Venom is an innovative platform aiming to revolutionize social and financial services using blockchain technology. With its decentralized structure, it offers effective solutions in transparency, accountability, financial inclusion, digital identity, and data protection. Developed by the Venom Foundation, this project seeks to accelerate the widespread adoption of blockchain through a scalable macro infrastructure called Mesh Networks. The $VENOM token supports network transactions, staking, and governance. In this article, we will explore what Venom is, how it works, and the opportunities it provides in detail.

What is Venom?

Venom aims to bring blockchain technology to mainstream use by addressing scalability, security, and interoperability issues. The Dynamic Sharding Protocol processes high transaction volumes in parallel, while Workchains provide industry-specific blockchains. Mesh Networks enable secure and seamless interchain communication, integrating Venom with other blockchains. The platform maintains security with a PoS-based Byzantine fault-tolerant consensus mechanism and collaborates with leading firms for smart contract audits.

As of 2025, Venom stands out with a test environment performance of 54,000 TPS and a mainnet capacity of 4,000 TPS.

Venom’s Purpose

Venom aims to make blockchain accessible to the masses. It addresses issues in traditional financial systems such as bureaucracy, lack of transparency, and high fees, offering innovations in CBDC, stablecoins, tokenized assets, and trade finance. Mesh Networks bridge public and private chains, balancing transparency and privacy. It targets financial inclusion for billions of people.

How Venom Works

Venom operates with Dynamic Sharding and Workchains. Sharding divides transactions into parallel-processing shardchains; shardchains split under high load and merge when load decreases. Workchains create industry-specific blockchains for sectors like finance or gaming, operating in public, private, or consortium models. The Masterchain, as the network’s backbone, coordinates Workchains and shardchains; the Threaded Virtual Machine (TVM) executes smart contracts.

The $VENOM token is used for network fees, staking, and governance. The PoS consensus encourages validators to secure the network by staking tokens; delegation allows user participation. The T-Sol programming language supports TVM’s asynchronous Actor Model, offering flexibility and upgradability in smart contracts.

Roadmap:

-

Phase 0 (PoA Launch): Proof of Authority (PoA) for controlled testing; the Foundation manages all validators.

-

Phase 1 (PoS and Governance): Transition to PoS, community validators, and governance launch.

-

Phase 2 (Workchains and Interoperability): Workchain framework, custom chains, and interchain communication.

Venom Use Cases

Venom offers versatile use cases:

-

Stablecoin and CBDC: Private Workchains ensure regulatory compliance while providing fast and secure transactions.

-

Tokenization: Tokenizing assets creates new opportunities for DeFi and trade finance.

-

Trade Finance: Private chains protect sensitive data; public chains ensure transparency.

-

Digital Identity: Account abstraction enables flexible authentication and recovery mechanisms.

-

Sustainability: Proof of Reserves (PoR) for transparent and secure financial systems.

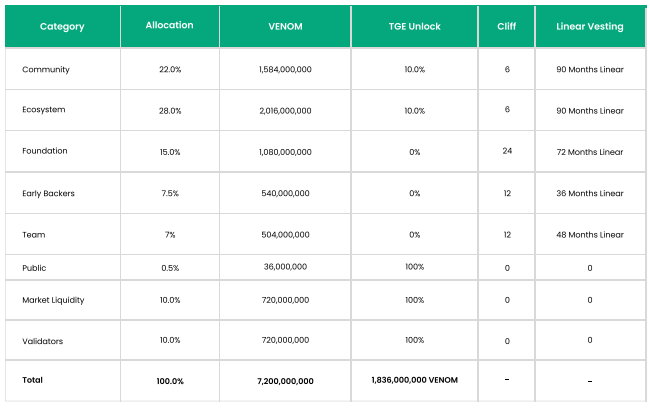

Venom Tokenomics

$VENOM is the network’s primary currency, supporting transactions, staking, and governance. It starts with an inflationary model (7.2 billion initial supply) but plans to transition to a deflationary model through fee burning. NanoVENOM is the smallest unit. Validators are incentivized with block rewards and transaction fees; delegation enables community governance participation.

-

Community: 20%

-

Ecosystem: 28%

-

Foundation: 15%

-

Early Backers: 7.5%

-

Team: 7%

-

Public: 0.5%

-

Market Liquidity: 10%

-

Validators: 10%

Venom Partners

Venom grows with projects like Web3World (DEX), Venom Bridge (cross-chain bridge), and NFT Marketplace. The Developer Program supports third-party teams; collaborations with payment systems and financial institutions enhance financial inclusion.

Venom Team

The Venom Foundation is led by Christopher Louis Tsu (CEO), Peter Knez (Chairman), and Ari Last (CBO). The team has been developing Everscale-based technologies since 2017, collaborating with the community and developers to create innovative solutions.

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.