record $134.6 billion, supported by price gains and renewed allocations. Institutional disclosures via 13F filings show $33.6 billion in holdings. However, weekly BTC net flows in August were limited or slightly negative, while ETH products continued to attract capital. Recent data shows average daily BTC spot volume near $3.4 billion, spiking above $6 billion on August 14 after PPI volatility.

The 90-day BTC-ETH correlation remains balanced, while links to gold and the S&P 500 are weaker. According to K33, this leaves room for two-way price movements.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.