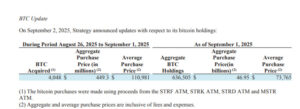

One of the world’s largest institutional Bitcoin investors, Strategy, continues to pursue its acquisition strategy with determination. Between August 26 and September 1, the company purchased 4,048 BTC at an average price of $110,981. The value of this latest acquisition was recorded at $449.3 million.

Strategy’s Bitcoin Strategy

Since 2020, Strategy has embraced Bitcoin as the “primary reserve asset for its corporate treasury.” The management views BTC not only as a short-term investment tool but also as a hedge against inflation and a long-term store of value.

Company co-founder and CEO Michael Saylor has previously described Bitcoin as “digital gold” and emphasized that it lies at the core of their long-term vision. In line with this approach, Strategy continues its purchases consistently despite market volatility.

Official Statement

In the company’s announcement, the following remarks were included:

“Bitcoin is the cornerstone of Strategy’s long-term treasury strategy. Despite volatile market conditions, we maintain our confidence in Bitcoin’s future and continue to grow our holdings.”

This statement underlines that the company is not merely focused on price movements, but on Bitcoin’s critical role in its long-term growth strategy.

Market Analysis and Impact

Crypto analysts interpret each of Strategy’s new acquisitions as a strong vote of confidence in the market. Institutional accumulation of Bitcoin boosts investor confidence and contributes to market maturity.

- Positive Effect: Institutional purchases strengthen belief in Bitcoin’s long-term value.

- Liquidity Increase: Regular acquisitions by major investors like Strategy help sustain liquidity in the BTC market.

- Institutional Trend: This move sets a precedent for other corporations to integrate Bitcoin into their treasury strategies.

Experts argue that Strategy’s actions act as a catalyst, accelerating Bitcoin’s acceptance in the corporate world.

Bitcoin Portfolio

With this latest acquisition, Strategy has further expanded its portfolio. The company now holds over 200,000 BTC, valued at several billion dollars, making it the world’s largest institutional Bitcoin investor.

The $449.3 million purchase once again highlights Strategy’s long-term commitment and confidence in Bitcoin. This move reinforces Bitcoin’s position as “digital gold” among institutional investors and demonstrates that corporate demand for BTC continues to grow at full speed.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.