The crypto market is facing a sharp decline as the US-China trade war intensifies. President Trump’s proposal to impose 100% tariffs on Chinese imports from November 1, 2025 triggered a wave of uncertainty across global markets.

The crypto market started October with impressive gains, but the second half of the week saw a rapid fall. Bitcoin dropped to $111,000, while Ethereum and altcoins also entered a downtrend.

Meanwhile, China announced “special tariffs” on US-owned or operated vessels, escalating tensions further. The US responded by imposing tariffs on Chinese imports, including furniture and kitchen cabinets, reducing investor appetite for risk.

Investor Outflows and ETF Sales Accelerate

The tension quickly affected financial markets. On October 13, Ethereum spot ETFs recorded $429 million in net outflows, while Bitcoin ETFs saw $327 million leaving the market. In total, $756 million exited, dropping the crypto market cap by 4% to $3.75 trillion.

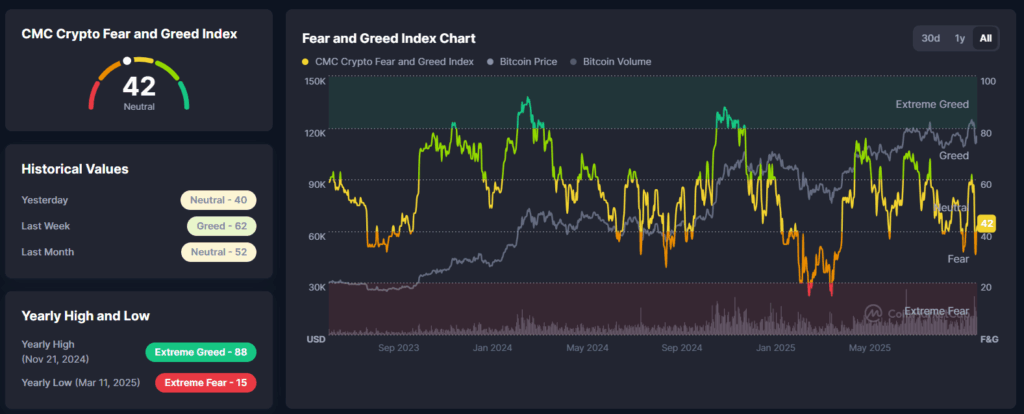

Analysts noted that this sell-off marked the return of fear in the market. Glassnode data shows funding rates in derivatives markets have fallen to their lowest since the 2022 bear market.

Additionally, the Bitcoin Fear & Greed Index moved into the “Fear” zone, signaling cautious investor sentiment.

Key investor signals to watch:

-

Bitcoin tests $111,000 support.

-

Ethereum ETFs see three consecutive days of outflows.

-

Derivatives funding rates decline.

-

A Trump Insider Whale increases short positions.

Trump Insider Whale Back in Action

The famous “Trump Insider Whale,” who previously made over $200 million in profits during last week’s market crash, has taken new action. The whale opened $340 million in new short positions, intensifying market fear.

Previously, the investor held $700 million in BTC and $350 million in ETH short positions. This move indicates a potential new price correction approaching.

According to Santiment analysts, the outcome of ongoing US-China trade talks will determine whether the market stabilizes or faces further declines. However, some experts argue the current sell-off may be a temporary correction, as historically similar waves often create new buying opportunities in crypto markets.

Conclusion: Fear Rises, Opportunities May Emerge

The crypto market remains uncertain amid US-China trade tensions. Analysts suggest short-term losses could lead to long-term recovery opportunities.

Investors are advised to closely follow market analysis, monitor ETF and altcoin trends, and strengthen risk management strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.