Long known in the crypto space for its memecoin culture, Solana is now making headlines for a very different reason. The blockchain has surpassed $500 million in tokenized real-world assets (RWAs), marking an important step in its evolution as a serious financial infrastructure.

Stablecoins Dominate Solana’s Tokenized Market

According to data from RWA.xyz, the vast majority of Solana’s tokenized value comes from stablecoins. In total, 17 different stablecoins operate on the network, collectively boasting a market cap of over $11.1 billion.

-

USD Coin (USDC) leads with more than $8.18 billion in circulation, holding over 70% of the market.

-

Tether (USDT) follows with $1.94 billion, representing nearly 17% of the share.

Treasury Assets and Institutional Funds

Beyond stablecoins, tokenized U.S. Treasury debt makes up the second-largest category of RWAs on Solana, amounting to $304.6 million. Of this, a substantial $249.4 million comes from Ondo Finance’s USDY and OUSG products.

Institutional alternative funds also contribute significantly, with $135.2 million in value. Leading this segment is OnRe’s Onchain Yield Coin (ONYc), which accounts for the majority of the allocation.

Outpacing BNB Chain and Closing in on Stellar

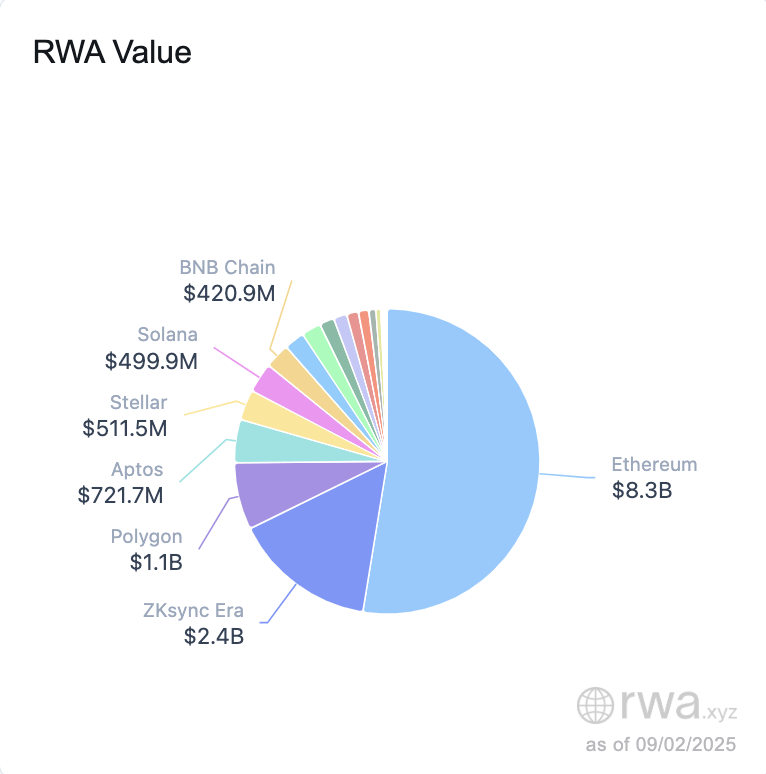

This growth places Solana ahead of BNB Chain, which holds $420.9 million in tokenized RWAs, and just shy of Stellar’s $511.5 million.

While Solana’s tokenized asset base still lags behind Ethereum, zkSync Era, and Polygon, crossing the half-billion mark demonstrates the blockchain’s growing credibility as a platform for real-world financial products.

Traditional Finance Eyes Solana

High throughput, low transaction costs, and scalability are making Solana increasingly attractive to banks and institutional players.

The recent partnership between Solana Foundation and R3 highlights this shift. R3’s client network includes financial heavyweights such as HSBC, Bank of America, Euroclear, and the Monetary Authority of Singapore (MAS) — signaling that traditional finance is looking at Solana as a faster and more efficient option for tokenizing real-world assets compared to other chains.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.