Cynthia Lummis, one of the U.S.’s pro-crypto senators, stated that the fundraising process for the Strategic Bitcoin Reserve (SBR) could start at any moment. She noted that some legal and regulatory hurdles have delayed the process, and there is still no official start date for funding.

However, Lummis indicated that the fundraising phase could become active in the coming weeks or months, signaling renewed momentum for the U.S. government’s plans to integrate Bitcoin into national reserves.

SBR Funding and Institutional Interest

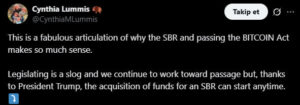

On social media, Senator Lummis commented:

“Although regulatory processes are still moving slowly, thanks to President Trump, fundraising for the SBR could begin at any time.”

Her remarks followed a discussion in which ProCap BTC Investment Director Jeff Park spoke with Bitcoin advocate Anthony Pompliano about SBR’s potential. Park argued that investing $1 trillion from U.S. gold reserves into Bitcoin could be a low-risk move from an economic standpoint.

Lummis supported Park’s perspective, emphasizing the importance of the Bitcoin Act and the SBR framework. According to the senator, the fund would not only increase the government’s reserve diversification but also strengthen Bitcoin’s credibility within the national economy and financial system.

Fund Formation and Purchase Process of the SBR

Details on how the Strategic Bitcoin Reserve (SBR) fund will be raised are still not fully clear. According to official information, the reserve will initially be created using Bitcoin seized by the Treasury Department. Later, new BTC purchases will be conducted in a budget-neutral manner, ensuring no additional burden on U.S. taxpayers.

The stages of the funding process are being closely monitored by investors and markets. Experts note that if the government begins direct Bitcoin acquisitions, this step could have a significant impact on both BTC price and institutional demand.

Even though seven months have passed since President Donald Trump signed the executive order to establish the SBR, the official structure of the reserve is still not finalized. However, many analysts expect the fund to become active soon and start official purchases.

Market Focus: Government Purchases

Analysts predict that if the SBR is implemented:

- Upward momentum in Bitcoin’s price could accelerate

- Institutional investors may increase their market participation

- The fund being managed by the Treasury could serve as a long-term stability signal for the markets

Expert Opinions and Expectations

Crypto analysts and investment professionals emphasize that the SBR would:

- Strengthen Bitcoin’s role in national reserves

- Increase acceptance of digital assets within the financial system

Senator Cynthia Lummis’ statements indicate that the SBR is not just a financial instrument but also reflects the U.S. government’s strategic approach to digital assets.

Once the fund becomes active, both institutional and retail investor interest in Bitcoin is expected to rise. This would be interpreted as a strong signal for increased liquidity and upward price movement in the BTC market.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.