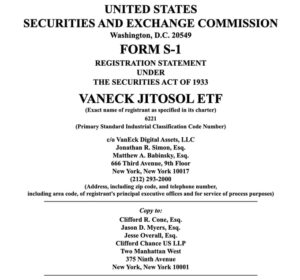

Global investment management giant VanEck is taking a significant step in crypto staking funds with a new proposal submitted to the U.S. Securities and Exchange Commission (SEC). With its new product, named the JitoSOL ETF, the firm aims to track the price of the liquid staking token (LST) JitoSOL.

JitoSOL is a tokenized version of staked SOL assets, allowing users to continue earning staking rewards while freely trading the value of these assets.

Statement from the Jito Foundation

The Jito Foundation expressed its support for VanEck’s proposal, stating:

“This fund will be the first spot Solana ETF fully backed by a liquid staking token (LST).”

“The opportunity to gain exposure to JitoSOL through a regulated wrapper will help bridge the gap between emerging blockchain infrastructure and institutional investors.”

Intensive Discussions with the SEC

Jito Labs CEO Lucas Bruder and Chief Legal Officer Rebecca Rettig held meetings in recent months with the SEC’s Crypto Task Force to assess the feasibility of staking, restaking, and ETF structures.

The SEC has recently clarified its stance on staking:

- In May, it announced that proof-of-stake–based staking activities do not constitute securities transactions.

- It later stated that certain liquid staking activities would also not be considered securities.

These statements have laid a regulatory foundation for LST-based ETFs.

Competition in the Market Heats Up

VanEck’s proposal follows just a month after REX-Osprey announced the integration of JitoSOL into its Solana staking ETF. This highlights the rapidly intensifying competition in the staking-based ETF space.

VanEck’s JitoSOL ETF proposal could represent a historic milestone in the integration of staking tokens into institutional financial products.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.