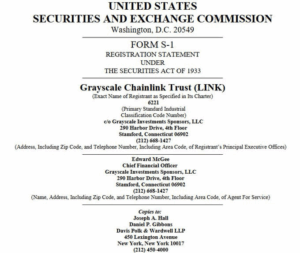

Grayscale has filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for its Chainlink (LINK) ETF.

What Does an S-1 Application Mean?

An S-1 filing initiates the SEC’s formal review process for a potential exchange-traded product. The regulatory body can evaluate the filing, provide comments, request changes, and ultimately decide whether the registration is declared effective.

However, submitting an S-1 does not guarantee SEC approval or set a timeline; it simply starts the official registration process.

Chainlink ETF Potential

If the S-1 registration goes through, the Chainlink ETF would give investors exposure to LINK tokens via an ETF. This product would expand institutional access to the underlying digital asset under SEC oversight and provide a new regulated investment vehicle for altcoin investors.

Market Implications

If approved, the Chainlink (LINK) ETF could:

- Attract more institutional interest

- Bring capital flows into projects within the Chainlink ecosystem

- Potentially drive positive price movement

Grayscale’s Chainlink ETF filing is seen as a new step in integrating crypto with traditional finance. While approval remains uncertain, this initiative could mark an important milestone for LINK.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.