Latest on Bitcoin ETFs

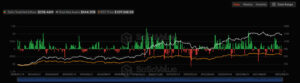

As of September 25, significant outflows were recorded from U.S. spot Bitcoin ETFs, highlighting investors’ cautious stance amid market turbulence.

- Total net outflows: $258.46 million

- Standout fund: BlackRock’s IBIT – the only ETF to record net inflows

- Market reaction: Short-term volatility in Bitcoin prices

BlackRock officials stated:

“Our IBIT fund continues to be seen as one of the safe-haven options for investors.”

Consecutive Outflows in Ethereum ETFs

Ethereum investors also moved toward ETF outflows, a trend seen as a notable signal for market confidence.

- Total net outflows: $251.20 million

- Trend: Fourth consecutive day of outflows

- Market impact: Limited volatility in ETH prices

Investor Recommendations

During this period, choosing reliable funds can serve as a guide for navigating market fluctuations. While short-term volatility may cause concern for investors, experts frequently advise not to alter long-term strategies.

Outflows from Bitcoin and Ethereum ETFs clearly reflect investor behavior and market trends. The net inflows to BlackRock’s IBIT fund highlight its role as a safe-haven option, while consecutive outflows in Ethereum ETFs underscore the market’s cautious short-term sentiment.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.