In crypto markets, trading volume is a critical indicator closely monitored by investors and analysts. An increase in volume boosts market liquidity, makes price movements more reliable, and creates new opportunities for traders. Particularly in major cryptocurrencies like Bitcoin ($BTC) and Ethereum ($ETH), rising volume serves as an important signal for assessing overall market health.

What Is Trading Volume and Why Is It Important?

Crypto volume shows the total value of buy and sell transactions within a specific period, typically measured over 24 hours. High trading volume indicates growing investor interest and increased liquidity.

For instance, according to CoinMarketCap, in the third week of October 2025, Bitcoin’s 24-hour volume averaged $71 billion, while Ethereum’s volume reached $50 billion. This rise allows for more balanced and rapid price discovery.

Altcoin volume changes can also trigger short-term price movements. For example, a sudden volume increase in projects like Solana ($SOL) and AsterDEX ($ASTER) may create profit opportunities for investors.

How Does Rising Volume Affect the Market?

Key effects observed when volume increases:

-

Liquidity Boost: Investors can buy and sell assets faster, spreads narrow, and prices trade at fairer levels.

-

Price Movements: Higher volume often generates upward momentum; sudden surges can increase short-term volatility.

-

Investor Confidence: Strong volume signals a healthy market, attracting new participants.

-

Reduced Manipulation Risk: Low-volume markets are easier to manipulate; higher volume lowers this risk.

These effects are more pronounced in altcoin markets, where volume surges can rapidly influence prices.

What Does High Trading Volume Indicate?

High volume indicates growing interest in a cryptocurrency and stronger liquidity. It supports the reliability of price movements and helps investors track trends more effectively.

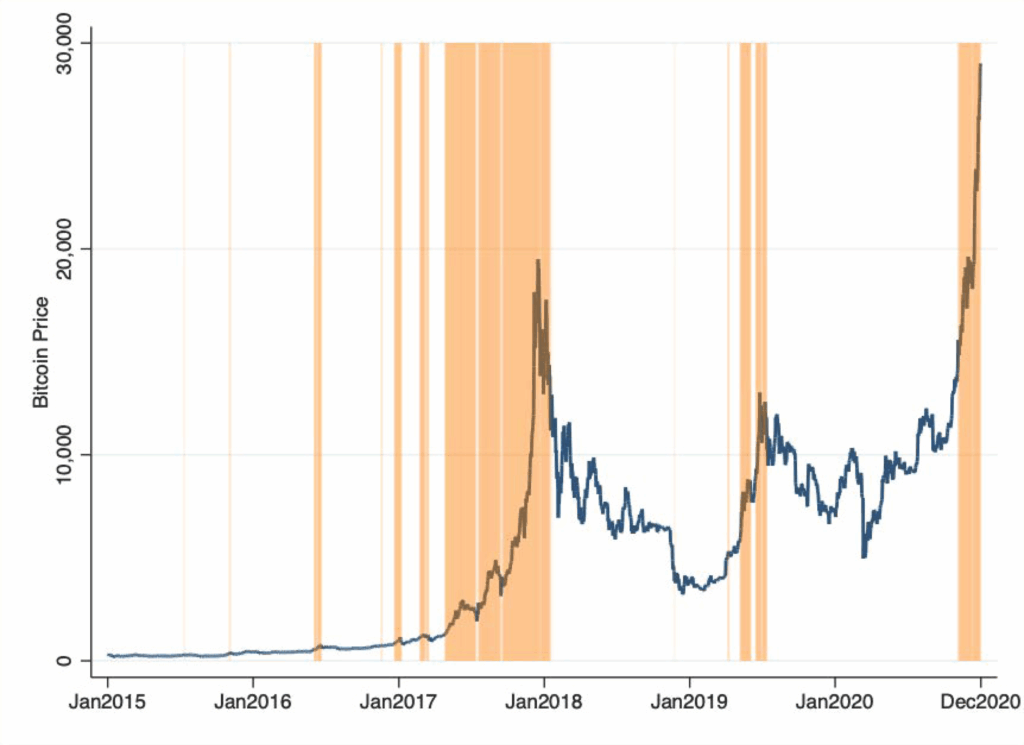

Historical examples underscore volume’s importance: During the COVID-19 period in 2020, Bitcoin trading volume reached record highs, reflecting a vibrant market. Sudden volume spikes in Bitcoin in 2017 and Dogecoin in 2021 highlighted high investor interest and market activity. In January 2021, Dogecoin price rose from $0.00468 to $0.7316 by May—a 15,500% increase—accompanied by significant volume growth, which played a key role in its price surge.

Volume and Price Moving in Opposite Directions

-

Volume rises, price falls: Selling pressure dominates; short-term downside risk increases.

-

Volume falls, price rises: Buying pressure is not fully supported; trend sustainability is uncertain.

Overall, volume alone doesn’t determine price direction but provides crucial insights on trend reliability and liquidity.

How Does Crypto Volume Increase?

Factors that typically drive volume growth:

-

Market news and media coverage

-

Exchange listings and increased liquidity

-

Rapid price movements

-

Institutional participation

What Happens When Crypto Volume Drops?

A decline in volume indicates lower investor interest and market liquidity. Prices may become more volatile, and even small trades can significantly impact value. This is particularly relevant for altcoins, where manipulation risks rise and investor uncertainty grows.

How to Calculate Cryptocurrency Volume

Volume reflects how much of an asset is traded within a period, providing insights into liquidity and market activity. Binance currently holds the highest 24-hour volume at around $20.87 billion, showing strong investor engagement.

Volume Calculation Formula:

Example:

500 BTC × $60,000 = $30,000,000

Monitoring volume alongside buy/sell directions and exchange concentration allows for more informed trading decisions.

Volume Tracking Strategies for Investors

-

Chart & Trend Analysis: Compare volume and price trends; parallel increases indicate strong trends.

-

Cross-Asset Comparison: Analyze volume changes in BTC, ETH, and altcoins for clearer market direction.

-

Spread & Liquidity Monitoring: Track bid-ask spreads to assess liquidity.

-

News & Social Media Tracking: Major news and Google Trends indicate investor interest and potential price moves.

Summary & Market Insight

Rising cryptocurrency volume signals higher liquidity, growing investor interest, and healthier price movements. However, volume growth doesn’t always equate to price increases; context and quality matter. Investors should analyze volume alongside price trends and market news to make informed decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.