Institutional investor interest in the cryptocurrency markets is resurging. As of September 18, both Ethereum and Bitcoin spot ETFs recorded significant inflows. This development reaffirms investor confidence in the crypto market and the renewed institutional appetite.

Record Inflows into Ethereum ETFs

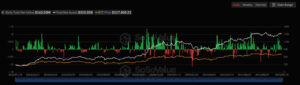

On the Ethereum side, a total of $213 million in net inflows was recorded. This figure highlights the sharp increase in confidence toward Ethereum ETFs. Most notably, none of the nine listed Ethereum ETFs experienced any net outflows. This trend signals that both institutional and retail investors see ETH as an attractive long-term investment vehicle.

Ethereum’s expanding use cases in areas such as DeFi (Decentralized Finance), tokenization, and staking stand out as key factors driving increased investor interest in the asset. In addition, the SEC’s recent regulatory moves to accelerate the crypto ETF approval process have further strengthened confidence in Ethereum products.

Strong Support for Bitcoin ETFs

On the Bitcoin side, a total of $163 million in net inflows was recorded. Just like with Ethereum, none of the twelve listed Bitcoin ETFs saw any outflows. This indicates that Bitcoin continues to be viewed as “digital gold,” and despite market volatility, investors still regard Bitcoin ETFs as a safe investment vehicle.

Bitcoin continues to stand out as a hedging tool in institutional portfolios, especially during periods of global economic uncertainty. The fact that all net inflows showed positive movement confirms that institutional funds are once again strongly turning toward Bitcoin.

Is Institutional Investor Appetite Returning?

The combined net inflows of over $376 million into Ethereum and Bitcoin ETFs in a single day serve as a strong indicator that institutional investors are once again moving back into crypto.

Several key factors are driving this trend:

- Improvements in the U.S. regulatory environment: The SEC’s acceleration of crypto ETF approval processes is boosting investor confidence.

- Expansion of the Ethereum ecosystem: ETH is not just an “asset,” but also provides the infrastructure for DeFi, NFTs, tokenization, and staking.

- Bitcoin’s safe-haven perception: Global inflationary pressures and interest rate uncertainties continue to push institutional investors toward Bitcoin.

Potential Market Impacts

According to experts, if this steady trend of ETF inflows continues:

- Both ETH and BTC prices may face stronger upward pressure.

- A sustained entry of institutional funds into the crypto market could boost liquidity and reduce volatility.

- Ethereum’s strong ETF performance could further solidify its position as the second most preferred digital asset for institutional investors after Bitcoin.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.