The cryptocurrency market has regained momentum with strong recoveries in Bitcoin, Ethereum, and major altcoins. Analysts emphasize that this move is not just a short-term bounce but rather the beginning of a long-term bull cycle.

Crypto Market Reaches Highest Daily Close of 2025

The altcoin market has recorded its highest daily close of 2025. This rally, which pushed prices to levels unseen since January, is considered by experts as a sign that “altcoin season has officially begun.”

A market analyst stated:

“The macro altcoin expansion is only just starting. This chart makes me incredibly bullish.”

Some of the standout developments include:

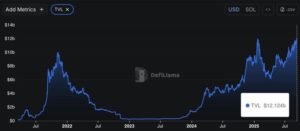

- Solana (SOL): Reached an all-time high with $12.1 billion TVL in the DeFi ecosystem.

- Chainlink (LINK): Investor interest rose again as Polymarket adopted Chainlink technology to power real-time prediction markets.

Two Main Reasons Behind the Crypto Market Rally

-

Federal Reserve Rate Cut Expectations

- Markets expect the Fed to lower interest rates at the upcoming FOMC meeting.

- A 25 bps cut is seen as almost certain.

- However, due to rising unemployment and weakening labor data, a more aggressive 50 bps cut is also being discussed.

- One analyst said: “This is no longer a maybe. This is a now or never.”

-

The Clarity Act Removing Regulatory Uncertainty

- The long-awaited Clarity Act for the crypto industry could soon be approved. This law aims to establish a clear market structure for digital assets.

- According to insider information, the anticipation of this law is the main reason behind the acceleration of institutional purchases.

- A market expert noted: “Those who know are aware of this… That’s why they’re buying today.”

Analysts’ Evaluation

Experts argue that the simultaneous occurrence of Fed rate cuts and regulatory clarity could trigger a historic bull cycle in the crypto market. With leading projects like Solana and Chainlink already showing strong signals, other major altcoins are also expected to join the rally.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.