There is a notable surge in ETF filings within the crypto asset market. Several major management firms have submitted updated S-1 filings for a Spot Solana ETF to the U.S. Securities and Exchange Commission (SEC). This development highlights the rapidly growing institutional interest in the altcoin market.

Companies Filing Applications

The ETF race is heating up. 21Shares, Franklin, and Canary have submitted updated versions of their Spot Solana ETF applications, while industry heavyweight Grayscale has also taken a similar step.

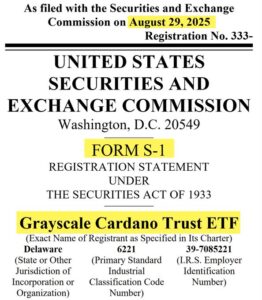

In addition, Grayscale has filed for an ETF based on Cardano (ADA), aiming to broaden its altcoin offering. ADA is known for its strong framework in smart contracts and energy efficiency. If approved, the ETF could help Cardano secure a stronger foothold among institutional investors.

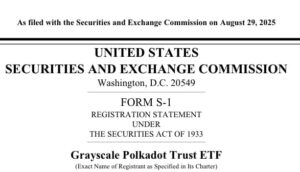

Grayscale hasn’t stopped there—it has also submitted an S-1 filing for Polkadot (DOT). With its focus on scalability and parachain infrastructure, DOT stands out as a strong project. The ETF application could, in the long run, attract significant attention from institutional investors.

Grayscale’s Move and Management Fee

In its Spot Solana ETF filing, Grayscale set a management fee of 2.5%. While this rate gives investors an idea of the potential costs involved, it also highlights the company’s aggressive stance in the ETF market.

Is a New Era Beginning?

Grayscale’s decision not to limit itself to Solana, but to also file for Polkadot and Cardano, has sparked expectations of an upcoming “altcoin ETF wave” in the market. Should the SEC approve these filings, institutional investments in altcoins may increase significantly, providing long-term support for their prices.

According to market analysts, the diversification of ETF applications further strengthens the legitimacy of crypto assets. In particular, if projects with robust infrastructures like Solana, Polkadot, and Cardano receive ETF approval, institutional interest in these assets could see a major leap.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.