In the digital age, dominant platforms like Facebook, LinkedIn, YouTube, and Amazon have mastered the art of extracting value through closed ecosystems, turning user data into their most lucrative asset. By centralizing the intelligence, behaviors, and preferences of billions, every interaction becomes a data point, and every data point translates into profit for these corporations. This isn’t just a privacy issue—it’s a matter of power, leverage, and control over digital capital. Bluwhale, a Web3 protocol, seeks to upend this paradigm. Let’s explore what Bluwhale is, how it functions, and the opportunities it unlocks.

What is Bluwhale (BLUAI)?

Bluwhale is a decentralized artificial intelligence (AI) personalization protocol built on a shared intelligence layer. It empowers users to retain full control over their data, identities, and intelligence, ensuring digital capital flows back to its creators. Having indexed over 700 million wallets, Bluwhale leverages on-chain signals to deliver precise personalization, serving more than 3,000 enterprises across gaming, DeFi, social media, and content sectors. It provides solutions like Sybil detection, intent mapping, and user retention. Over 3 million verified contributors are rewarded based on the reach and relevance of their digital profiles. The BLUAI token drives the protocol, used for gas, node operations, and governance, while BLUP serves as a loyalty program token.

Purpose of Bluwhale (BLUAI)

Bluwhale envisions an internet economy where digital capital belongs to users. It disrupts the traditional model where platforms centralize data for profit, offering data liquidity, intelligence ownership, and rewarded participation. Users control their data, AI models learn from cross-chain shared knowledge, and contributions are directly rewarded. Identities become portable and monetizable. As AI advances faster than data sovereignty, Bluwhale aims to reclaim control before proprietary walls grow stronger, creating a network where users are stakeholders, not products.

How Does Bluwhale (BLUAI) Work?

Bluwhale operates as a decentralized AI personalization protocol, transforming on-chain behaviors into a queryable intelligence layer. User embeddings—portable, composable profiles—enable tailored experiences across applications. Users who share embeddings with dApps earn revenue shares; those who opt out remain anonymous. The protocol functions through three core modules:

Data Verification Module

-

Community Engagement: Anyone can run verifier nodes to secure data.

-

Node Operations: Verifiers validate data, ensuring the AI network’s integrity.

-

Governance: Licensed nodes enforce rules and penalize bad actors.

-

Responsibilities: Validate data quality, contribute to the network, and comply with guidelines.

Identity Embedding Module

-

Multidimensional Identity: Web2 and Web3 identities are linked to NFTs and Soulbound Tokens.

-

Merkle Tree: Identities are structured for selective disclosure, minimizing data leakage risks.

-

Benefits: Self-authentication, social interactions, and commercial value creation.

Privacy Inference Module

-

Zero-Knowledge Proof (zk-SNARK): Validates data with minimal disclosure.

-

Trusted Execution Environment (TEE): Intel SGX ensures secure data processing.

-

Rewards: Contributions and demand determine payouts.

-

On-Chain Records: TEE attestations and rewards are logged on the blockchain.

Key Features:

-

User Control: Data remains with users.

-

Shared Intelligence: AI learns cross-chain, not in silos.

-

Rewards: Contributions yield revenue shares.

-

Portable Identity: Interoperable across applications.

Transaction Process:

-

Users verify Web2/Web3 identities.

-

Data is contextualized via a knowledge graph.

-

Embeddings are shared with dApps optionally.

-

Contributions are rewarded with BLUAI.

Bluwhale (BLUAI) Use Cases

Bluwhale supports:

-

Personalization: Tailored UX and recommendations for dApps.

-

Data Monetization: Users earn by sharing profiles.

-

Gaming and DeFi: User targeting and Sybil detection.

-

Social and Content: Enhanced messaging and social dynamics.

Usage Steps:

-

Join the Bluwhale network and verify identity.

-

Aggregate digital footprint and create embeddings.

-

Share data with dApps for rewards.

-

Trade profile tokens on Whale Tank.

Advantages of Bluwhale (BLUAI)

-

Data Sovereignty: Full user control over data.

-

Shared Intelligence: Cross-chain AI learning.

-

Rewards: Direct revenue sharing.

-

Privacy: Secured by zk-proofs and TEEs.

Risks of Bluwhale (BLUAI)

-

Technical Risk: Smart contract vulnerabilities.

-

Regulatory Risk: Data privacy laws.

-

Market Risk: Token price volatility.

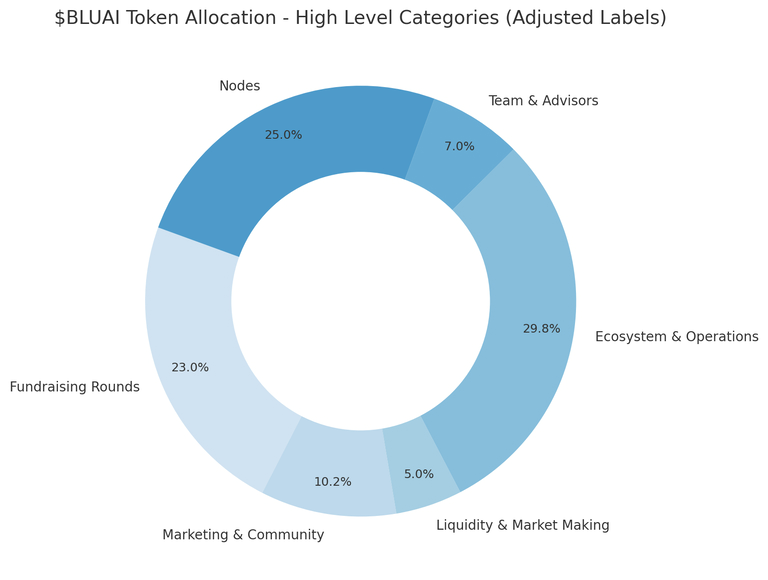

Bluwhale (BLUAI) Tokenomics

Total Supply: 10 billion BLUAI.

-

Distribution:

-

Nodes: 25%

-

Foundation/Treasury: 21%

-

Ecosystem Use: 8.8%

-

Team & Advisors: 7%

-

Airdrop: 6%

-

Exchange Marketing: 2%

-

Future Airdrop: 1%

-

Partner Marketing: 1%

-

Affiliate Marketing: 0.2%

-

Seed Round: 9.16%

-

Private A Round: 6.57%

-

Pre-Seed Round: 4.28%

-

KOL Round: 1%

-

Public Sale: 2%

-

Liquidity: 3%

-

Market Making: 2%

-

Vesting Schedule:

-

Initial Circulation: 12.28%

-

T+3M: Marketing and ecosystem initiatives.

-

T+6M, T+9M, T+12M: Liquidity and growth releases.

-

T+13M onward: 1.2–1.6% monthly emissions.

BLUP Token:

-

Loyalty token, launched at 0 FDV on April 20, 2025.

-

Tradable on WhaleTank and Uniswap.

-

BLU points convert 1:1 to BLUP, locked linearly over 3 years with a 12-month cliff.

Node Types:

-

Master Nodes: Limited to 100,000, with 38,000 sold in Q4 2024, 20% token allocation, non-linear over 4 years.

-

Common Nodes: Unlimited, 5% token allocation, linear over 4 years.

-

Tier 88: Unlocked with 1,000+ referrals, offering exclusive rewards.

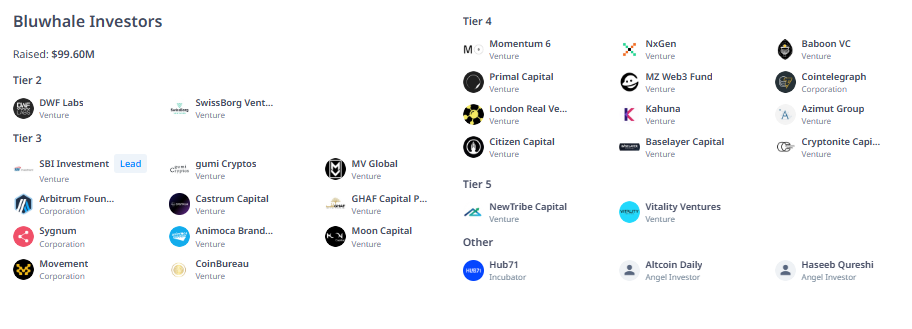

Bluwhale (BLUAI) Investors

Bluwhale raised $99.6 million from investors including DWF Labs, SwissBorg Ventures, SBI Investment, gumi Cryptos, MV Global, Arbitrum Foundation, Castrum Capital, GHAF Capital Partners, Sygnum, Animoca Brands Japan, Moon Capital, Movement, CoinBureau, Momentum 6, NxGen, Baboon VC, Primal Capital, MZ Web3 Fund, Cointelegraph, London Real Ventures, Kahuna, Azimut Group, Citizen Capital, Baselayer Capital, Cryptonite Capital, NewTribe Capital, Vitality Ventures, Hub71, Altcoin Daily, and Haseeb Qureshi.

Bluwhale (BLUAI) Team

Led by CEO Han Jin, the Bluwhale team drives a visionary approach to data sovereignty and AI personalization. Jin’s leadership anchors the protocol’s user-centric focus, supported by a skilled team dedicated to redefining digital ownership.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.