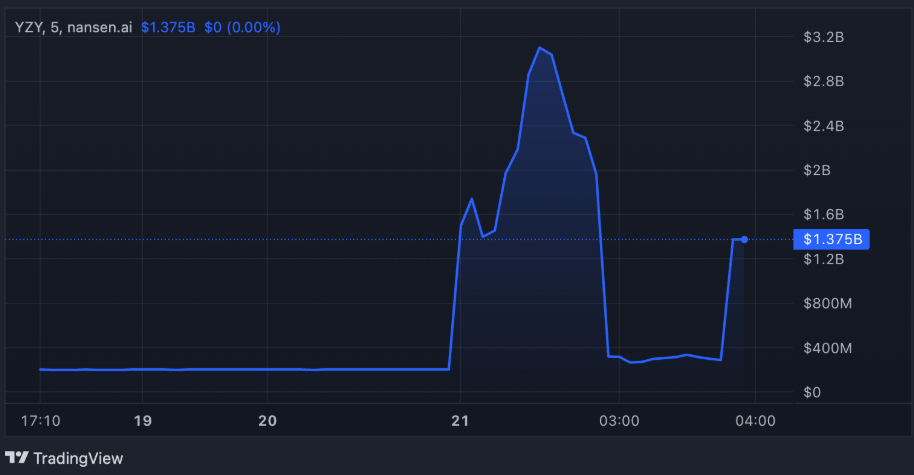

US rapper Kanye West officially launched a memecoin project called YZY on the Solana network. Shortly after its debut, the market cap skyrocketed to $3 billion. However, the price quickly crashed by 60%, dropping to $1.2 billion.

Moreover, more than 90% of the total supply is concentrated in just six wallets, sparking concerns among investors about centralization and security. Kanye West had made a critical statement about crypto only a few months earlier. On February 7, he revealed on X that he had been offered $2 million to promote a fake crypto scheme. The plan involved West promoting the scam token to his 32.6 million followers and later claiming his account had been hacked. West emphasized that he refused to scam his community and cut all ties with the individual behind the offer.

The YZY project, according to its official website, aims to connect users with a decentralized ecosystem. The platform includes the YZY token, a crypto payment system called Ye Pay, and a USDC-backed YZY Card. It also features an anti-sniping mechanism within its smart contracts.

Additionally, the team deployed 25 contract addresses but selected only one as the official token. This approach was intended to prevent speculative traders from front-running the launch. The total supply was set at 999.99 million tokens, currently held across more than 31,000 wallets.

YZY Tokenomics and Heated Market Debates

In terms of tokenomics, 20% of the total supply was allocated to the public sale. Another 10% was dedicated to liquidity, while the remaining 70% was locked under Yeezy Investments LLC, subject to a vesting schedule between 3 and 12 months.

However, blockchain analytics firms detected significant insider activity at launch. According to Lookonchain data, several wallets knew the contract address in advance, allowing them to earn millions on day one. One trader reportedly turned a $450,000 USDC investment into more than $3.4 million.

Whales also joined early. One investor spent 12,170 SOL to acquire YZY tokens and later transferred them to another wallet, boosting their balance to $8.29 million — a profit of nearly $6 million.

Furthermore, Solscan data shows that the top 10 wallets control more than 92% of the supply. This concentration has raised concerns about potential price manipulation. Reports also reveal that the liquidity pool contains only YZY, giving developers the ability to influence price movements.

Finally, Bubblemaps uncovered multiple fake tokens launched under the YZY name, which misled investors and caused major losses. While the YZY launch attracted huge attention, high volatility and transparency issues leave the project’s future uncertain.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.