The U.S. Securities and Exchange Commission (SEC) continues to influence the direction of the crypto market. Two key developments have recently emerged: the SEC’s delay of Grayscale’s spot Ethereum ETF and 21Shares’ new ETF application focused on Sei (SEI). These moves are increasing institutional investor interest in crypto.

SEC and Grayscale: Ethereum ETF Delay

The SEC has postponed Grayscale’s spot Ethereum ETF application. It remains unclear whether the fund will include a staking feature. Staking could offer investors additional yield and enhance Ethereum network security. However, the SEC is carefully reviewing legal compliance and potential market manipulation risks. Experts suggest that this delay could be a “batch approval” preparation, allowing multiple applications to be evaluated simultaneously.

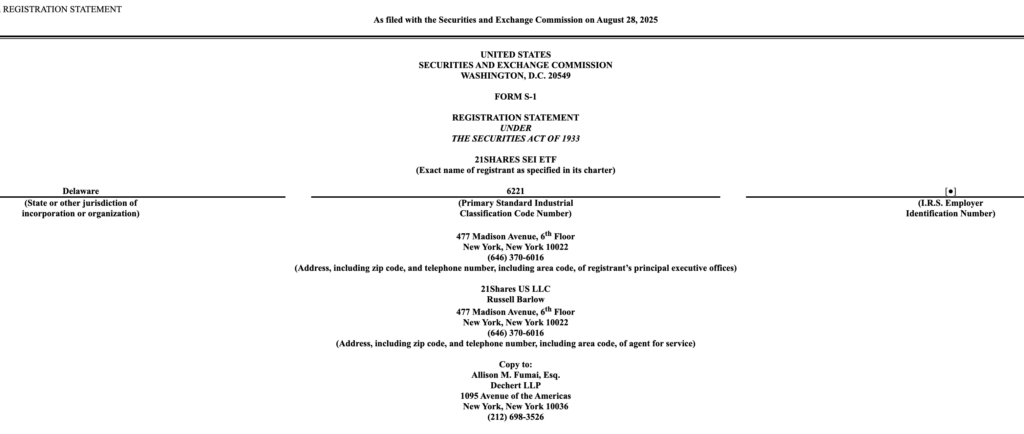

21Shares’ New Move: Sei (SEI) ETF

Crypto asset manager 21Shares has submitted a spot ETF application for Sei (SEI). The company previously applied for Bitcoin and Ethereum ETFs. Sei is a blockchain platform known for its high transaction speed, crucial for trading applications. This application facilitates institutional investors’ access to altcoins and supports the growth of the Sei ecosystem. Additionally, focusing on niche projects opens new opportunities for altcoins.

Institutional Moves Strengthen the Market

Although the SEC’s delay creates short-term uncertainty, new ETF applications from firms like 21Shares boost market confidence. Regulated products allow investors to access digital assets more safely and securely. These developments show that cryptocurrencies are not just an asset class but a serious investment vehicle. Institutional approvals enhance market maturity and reliability, enabling crypto assets to reach a wider audience.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.