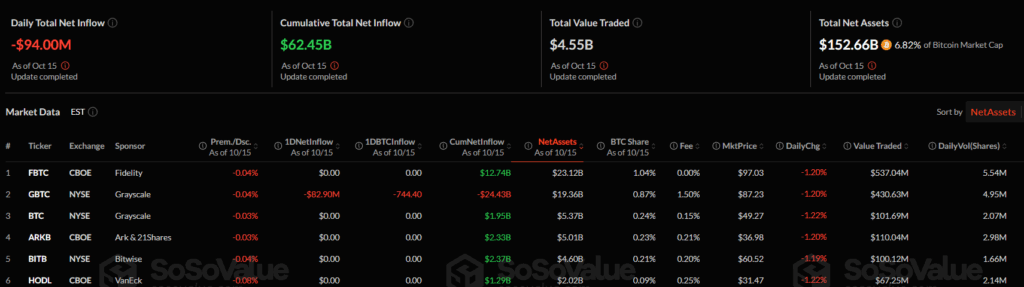

As of October 15, Bitcoin (BTC) spot ETF recorded a total daily net outflow of $94 million, while Ethereum (ETH) ETF posted a modest inflow of $5.32 million.

According to data from SoSoValue, total trading volume across Bitcoin ETFs reached $4.55 billion, with total net assets rising to $152.66 billion — representing about 6.82% of Bitcoin’s market capitalization.

Bitcoin ETF Overview

-

Total Daily Net Flow: -$94 million

-

Cumulative Total Net Flow: $62.45 billion

-

Largest Outflow: Grayscale’s GBTC, with a -$82.9 million outflow

-

Top Fund by Net Assets: Fidelity’s FBTC, holding $23.12 billion

The day’s negative flow was primarily driven by Grayscale’s GBTC redemptions, while other funds such as Ark & 21Shares (ARKB) and Bitwise (BITB) showed minimal activity.

Ethereum ETF Overview

Ethereum ETFs maintained a positive trend, with daily net inflows totaling $5.32 million and cumulative inflows reaching $14.72 billion.

-

Total Daily Net Flow: +$5.32 million

-

Cumulative Total Net Flow: $14.72 billion

-

Largest Inflow: Fidelity’s FETH fund with +$996,000

-

Total Net Assets: $27.69 billion (≈5.66% of ETH market cap)

Grayscale’s ETHE remains the largest Ethereum ETF with $4.20 billion in assets, despite showing no daily flow.

Market Takeaway

The divergence between BTC and ETH ETF flows highlights shifting institutional sentiment. While Bitcoin ETFs experienced notable redemptions, Ethereum ETFs — led by Fidelity — continued to attract steady inflows. Overall, ETF cumulative data still points to strong long-term institutional engagement in crypto markets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.