China’s largest institutional Bitcoin treasury company, Next Technology Holding, has filed with the U.S. Securities and Exchange Commission (SEC) to sell up to $500 million in common stock. The company plans to use part of the proceeds for Bitcoin purchases.

The filing stated:

“We intend to use the net proceeds from the sale of the securities offered under this prospectus for general corporate purposes, which may include Bitcoin purchases.”

Current Bitcoin Holdings

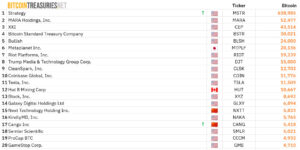

According to data, Next Technology currently holds about 5,833 BTC ($671.8 million). This makes it the 15th largest publicly traded Bitcoin treasury company worldwide, based on BitcoinTreasuries.net.

If even half of the $500 million is allocated to BTC, the firm could acquire an additional ~2,170 BTC at current prices, pushing its total holdings above 8,000 BTC.

Contributing to the Global Bitcoin Treasury Trend

Next Technology’s move adds to the recent trend of publicly listed firms financing Bitcoin acquisitions through equity sales, debt offerings, and SPAC structures.

As of today, the number of publicly traded companies holding Bitcoin has reached 190, with a combined treasury of over 1 million BTC, representing more than 5% of the circulating supply. The leader remains Michael Saylor’s MicroStrategy, with around 639,000 BTC on its balance sheet.

Next Technology Shares Drop

Following the announcement, Next Technology (NXTT) shares on Nasdaq fell 4.76% to $0.14. In after-hours trading, losses deepened to 7.43%.

Despite this, the company has made significant gains from its past purchases. In December 2023, it acquired 833 BTC, and in March 2024, it purchased 5,000 BTC. The company’s average acquisition cost for its Bitcoin holdings is $31,386, which currently represents an unrealized profit of approximately 266.7%.

The company has not disclosed a specific target for the total amount of Bitcoin it intends to hold. The filings only state that it will “act in line with market conditions.” This strategy indicates a different approach compared to aggressive competitors like Metaplanet and Semler Scientific, which aim to accumulate 1% of the total supply by the end of 2027.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.