The U.S. stock exchange Nasdaq is increasing scrutiny of publicly traded companies that raise funds to acquire cryptocurrency. This move specifically targets firms channeling capital market proceeds into crypto through corporate digital asset treasury programs.

Rising Number of Crypto-Adopting Companies in the U.S.

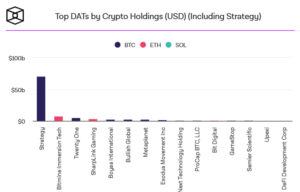

According to Architect Partners, about 154 U.S.-listed companies have announced planned increases totaling $98 billion to purchase crypto since January 2025. Most of these firms are traded on Nasdaq.

As Wall Street firms accelerate the allocation of capital market proceeds into digital asset treasury programs, Nasdaq has started to tighten oversight of public companies holding crypto.

Nasdaq’s New Measures

According to The Information:

- Shareholder approval is being required for certain transactions,

- Companies are under pressure to provide greater disclosure and transparency,

- Non-compliant firms could face suspension or delisting.

These measures come amid a wave of share issuances aimed at acquiring digital assets for corporate balance sheet strategies.

Market Reaction and Risks

Several crypto-focused companies saw sharp drops in stock prices following these announcements. Tighter oversight could delay transaction timelines and increase market uncertainty. Some firms are developing complex structures aligned with Bitcoin-heavy balance sheets and token strategies.

Notable Companies

According to Architect Partners, some of the largest crypto-buying Nasdaq-listed companies include:

- Strategy, Michael Saylor’s Bitcoin treasury company

- BitMine Immersion, Tom Lee’s Ethereum treasury company