As one of the innovative solutions in blockchain technology, Blast (BLAST) stands out among Ethereum’s layer-2 (L2) solutions, being the only platform that offers native yield for ETH and stablecoins. Built on a decentralized structure, project provides higher yield rates to its users and developers, adopting a distinct approach compared to other L2 solutions in the Ethereum ecosystem. The project focuses on financial yields and enables new yield-driven business models. So, what is Blast, how does it work, and why is it important? Let’s dive in!

What is Blast (BLAST)?

Project is an EVM-compatible, optimistic rollup platform designed as an Ethereum layer-2 (L2) scaling solution. It offers native yield for ETH and stablecoins, providing users and developers with 4% and 5% yield rates, respectively. Enabled by Ethereum’s Shanghai upgrade, this yield is derived from ETH staked on L1 and MakerDAO’s on-chain T-Bill protocol. The project stands out with its auto-rebasing mechanism, which ensures users automatically receive these yields. Supported by the $BLAST token, the platform introduces innovative features like gas revenue sharing for Dapps, aiming to create a community-driven economy. Backed by prominent investors such as Paradigm, Standard Crypto, and Santiago R. Santos, project lays the foundation for next-generation financial models.

Blast Key Features

The project differentiates itself in the Ethereum ecosystem with its innovative features:

Native Yield

Offers 4% yield for ETH and 5% for stablecoins, compared to 0% on other L2s.

Auto-Rebasing

ETH and USDB (the project’s native stablecoin) provide yields in users’ wallets through automatic rebasing.

$BLAST Token

The platform’s governance and incentive token, $BLAST, is used for transactions and voting.

Gas Revenue Sharing

Dapps automatically share net gas fee revenue, which can be used by developers or to subsidize user gas fees.

Decentralized Governance

Token holders shape the platform’s future through DAO-based governance.

Mobile App: Blast Mobile

Offers a user-friendly experience with features like passkey authentication, gas sponsorship, and pro mode.

Robust Infrastructure

On-chain T-Bill protocols and L1 staking support the platform’s scalability and yield generation.

How Does Blast Work?

The project offers an ecosystem that enables users and developers to earn yields:

-

Auto-Rebasing: ETH and USDB automatically rebase in external wallets (EOAs). Smart contracts can opt-in to this feature.

-

L1 Staking: Enabled by Ethereum’s Shanghai upgrade, ETH yield from L1 staking via Lido is automatically transferred to project users.

-

T-Bill Yield: Bridged stablecoins are converted to USDB, which generates yield through MakerDAO’s T-Bill protocol.

-

Gas Revenue Sharing: The project distributes net gas fee revenue to Dapps, enabling new business models.

-

Governance: $BLAST token holders participate in governance through forums (Foundation Discourse) and voting platforms (Snapshot).

-

Blast Mobile: Users access the platform on iOS and Android devices with features like passkey authentication and gas sponsorship.

-

Earn App: USDB deposits earn liquid $BLAST rewards, with yields boosted up to a 6x multiplier.

The project offers a flexible structure, allowing the community to replace Lido or MakerDAO with Blast-native solutions.

Benefits to Stakeholders

-

Users: Earn native yield on ETH and USDB, with easy access via Blast Mobile.

-

Developers: Gain new Dapp opportunities through gas revenue sharing and yield-driven models.

-

Community: Participate in governance with $BLAST tokens and contribute to ecosystem growth.

-

Investors: Benefit from platform growth through $BLAST tokens and the ecosystem.

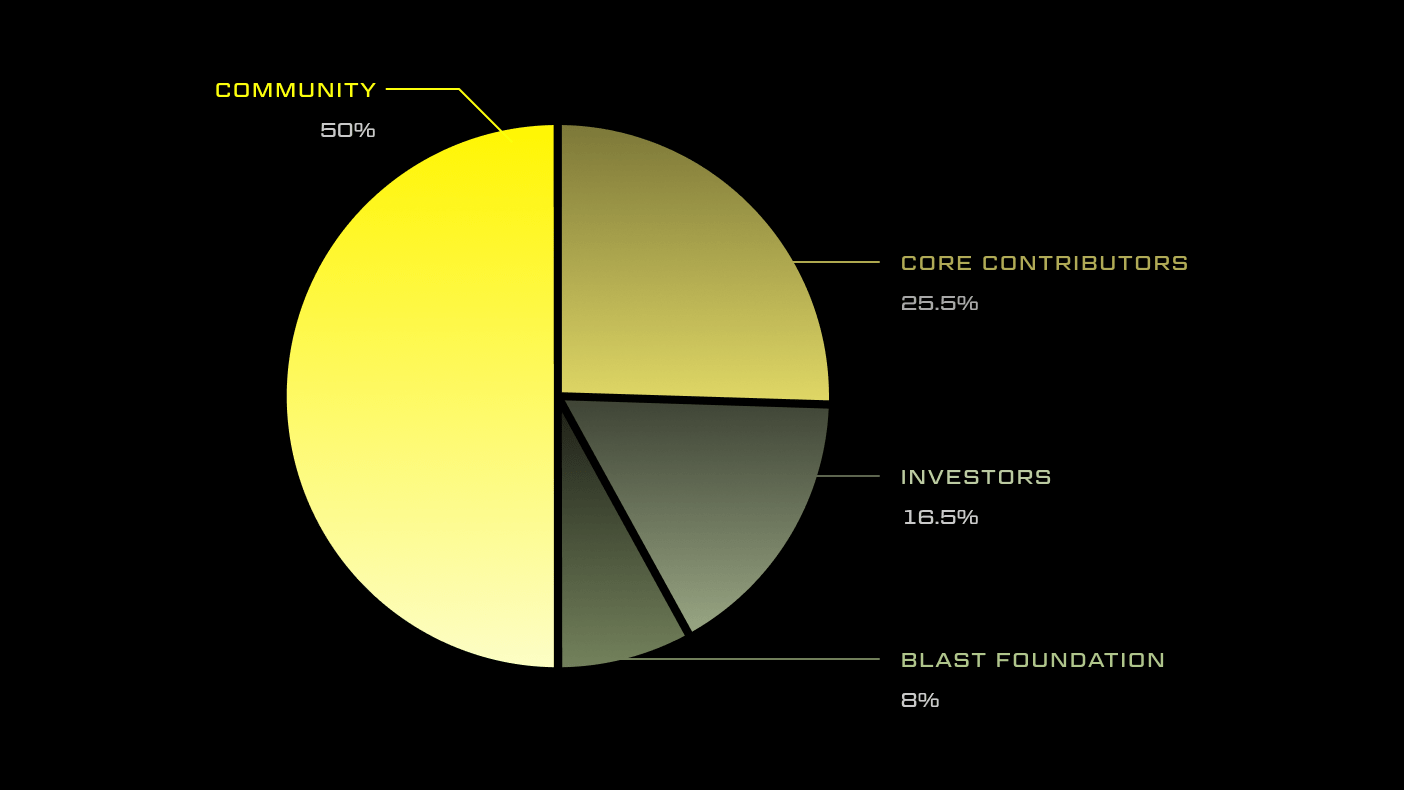

Blast Tokenomics

$BLAST is the platform’s utility token:

-

Token Name: BLAST

-

Total Supply: 100 billion (fixed)

-

Distribution:

-

Community: 50% (linear unlock over 3 years)

-

Core Contributors: 25.5% (4-year lock, 25% unlocked after 1 year, then linear over 3 years)

-

Investors: 16.5% (4-year lock, 25% unlocked after 1 year, then linear over 3 years)

-

Blast Foundation: 8% (linear unlock over 4 years)

-

Airdrop Phase 1: 7% (Blast Points), 7% (Blast Gold), 3% (Blur Foundation)

-

Airdrop Phase 2: 2.5% (Blast Points), 2.5% (Blast Gold)

-

-

Use Cases:

-

Payments: Transaction fees and asset purchases.

-

Governance: DAO voting.

-

Rewards: Blast Mobile Earn app and staking rewards.

-

-

Deflationary Mechanism: Community incentives support ecosystem growth.

Roadmap

The project advances to strengthen the Ethereum L2 ecosystem:

-

2024: $BLAST token launch, Phase 1 airdrop, Blast Mobile launch.

-

2025: Phase 2 airdrop (ends January 2025, 5 billion $BLAST), Blast Mobile Dapp integrations.

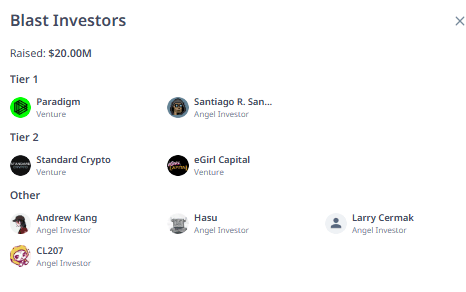

Blast Investors

The project has raised a total of $20 million, backed by strong investors. Tier 1 includes Paradigm and Santiago R. Santos, while Tier 2 features Standard Crypto and eGirl Capital. Additionally, individual angel investors such as Andrew Kang, Hasu, Larry Cermak, and CL207 contribute to the project.

Blast Team

The project is led by an experienced leader. Tieshun (Pacman) Roquerre serves as the Founder, leveraging his entrepreneurial background and blockchain vision to position the project as one of Ethereum’s leading L2 solutions.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.