Crypto derivatives funding rates have dropped to the lowest levels seen since the 2022 bear market, following massive liquidations. Analysts suggest this decline indicates that excessive leveraged positions have cleared the market, potentially paving the way for a price rally.

Historic Drop in Funding Rates: Leverage Reset

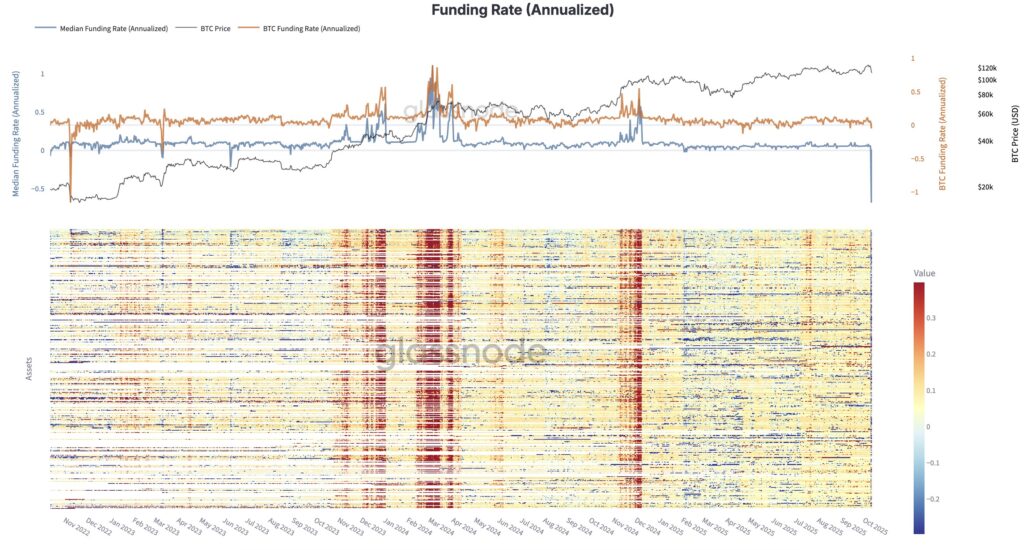

On-chain analytics platform Glassnode reported that crypto derivatives funding rates have reached a three-year low. Experts describe this as “one of the most aggressive leverage cleanups in crypto history.”

Funding rates balance long and short positions among traders in futures contracts. When rates turn negative, traders take more short positions, but this scenario can create opportunities for a rapid price rebound if markets move upward.

Short Position Pressure Could Trigger a Rally

Extremely low funding rates increase the risk of a short squeeze. When many traders open short positions expecting price drops, the market can spike sharply upward.

CoinGlass data shows the long/short ratio has shifted toward bullish sentiment. Around 54% of participants hold long positions, while 29% maintain short positions. Long positions account for 60% of total holdings.

Meanwhile, Bitcoin (BTC) rebounded over 5% after dropping below $110,000 in the last 24 hours. Ethereum (ETH) gained 12%, climbing from $3,800 to $4,183. This recovery has boosted short-term investor confidence in crypto markets.

Historic Liquidation Wave: Crypto Black Friday

Trading platform TradingView labeled the recent event as “the largest leveraged liquidation in crypto history.” After former U.S. President Donald Trump announced new tariffs on China, whales increased short positions.

About 1.6 million leveraged traders were liquidated, causing a $1 trillion market value drop in just a few hours. Kobeissi Letter reported Bitcoin’s first-ever $20,000 red candle and a $380 billion decline in market capitalization. As short positions closed, the market formed a V-shaped recovery, showing how clearing excessive leverage can create healthier market conditions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.