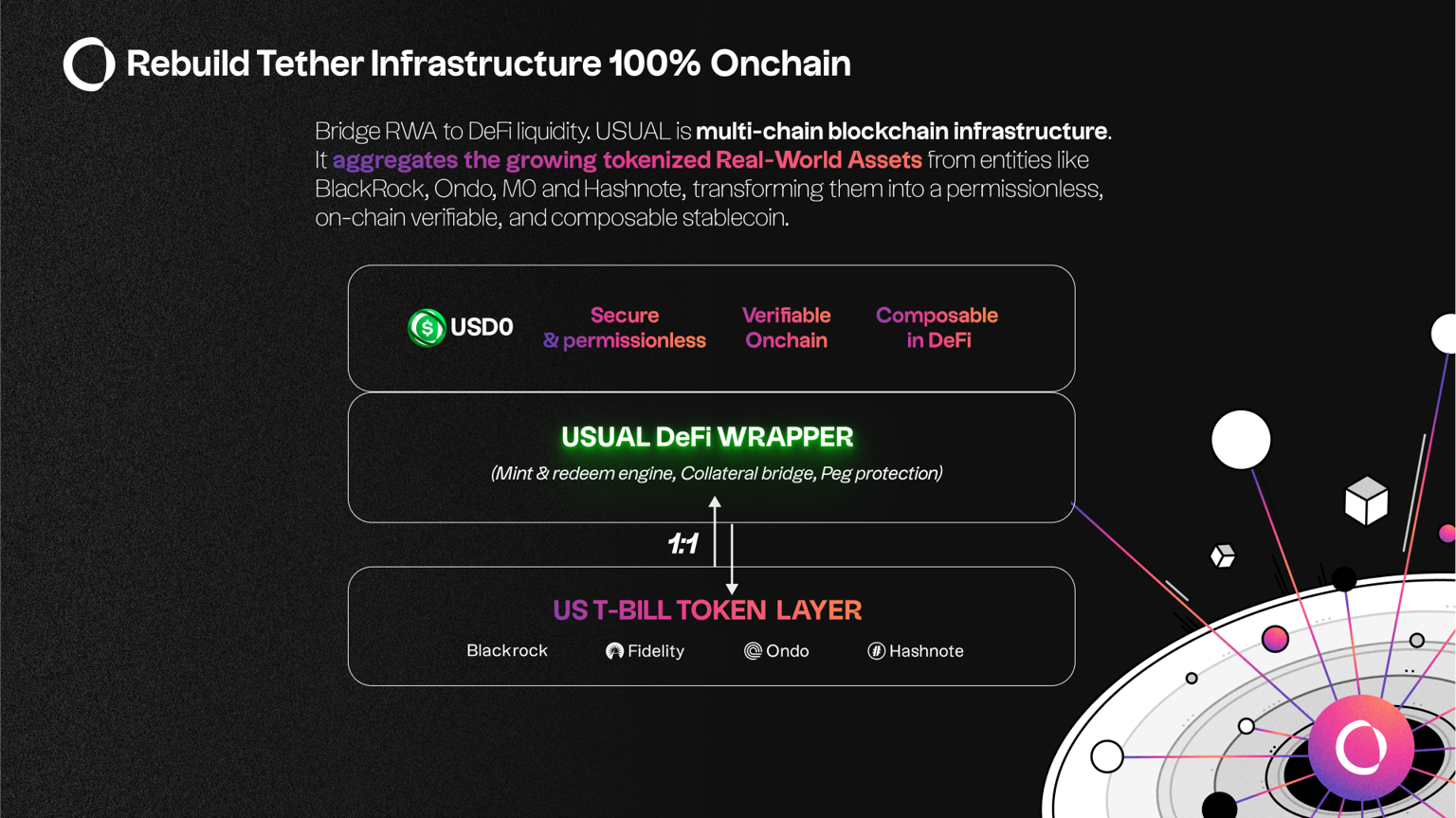

Usual USD (USD0) is a secure, decentralized fiat-backed stablecoin that redistributes ownership and governance to its community through the $USUAL token. By aggregating tokenized Real-World Assets (RWAs) from entities like BlackRock, Ondo, Mountain Protocol, M0, and Hashnote, Usual creates USD0, a permissionless, on-chain verifiable, and composable stablecoin. Addressing the issue of traditional stablecoins like Tether and Circle, which generated over $10 billion in revenue in 2023 without sharing value with users, Usual ensures that protocol success benefits its community. This article explores Usual USD’s functionality, mechanics, and opportunities.

What is Usual USD (USD0)?

Usual operates as a multi-chain infrastructure, combining tokenized RWAs to produce USD0, a stablecoin backed by ultra-short-term RWAs, integrated seamlessly into the DeFi ecosystem. Unlike Tether, where TVL providers control the company and its revenues, Usual redistributes ownership and governance to users and third parties via the $USUAL token. It is built on three key observations:

-

Profit Privatization: Tether and Circle, despite earning over $10 billion in revenue and valuations exceeding $200 billion in 2023, do not share value with users.

-

RWA Growth and DeFi Integration: RWAs are expanding, but with fewer than 5,000 holders on the mainnet, their DeFi integration remains limited.

-

DeFi User Expectations: Users seek exposure to the success of projects they support, especially for early participation and risk-taking.

Usual reimagines fiat-backed stablecoins as fully on-chain, distributing profits and control to $USUAL token holders.

Purpose of Usual USD (USD0)

Usual aims to reform the structure of fiat-backed stablecoins, which privatize profits while socializing losses, by creating a fairer financial system. It empowers users to own the protocol’s infrastructure, treasury, and governance. Through the $USUAL token, 100% of the value and control is distributed to the community, ensuring users benefit from both current and future revenues. USD0 serves as a payment method, trading counterparty, and collateral token in DeFi, while enhancing RWA liquidity and bridging traditional finance (TradFi) with DeFi.

How Does Usual USD (USD0) Work?

Usual aggregates the yield from RWAs backing USD0 into the protocol’s treasury. Instead of distributing this yield as cash flow, it enhances the protocol’s value, strengthening the intrinsic worth of the $USUAL token. This token grants users ownership and decision-making power over the protocol, treasury, and future revenues.

Key Features:

-

Ownership and Revenue Sharing:

-

Treasury Allocation: 100% of protocol revenues flow into the treasury, with 90% distributed to the community via $USUAL tokens.

-

Real-Time Cash Flow: The treasury reflects protocol revenues.

-

Future Cash Flow: Based on potential growth in Total Value Locked (TVL) and revenues.

-

-

Governance Rights: $USUAL holders influence decisions on revenue distribution, collateral management, and risk policies.

-

Utility Rights: $USUAL unlocks staking, validator token mechanisms, and liquidity incentive redirection (“bribing”) opportunities.

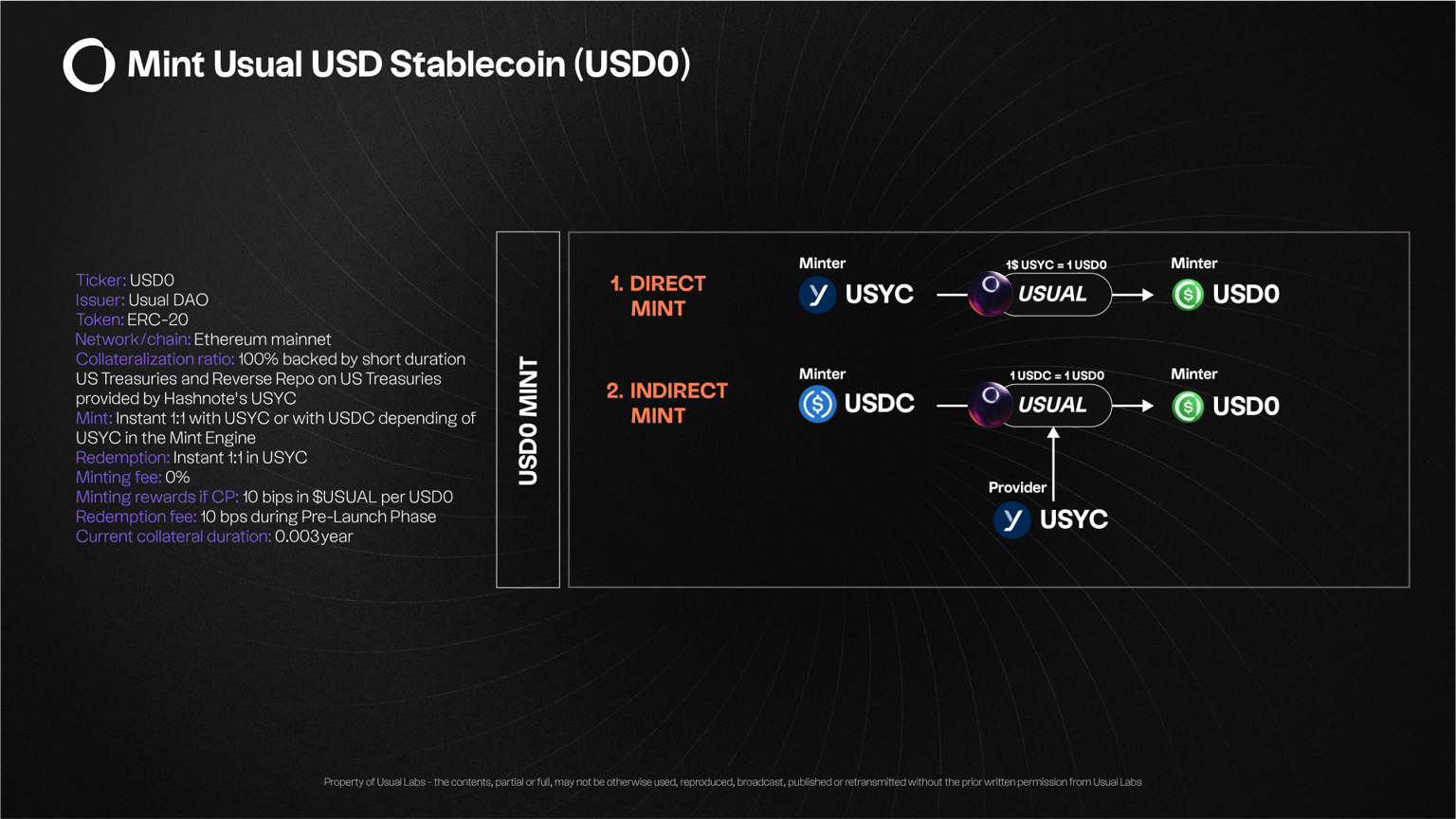

USD0 Mechanics:

-

Minting Process:

-

Direct Mint: Users deposit eligible RWAs into the protocol to receive USD0 on a 1:1 basis.

-

Indirect Mint: Users deposit USDC to receive USD0; a collateral provider (CP) supplies the RWAs. Orders below 100,000 USD0 are redirected to the secondary market.

-

-

Redemption:

-

Direct: USD0 is redeemed for underlying RWAs.

-

Secondary Market: USD0 is sold for USDC/T, with the 1:1 peg maintained through arbitrage.

-

-

Collateral Provision:

-

Collateral providers deposit RWAs, receiving USDC and $USUAL rewards.

-

Process: RWA deposit, USDC-triggered minting, settlement, and reward distribution.

-

USD0++ (Liquid Staking Token):

-

USD0++: A yield-generating Liquid Staking Token (LST) comprising USD0 locked for 4 years, providing daily $USUAL token rewards.

-

Features: Liquid and composable in DeFi, with options for early unstaking or secondary market sales, and leverage via Usual Stability Loan.

-

Yield: Alpha Yield offers exposure to protocol success through $USUAL token volatility and pricing.

-

Early Redemption: Converting USD0++ to USD0 requires returning specific $USUAL tokens; 33% are burned, and 67% are distributed to USUALx and USUAL* holders.

-

Price Floor: USD0++ is locked until June 30, 2028, with a discounted redemption option (e.g., 0.87 USD0) for liquidity. The price floor, calculated based on Federal Reserve interest rates, converges to 1 as maturity approaches.

Usual USD (USD0) Use Cases

USD0 functions as a payment, trading, and collateral token in DeFi, with USD0++ enabling yield generation and governance participation. Use cases include:

-

Payments and Trading: USD0 serves as a secure, permissionless stablecoin for DeFi transactions.

-

Yield Generation: USD0++ allows users to earn $USUAL token rewards.

-

Governance: $USUAL provides voting rights on protocol decisions.

-

RWA Liquidity: Integrates RWAs from Hashnote, Ondo, BlackRock, and others into DeFi.

Usage Steps:

-

Mint USD0 with USDC or deposit RWAs.

-

Stake USD0 into USD0++ to earn $USUAL rewards.

-

Sell USD0++ on the secondary market or unstake early.

-

Use $USUAL for governance or to redirect liquidity incentives.

Usual USD (USD0) Tokenomics

The $USUAL token is distributed in a deflationary manner:

-

Distribution: 90% to protocol operations, stakers, and liquidity providers; 10% to $USUAL* holders.

-

Treasury: 100% of revenues flow to the treasury, with 90% distributed to the community.

-

Governance: $USUAL influences risk policies, collateral, and liquidity incentives.

Usual USD (USD0) Team

The Usual USD (USD0) team comprises the Usual Protocol team:

-

Pierre Person – CEO

-

Adli Takkal Bataille – DEO

-

Hugo Sallé de Chou – COO

-

Manfred Tourron – CTO

-

Pete – CFO

-

Allan Floury – Vice President of Product

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.