In the world of decentralized exchanges (DEXs), perpetual futures (perp) trading has surged in popularity in recent years. What is a Perp DEX, you ask? In short: They are on-chain platforms offering perpetual futures contracts. These exchanges allow traders to open leveraged positions with no expiration date; just don’t forget about funding fees. Unlike centralized exchanges (CEXs), Perp DEXs operate transparently and automatically via smart contracts, using oracles or price feeds to track spot markets. Users retain control of their assets in their wallets, reducing counterparty and custodial risks. Unlike spot DEXs, Perp DEXs are ideal for leveraged derivatives.

As of 2025, we’ve compiled the top 5 Perp DEXs. These platforms stand out for their liquidity, speed, fees, and innovations. Let’s take a closer look at each one.

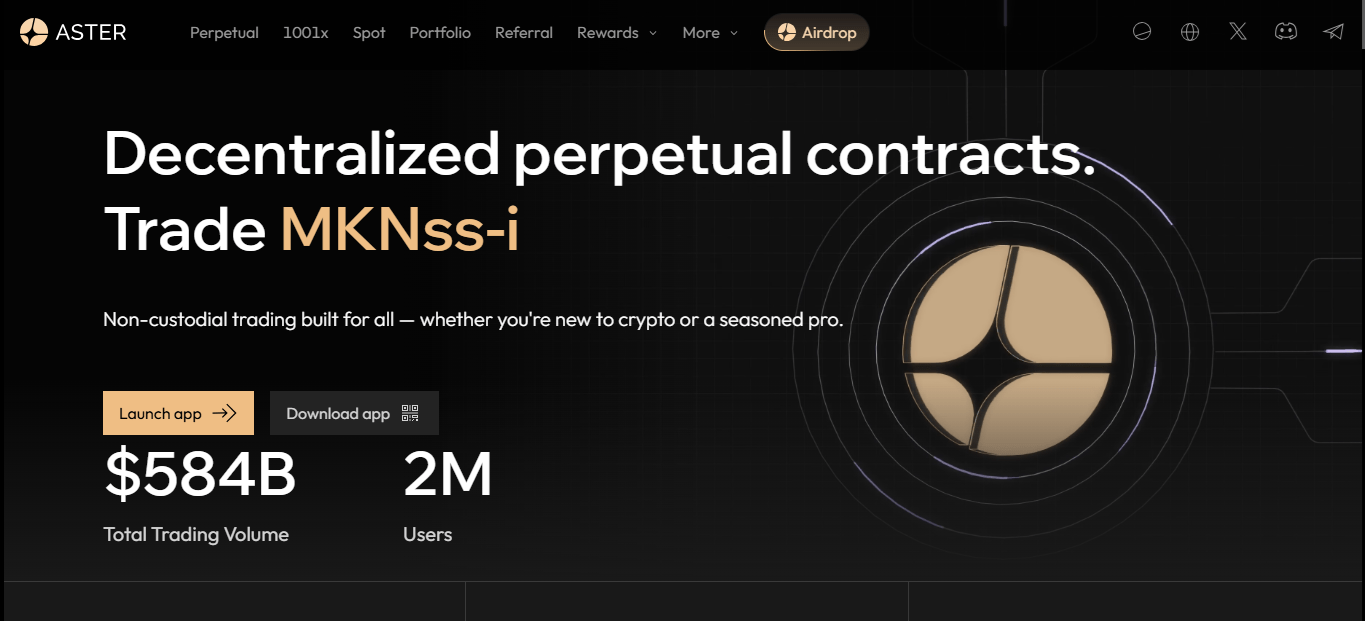

1. Aster DEX: Multi-Chain Perpetual Powerhouse

Aster DEX is an innovative Perp DEX born from the 2024 merger of Astherus and APX Finance. It offers deep on-chain liquidity and one-click trading, equipped with advanced tools for professional traders. It operates in two modes: a low-fee full order book Pro Mode and an MEV-resistant 1001x mode.

Supporting Ethereum, BNB Chain, Solana, and Arbitrum, it features spot fees of 0.10% maker/0.04% taker and perpetuals at 0.035% maker/0.01% taker. Spot trading offers 8+ pairs, while perpetuals provide 93+ contracts (crypto, forex, stocks) with up to 100x leverage. The high-leverage 1001x mode offers 1000x for BTC/ETH but carries rapid liquidation risks, so risk management is crucial.

Backed by YZi Labs and PancakeSwap, Aster has reached a $1.11 billion trading volume, rivaling Hyperliquid, and gained attention from CZ. Multi-chain access and low costs simplify perp trading.

Click here to open an Aster DEX account at a discount and benefit from the opportunities.

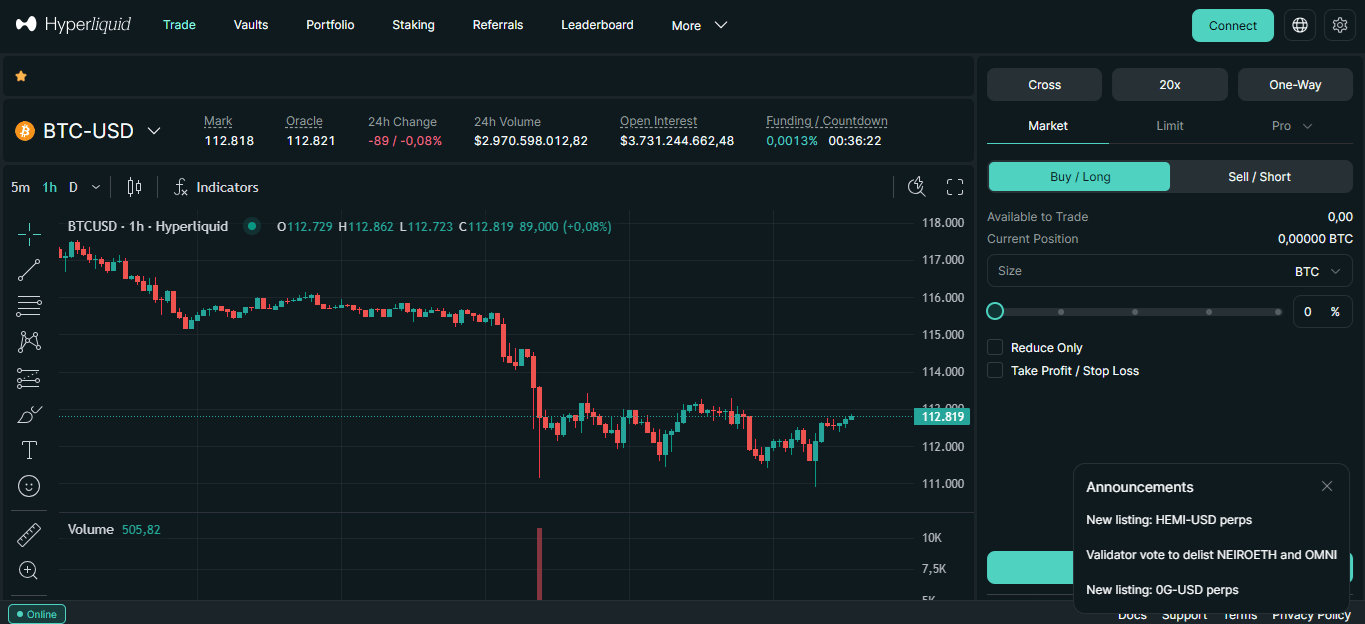

2. Hyperliquid: High-Performance L1 Perp Leader

Hyperliquid is a decentralized L1 blockchain optimized for futures and spot trading. It delivers the speed and depth of traditional exchanges on-chain, powered by the HyperCore order book engine, processing 200,000 orders per second, with instant finality via HyperBFT consensus.

Using USDC as collateral, it offers 100+ perpetual and spot trades; its “hyperps” products are resistant to price manipulation. It democratizes financial markets, blending CEX speed with DeFi transparency. One of the largest open-source Solana Perp DEXs, since 2021, it has grown to $350 million TVL, 175,000 traders, and over $20 billion in cumulative volume.

Click here to sign up for the Hyperliquid platform!

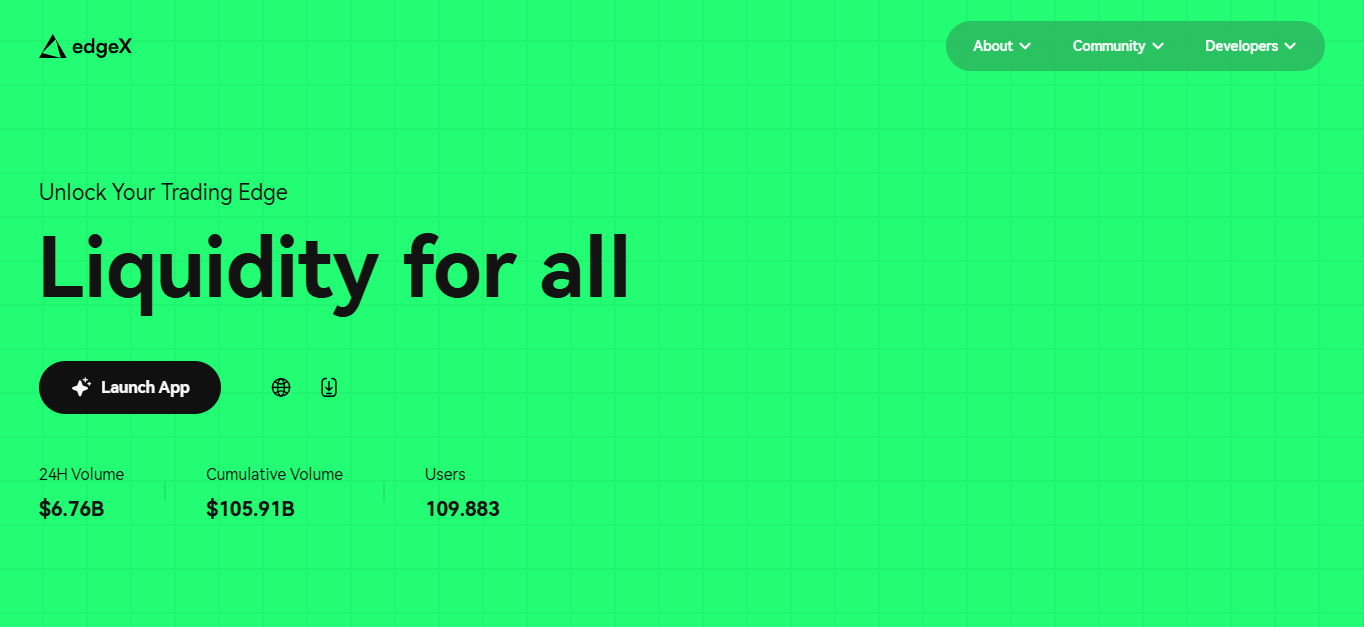

3. EdgeX: zk-Powered Derivatives Giant

EdgeX is a decentralized derivatives platform offering CEX-level speed and depth. Users retain assets in their wallets; powered by StarkWare’s zk technology, it processes up to 200,000 orders per second with low latency and high throughput.

Supported by Amber Group, it enables cross-chain transactions across 70+ blockchains; spot and perpetual trading, with tools like eStrategy Vault, cater to professionals. Features include: order-book-based derivatives, advanced order types, margin/liquidation/isolate/hedge modes, sub-account system, reverse positions, and trailing stop/profit.

Click here to open an EdgeX account and benefit from the discounted opportunities.

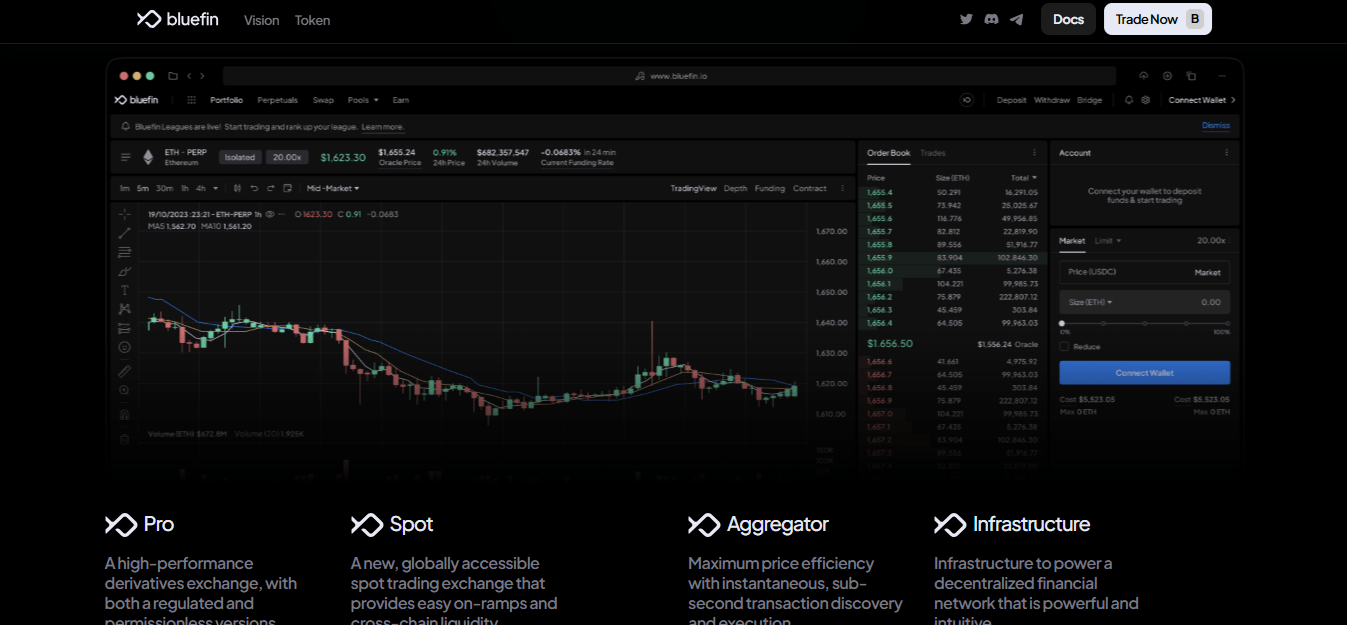

4. Bluefin: Sui-Based Spot and Derivatives Master

Bluefin is a decentralized spot and derivatives exchange on the Sui blockchain. It offers fast, low-cost, and secure transactions; the BLUE token supports fees, staking, and governance. It enables spot and derivatives trading via smart contracts.

Leveraging Sui’s high speed and low fees, it supports wallets like Suiet, Martian, Stashed, Nightly, and Surf. Google account integration (via ZK technology) eliminates private key management, enabling seamless cross-device connectivity with the same account.

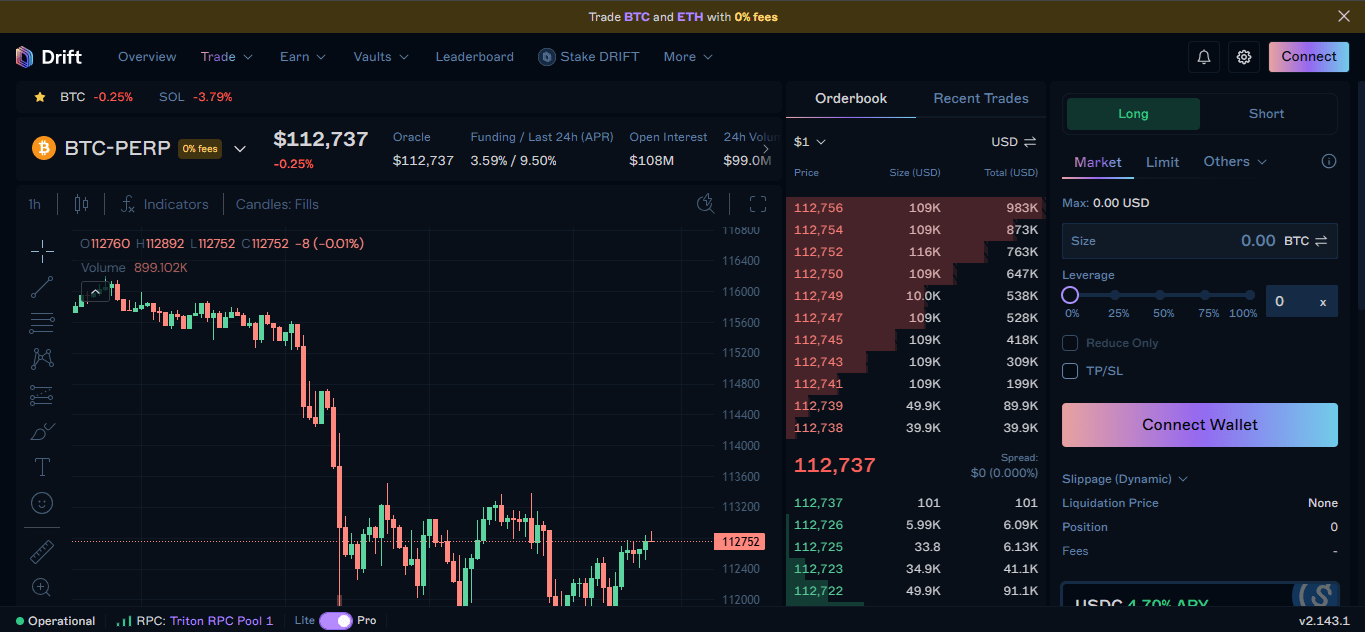

5. Drift: Solana’s Powerful Perp DEX Player

Drift Protocol is a DEX on Solana designed for spot and perpetual markets. It offers low slippage, minimal fees, and transparency for a secure trading environment; advanced features like leverage trading and a cross-margin risk engine suit various strategies.

It addresses traditional on-chain exchange shortcomings, ensuring efficiency, liquidity, and accessibility. One of Solana’s largest open-source perpetual futures DEXs, since 2021, it has $350 million TVL, over 175,000 traders, and $20 billion in cumulative volume.

Liquidity Mechanisms: JIT Auction Liquidity (short-term auctions for liquidity), Limit Orderbook Liquidity (DLOB for continuous liquidity), AMM Liquidity (virtual AMM for backup).

Main Products: Spot Trading with Margin (direct buy-sell, leveraged), Perpetual Trading (futures swaps for speculation), Borrow Lend (interest-based lending), BAL (backstop AMM liquidity boosting sqrtK).

Click here to register for Draft with a discount.

Perp DEX Trend

The top 5 Perp DEXs – Aster DEX, Hyperliquid, EdgeX, Bluefin, and Drift – are redefining on-chain trading. With deep liquidity, low fees, and high leverage, they cater to professionals; multi-chain support and innovative modes enhance accessibility. In crypto trading, Perp DEXs reduce CEX risks while offering DeFi opportunities. Your choice depends on your strategy and preferred chain – don’t forget to do your research!

Our Stock Exchange User Guides

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.