The crypto market shows weak performance due to low trading volume and sideways movement. Bitcoin (BTC) trades near critical support levels, indicating increasing bearish pressure. After a brief recovery yesterday, the market returned to a stagnant trend. The total market capitalization (TOTAL) remains caught between support and resistance, keeping uncertainty high. PUMP recorded the worst performance of the day.

Department of Justice Statement and Coinbase Stablecoin Move

The Deputy Head of the Department of Justice Criminal Division stated that no new charges target software developers. The statement indirectly referred to the Roman Storm case of Tornado Cash. This stance received support even within government circles and signals a change in the treatment of developers.

Meanwhile, Coinbase announced plans to list the USD1 stablecoin issued by World Liberty Financial. The move follows over $200 million USD1 entering the market yesterday. This step increases liquidity for new users and brings more activity to the stablecoin ecosystem.

TOTAL and BTC Key Levels

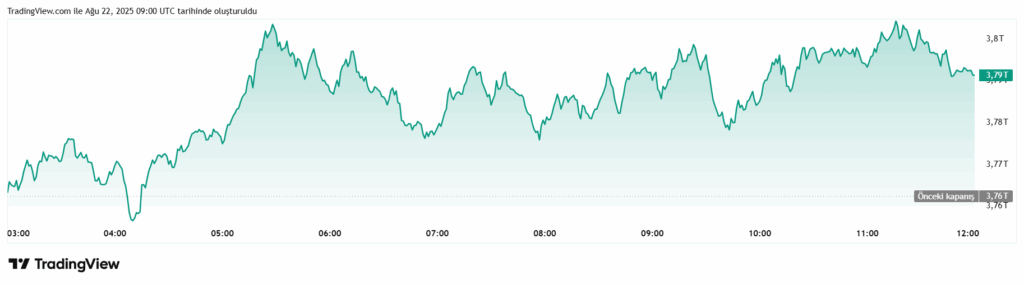

The total cryptocurrency market value has remained sideways since the start of the week. TOTAL faces strong resistance at $3.85 trillion and finds support around $3.73 trillion. Investors await a catalyst that could break the market in either direction. The Average True Range (ATR) indicator on the daily chart shows a declining trend, confirming that the market is in a consolidation phase.

Since August 15, TOTAL has gradually lost momentum and moved sideways. If demand rises, the $3.85 trillion barrier could be breached, potentially pushing toward $3.94 trillion. However, if bears strengthen control, the market may test below $3.73 trillion and drop toward $3.57 trillion.

BTC fell by 1% in the past 24 hours, trading at $112,976. During the same period, daily trading volume dropped by 11%. A simultaneous decline in price and volume indicates weakening investor interest. This suggests reduced buying pressure and potential tests of levels below $110,000.

Macroeconomic Developments and ETF Outflows

Recent crypto market declines are also influenced by uncertainties from the U.S. Federal Reserve (Fed). Investors closely watch Fed Chair Jerome Powell’s speech at the Jackson Hole meeting. Signals of potential rate hikes or tighter monetary policy accelerate outflows from risky assets. This triggers a “flight from risk” behavior in crypto markets.

Additionally, recent days have seen significant outflows from spot Bitcoin ETFs approved in January. Normally expected to bring capital inflows, these outflows increase selling pressure on Bitcoin. This reflects cautious behavior among institutional investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.