The crypto market will see a total of $4.5 billion in token unlocks this September. Data shows $1.17 billion will come from cliff unlocks, while $3.36 billion will be released via linear unlocks. Investors, project teams, and stakeholders will gain access to these tokens as vesting agreements expire.

Cliff unlocks usually involve large, one-time token releases, often affecting the market due to supply shocks. On the other hand, linear unlocks distribute tokens gradually, reducing sudden market impact. This method smooths out supply increases and stabilizes trading activity.

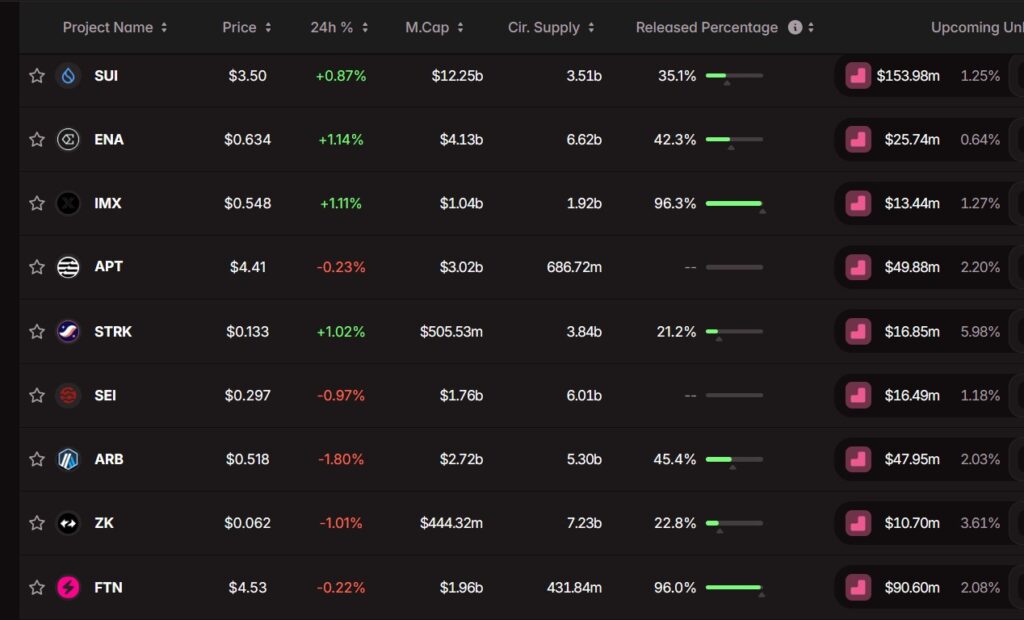

Major projects include Sui, Fasttoken (FTN), Arbitrum (ARB), and Aptos (APT). Sui will release $153 million in September, with only 35.1% of its total supply currently circulated. This unlock could have a significant market effect.

Leading Projects and Token Release Amounts

FTN follows with $90 million in token unlocks. Unlike Sui, FTN has already released over 96% of its supply, so the impact will be smaller. Aptos plans to unlock nearly $50 million, while Arbitrum will release approximately $48 million next month.

Other notable unlocks include Starknet with $16.85 million and Sei with $16.49 million. ZK and Immutable will release $10.7 million and $13.4 million, respectively. These releases influence both short-term market movements and long-term planning.

Vincent Kadar, CEO of Polymath, stated that token unlocks no longer create “unlock anxiety” among investors. Sophisticated investors now focus on project economics, adoption, governance transparency, and long-term alignment.

Kadar emphasized that as blockchain projects integrate with public markets, token unlocks gain importance not just for supply but also for long-term investor confidence. Overall, the market increasingly values fundamentals over short-term shocks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.