The 2025 Ethereum rich list has been updated. Leading ETH holders include whales, institutions, and smart contracts. The data shows Ethereum has shifted from individual investors to corporate players.

As of August 2025, the top 10 ETH addresses hold roughly 70% of the 120.7 million circulating ETH. However, most belong to staking contracts, exchanges, or institutional funds rather than individual whales.

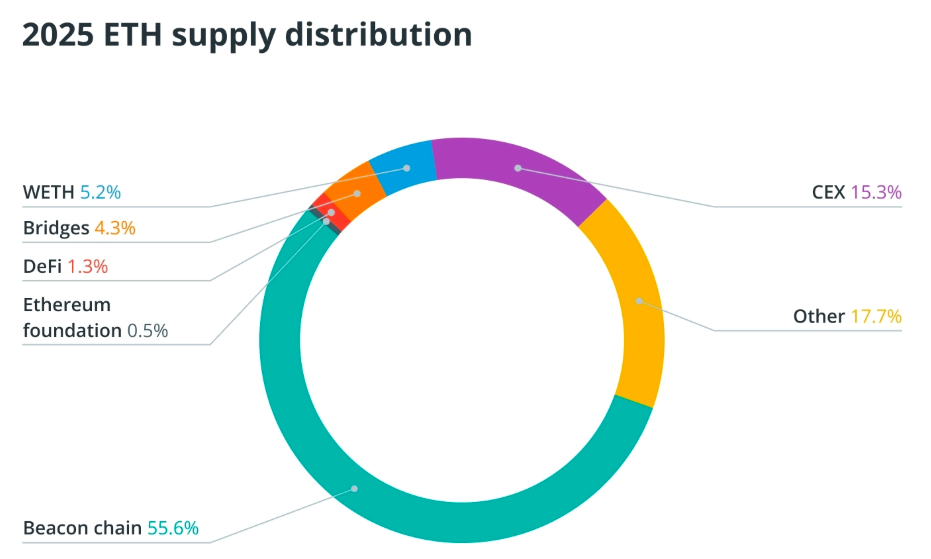

The Beacon Deposit Contract alone holds 65.88 million ETH, representing 54.5% of the total supply. Validators must wait a set period to withdraw ETH, making this contract a protocol-controlled treasury rather than a personal wallet.

The Wrapped Ether (WETH) contract also ranks high, holding 2.26 million ETH. These figures highlight the importance of staking and DeFi usage in the Ethereum ecosystem.

Institutional and Individual ETH Holders

Exchanges like Coinbase hold 4.93 million ETH, Binance 4.23 million, Bitfinex 3.28 million, Robinhood 1.66 million, and Upbit 1.36 million. These addresses actively support exchange liquidity and staking derivatives.

Institutional investors are also treating ETH as a treasury asset. BlackRock’s iShares Ethereum Trust (ETHA) controls 3 million ETH, Grayscale ETHE manages 1.13 million, and Fidelity’s FETH oversees $1.4 billion in ETH. Together, these institutions control over 5 million ETH, reshaping the Ethereum ownership landscape.

Individual holders include Vitalik Buterin with 250–280k ETH, Joseph Lubin around 500k ETH, and the Winklevoss twins 150–200k ETH. These numbers emphasize the contrast between corporate and personal ETH ownership.

Over 130 million addresses exist on Ethereum, but fewer than 1.3 million hold at least one ETH. Ownership is concentrated, with most assets in staking, exchanges, and institutional funds.

On-chain data confirms Ethereum has moved from individual whales to institutional and protocol-based players. This trend highlights the ecosystem’s corporate depth and the strength of staking infrastructure.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.