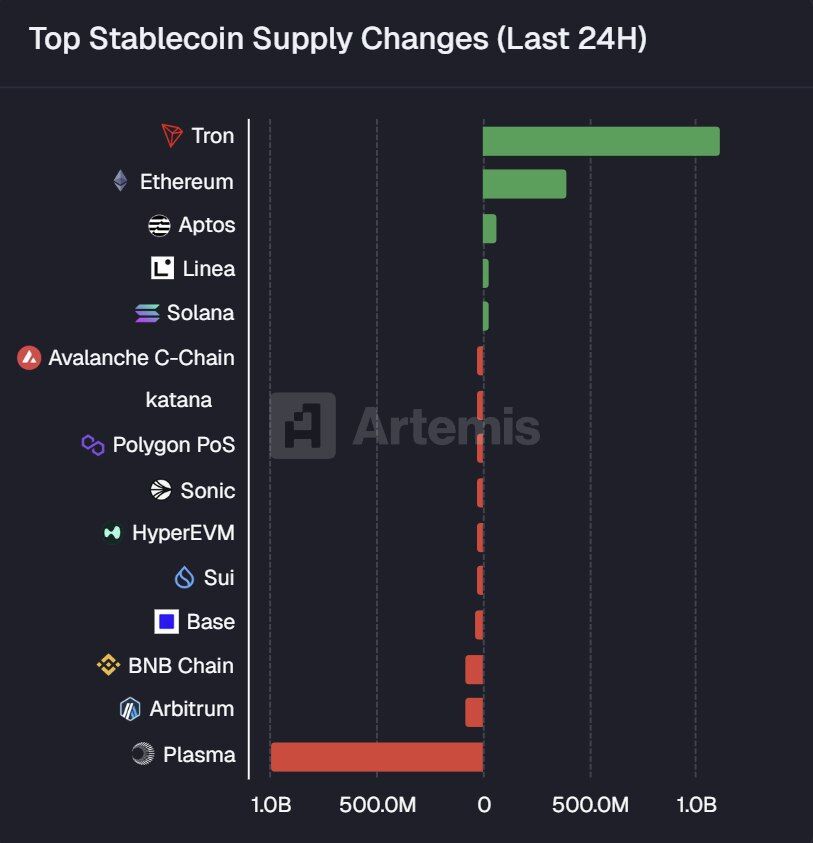

The crypto market has witnessed significant capital movements between TRON and PLASMA (XPL) networks. TRON recorded $1.1 billion in stablecoin inflows thanks to fast transaction speeds and broad token support, while PLASMA experienced a $996 million outflow. These trends highlight how users prioritize speed, variety, and strong DeFi integration when choosing networks. Stablecoin flows remain a key indicator of market trends and investor behavior.

TRON Attracts Strong Capital Inflows

TRON (TRX) supports multiple stablecoins including USDT, USDC, and USDD, attracting users seeking low-cost and fast fund transfers. Its daily transfer volume and active usage across DeFi platforms contribute to a total stablecoin market capitalization exceeding $80 billion. Fast transactions and low fees make TRON a reliable choice for both liquidity and user trust.

Key features:

-

Multi-stablecoin support (USDT, USDC, USDD)

-

Near-instant transactions with low fees

-

Extensive DeFi integration

-

Strong user trust and growing market capitalization

These advantages make TRON a preferred platform for both investors and developers. High transaction volume also helps the network remain competitive in a rapidly evolving market.

PLASMA Sees Nearly $1B Outflow

Despite offering zero transaction fees, PLASMA recorded a $996 million outflow, largely due to its reliance on USDT alone. Analysts point to limited token support and a smaller ecosystem as factors behind the capital loss. Without broader usage and expansion, PLASMA may struggle to compete with larger networks like TRON.

While PLASMA provides fast and free transfers, a more comprehensive ecosystem and broader token support are necessary to maintain competitiveness. This indicates that stablecoin networks must adapt quickly to user preferences and market trends.

Stablecoin Flows as Market Signals

The recent fund movements between TRON and PLASMA illustrate how quickly market sentiment can change. TRON’s inflows reflect strong user confidence and liquidity, whereas PLASMA’s outflows highlight the importance of infrastructure and ecosystem support. These trends will continue shaping the development and competition of stablecoin networks in the coming months.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.