Klink Finance (KLINK) is an affiliate advertising technology infrastructure designed for Web3, enabling platforms to expand and monetize their services through a global network of partner offers and online campaigns. With over 900,000 active platform users and a publisher network reaching more than 5.1 million users, Klink has earned trust within the Web3 ecosystem. Collaborating with industry leaders such as Arbitrum Foundation, Bybit, Coinbase, Crypto.com, XDC Network, Wirex, Revolut, and Ledger, Klink delivers high-impact advertising solutions at scale. This article explores what Klink Finance is, how it operates, and the opportunities it provides in detail.

What is Klink Finance (KLINK)?

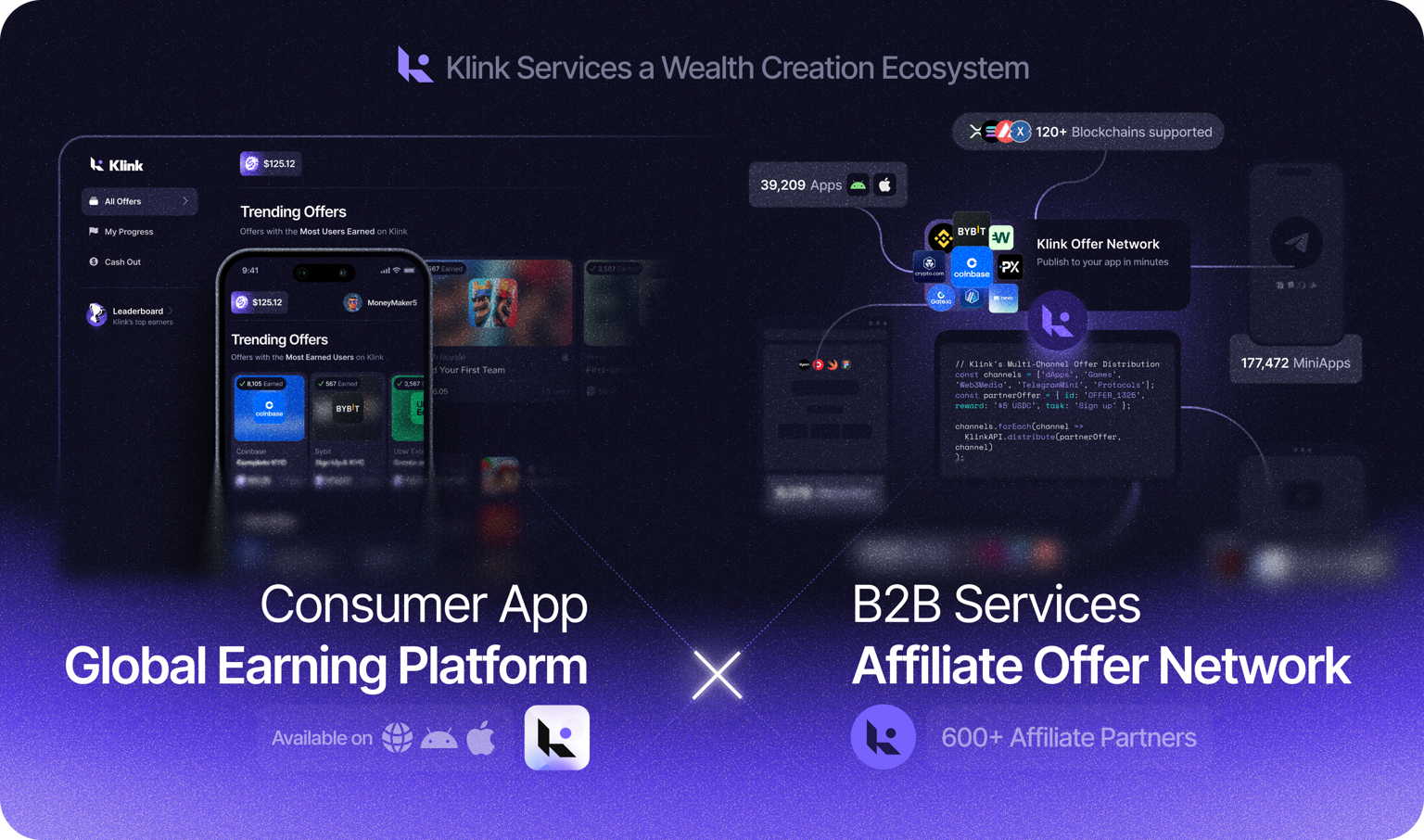

Klink Finance operates as both a consumer-facing platform and a commercial partner network. Its consumer platform, available on iOS, Android, and web, allows users to access partner payouts, multi-chain airdrop campaigns, and daily affiliate offers. The commercial partner network, through the Klink Offer API, enables third-party platforms to monetize and grow their user bases. Klink leverages the $17 billion revenue potential of the Web2 affiliate marketing industry, bringing it to Web3 while addressing challenges like low user activation and high customer acquisition costs (CAC). By connecting users, advertisers, and partners, Klink creates a robust infrastructure for performance-driven growth in Web3.

Purpose of Klink Finance (KLINK)

Klink’s core mission is to establish a global online earnings platform and affiliate advertising network that connects users, advertisers, and partner platforms. It tackles critical issues in Web3 platforms, including low user activation (less than 5% conversion rates), monetization difficulties, rising CAC, fraudulent or bot users, and retention challenges. Klink enables users to earn crypto with zero entry cost and uses AI-powered technology to optimize advertising engagement. Additionally, through B2B integrations, it provides a scalable publisher network for dApps, gaming platforms, and blockchain ecosystems, fostering sustainable revenue models for both individual users and enterprises.

How Does Klink Finance (KLINK) Work?

Klink Finance operates through two primary components: a consumer-facing platform and a commercial Offer API integration.

Consumer-Facing Platform:

- Users access Klink via iOS, Android, or web applications, completing partner offers such as trading, purchasing, gaming, or providing online feedback to earn rewards.

- On-chain and off-chain attribution tracking verifies user activities on partner platforms, with payouts ranging from a few cents to hundreds of dollars in crypto or fiat.

- Earnings can be seamlessly withdrawn to third-party wallets or local bank accounts.

- The $KLINK token is used for campaign payments, subscriptions, and accessing premium features.

Commercial Offer API Integration:

- The Klink Offer API integrates partner offers into third-party platforms like dApps, DeFi protocols, fintech apps, wallets, online games, Telegram mini-apps, and Web3 media.

- Platforms activate and monetize their user bases through Klink’s offer network, leveraging a revenue-sharing model.

- Klink manages offer publishing, deep-link routing, conversion tracking, geo-fencing, and localized cash-out processes. Integration is free, allowing partners to start earning immediately.

AI-Powered Optimization:

- Klink employs machine learning to enhance campaign performance, prevent fraud, and optimize user engagement, ensuring a seamless experience for users and measurable ROI for partners.

Business Model:

- Affiliate Partnerships: Users receive 50% of the payouts from completed offers, with the remaining 50% shared with the platform.

- Airdrop Campaigns: Partner tokens boost social visibility, with Klink taking a treasury share.

- Cash-Out Partners: Users can convert earnings into vouchers, gift cards, or premium retail offers.

- Future Plans: Web3 Offer API integration, $KLINK token launch, Klink Pro subscription, and a DeFi Debit Card for instant spending of earnings.

Klink Finance Use Cases

Klink offers a wide range of use cases:

- Users: Earn crypto or fiat by completing partner offers, participating in airdrops, and engaging with daily opportunities.

- Platforms: Activate and monetize user bases through the Klink Offer API, driving growth.

- Advertisers: Reach a global user base with low CAC and achieve high conversion rates.

- Developers: Create viral campaigns using the Quest API with on-chain attribution tracking.

Usage Steps:

- Download the Klink app and connect a wallet.

- Complete partner offers to earn rewards.

- Stake $KLINK tokens to access Klink Pro premium features.

- Partner platforms use the self-serve portal for API integration.

- Withdraw earnings to crypto wallets or bank accounts.

Advantages of Klink Finance (KLINK)

- Low Customer Acquisition Cost (CAC): Partner-funded offers enable zero-cost user activation.

- High User Engagement: AI optimization and consistent incentives ensure ongoing participation.

- Global Reach: Over 900,000 active members and a network reaching 5.1 million users.

- Diverse Earning Options: Crypto, fiat, airdrops, gift cards, and retail offers.

- B2B Convenience: Free API integration and revenue-sharing model for rapid monetization.

- Security and Transparency: On-chain/off-chain attribution tracking and AI-driven fraud prevention.

Klink Finance Tokenomics

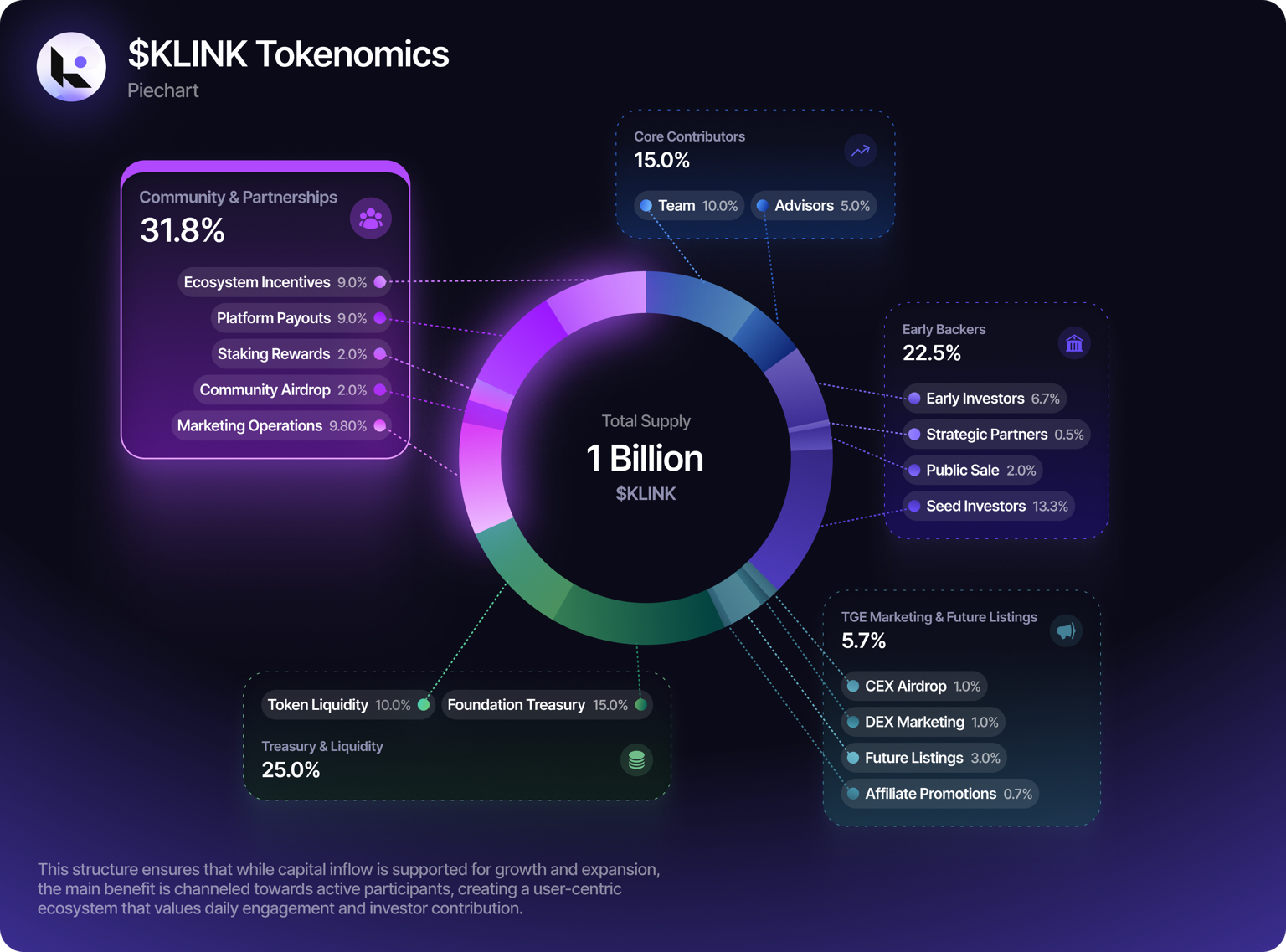

Total Supply: 1,000,000,000 $KLINK (ERC-20, BNB Chain).

Initial Price: $0.03 USD.

Distribution:

- Community and Partnerships: 31.8%

- Core Contributors: 15%

- Early Backers: 22.5%

- TGE Marketing and Futures Listings: 5.7%

- Token Liquidity: 10%

- Foundation Treasury: 15%

Vesting Schedule:

- Seed and Early Investors: 6-month lock, followed by 9–14 months vesting.

- Public Sale: Fully unlocked at TGE.

- Strategic Partners: 6-month lock, followed by 6-month vesting.

- Team and Advisors: 15-month lock, followed by 25-month vesting.

- TGE Marketing and Listings: 100% unlocked at TGE.

- Community and Partnerships: Gradual unlocking over 25 months.

- Staking Rewards and Airdrop: Fully unlocked at TGE.

- Foundation Treasury: 10% unlocked at TGE, remaining vested over 25 months.

$KLINK Usage:

- Payments for advertising campaigns and API integrations.

- Access to Klink Pro subscription for premium features.

- Staking for enhanced earning multipliers and exclusive campaign access.

- Klink Credits (USD-pegged) convert fiat payments to $KLINK via market purchases, driving token demand.

Economic Management:

- Advertiser payments are processed in $KLINK; fiat payments are converted via market buys.

- The treasury supports platform growth, user payouts, and liquidity incentives.

- Staking rewards and airdrops incentivize early user participation.

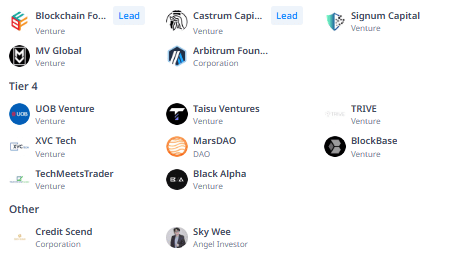

Klink Finance Investors and Partners

Klink has partnered with major global brands, including Arbitrum Foundation, Bybit, Coinbase, Crypto.com, XDC Network, Wirex, Revolut, Ledger, Binance, Sorare, and OKX. Over 40 dApps, gaming platforms, Web3 media, mini-apps, and blockchain ecosystems are on the waitlist for Klink Offer API integration. Klink has hosted successful airdrop campaigns with $LUCKY, YouHodler, TokenMetrics, KOII Network, and Orochi Network, distributing over $500,000 in TGE tokens to hundreds of thousands of participants. Ecosystem support has been secured from Arbitrum Foundation, with ongoing integration discussions with BNB, BASE, XDC, TON, and others.

Klink Finance Team

Founded in 2023, Klink Finance is led by a globally distributed team specializing in affiliate advertising and Web3 technologies. The team, with deep expertise in innovative ad tech and blockchain integrations, is dedicated to building a user-centric earnings platform and a scalable partner network.

- Co-Founder: Chris James Murphy

- Co-Founder: Philip Jonitz

- Strategic Advisor: Tomer Warschauer Nuni

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.