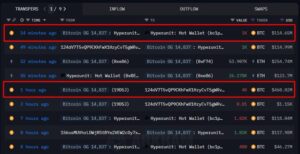

A striking whale transaction has taken place in the cryptocurrency market. An address known among major investors as an “OG” sold 5,000 Bitcoin (BTC) worth a total of $574.67 million, converting the entire amount into Ethereum (ETH). This move clearly signals a strategic shift from Bitcoin to Ethereum.

OG’s Portfolio Status

After the sale, OG’s portfolio consists of:

- 179,498 ETH, valued at approximately $850.5 million.

- 135,265 ETH long position, valued at approximately $640.92 million.

This brings the investor’s total Ethereum position to over $1.49 billion.

Why It Matters

Bitcoin has long been viewed as the leader and safe haven of the crypto market. However, this sale indicates a growing confidence among large-scale investors in Ethereum. The increasing institutional interest surrounding Ethereum, ETF applications, and its price approaching new record highs have all contributed to ETH becoming more attractive to investors.

Ethereum’s stronger institutional adoption potential compared to Bitcoin, its staking mechanism, and ongoing ecosystem development continue to capture the attention of major investors. This move is being interpreted as a concrete signal of long-term confidence in Ethereum.

Market Impact

Such large-scale shifts are known to influence liquidity, price movements, and investor sentiment in the market. Following OG’s Bitcoin sale and accumulation of Ethereum, upward pressure on ETH’s price may intensify. Furthermore, this development could prompt other major investors to reassess their own strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.