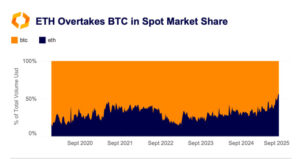

A historic development occurred in the cryptocurrency market: Ethereum’s (ETH) monthly spot trading volume on centralized exchanges (CEX) surpassed Bitcoin (BTC) for the first time in at least seven years.

ETH Spot Volume Surpasses BTC

In August, Ethereum’s total CEX spot turnover was recorded at approximately $480 billion. This figure exceeded Bitcoin’s $401 billion spot volume, ending BTC’s years-long dominance.

This shift was driven primarily by institutional digital asset treasury programs, active trading in U.S. spot ETH ETFs, and overall positive narratives surrounding Ethereum.

Institutional Purchases and Spot ETF Demand

Firms like BitMine Immersion and SharpLink Gaming made multi-billion-dollar ETH acquisitions in August.

Spot Ethereum ETFs saw irregular but strong demand, registering $3.95 billion in net inflows.

For comparison, spot Bitcoin ETFs experienced a net outflow of $301 million during the same period.

ETH Outperforms BTC

Since the beginning of 2025, ETH’s price has surged over 105%, while BTC has gained only around 18% in the same timeframe.

At least one BTC whale swapped long-held Bitcoins for approximately $4 billion worth of ETH.

This clearly highlights the flow of capital and institutional interest moving toward Ethereum.

Analyst Commentary and Future Outlook

Paul Howard, Senior Director at crypto market maker Wincent, noted that the trend of institutional investors switching to ETH is likely to continue:

“It’s worth monitoring Bitcoin whale wallets that have shifted into ETH this quarter. We expect further blue-chip price movements through Q4. Following potential U.S. rate cuts, all major assets could reach all-time highs.”

According to Howard, institutional investors will continue to adopt ETH as an asset with higher beta and return potential. Ethereum surpassing Bitcoin in spot trading volume marks a key milestone, supported by institutional interest and ETF inflows.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.