September 16, 2025 marked an important day in the crypto markets, revealing key data about ETF investor preferences. While Ethereum-based spot ETFs signaled a decline in investor interest, Bitcoin spot ETFs, on the other hand, stood out with a strong wave of inflows. This trend shows that, in the short term, investors are leaning more heavily toward Bitcoin.

Declining Trend in Ethereum Spot ETFs

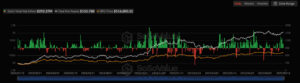

According to the data, Ethereum spot ETFs saw a total net outflow of 61.74 million dollars on September 16. Most of the funds experienced reduced investor interest, with only Bitwise ETF ETHW managing to record net inflows and deliver a positive performance.

Despite this short-term outflow, expectations for Ethereum’s long-term potential remain strong. Analysts suggest that the majority of these ETF redemptions stem from institutional investors engaging in profit-taking and adjusting positions in response to market conditions. The limited yet positive inflows into Bitwise ETF ETHW demonstrate that investors have not abandoned Ethereum entirely but are instead taking a selective approach by diversifying into different products.

Strong Inflows into Bitcoin Spot ETFs

In contrast to Ethereum’s weak performance, Bitcoin spot ETFs showed the opposite trend. On September 16, Bitcoin-based funds recorded a total net inflow of 292.27 million dollars. With these inflows, Bitcoin spot ETFs achieved their seventh consecutive day of positive net flows.

Especially on the same day, BlackRock’s Bitcoin ETF (IBIT) — managed by the world’s largest asset management company — made a notable move. The fund purchased 1,810 Bitcoin worth 209.2 million dollars. This transaction highlights that institutional investors’ interest in Bitcoin remains strong and that the adoption of crypto assets through ETFs continues to gain momentum.

According to experts, this trend reflects global investors’ view of Bitcoin as a more reliable store of value despite ongoing market volatility.

What Does This Mean for Investors?

- The increasing inflows into Bitcoin ETFs could create upward pressure on its price.

- Outflows from Ethereum ETFs indicate a short-term loss of confidence, though Ethereum’s medium-term outlook remains strong.

- The fact that Bitwise’s ETHW ETF was the only Ethereum product to record inflows shows that investors are becoming more selective in their choices.

The September 16 data clearly illustrates the divergence in investor preferences between Bitcoin and Ethereum. While Bitcoin spot ETFs delivered their seventh straight day of strong inflows, boosting market confidence, Ethereum ETFs experienced outflows, signaling a more cautious stance among investors in the short term.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates instantly.