Frax is a pioneering decentralized finance (DeFi) platform that blends innovative stablecoins with a robust protocol ecosystem. It offers three distinct stablecoins—frxUSD, FPI, and frxETH—alongside various non-stablecoin tokens. Integrated with multiple subprotocols, Frax ensures stability and usability, delivering a modular and versatile system tailored to the needs of users and protocols. This article delves into what Frax is, how it operates, its tokenomics, and the opportunities it provides.

What is Frax (FRAX)?

Frax is a comprehensive DeFi platform that combines stablecoins and subprotocols to create a dynamic financial ecosystem. It currently issues three stablecoins: frxUSD (pegged to USD), FPI (the Frax Price Index stablecoin, tied to a basket of consumer goods), and frxETH (a liquid staking derivative pegged to ETH). The Frax ecosystem also includes subprotocols like Fraxswap, Fraxlend, and BAMM (Borrow AMM), as well as Fraxtal, a Layer 2 (L2) blockchain. Frax leverages Algorithmic Market Operations (AMOs) to manage protocol-owned liquidity (POL), with the FRAX token serving as the native gas token for Fraxtal. Backed by $1.21 million in funding, Frax is supported by a vibrant community.

Purpose of Frax

Project aims to deliver decentralized financial solutions through stablecoins and DeFi protocols. It enables users to conduct secure, transparent, and efficient transactions. frxUSD provides a stable fiat-backed asset, FPI establishes an independent unit of account, and frxETH simplifies Ethereum staking for yield generation. Fraxtal offers low-cost transactions and rapid scalability. Frax fosters a community-driven ecosystem that encourages value creation and sharing for both users and protocols.

How Does Frax Work?

Project operates as a multi-layered ecosystem, integrating stablecoins and subprotocols to address diverse financial needs. Each component is designed to work seamlessly together. Here are the key elements:

Stablecoins

-

frxUSD: A 1:1 USD-pegged, fully collateralized stablecoin backed by tokenized U.S. Treasury funds (e.g., BlackRock BUIDL, Superstate USTB). Managed by Frax Inc under Frax DAO delegation, it ensures 1:1 reserves with regulated custodians, handling custody, KYC/KYB compliance, and fiat redemptions.

-

FPI: The first stablecoin pegged to a consumer goods basket, offering a unit of account independent of national currencies.

-

frxETH: A liquid staking derivative pegged to ETH. Its counterpart, sfrxETH, accrues staking rewards. frxETH V2 supports anonymous validator pools.

Subprotocols

-

Fraxswap: A Uniswap V2-based AMM with a time-weighted average market maker (TWAMM) feature, used for collateral rebalancing, stablecoin supply management, and liquidity deployment.

-

BAMM (Borrow AMM): A borrowing/lending module built on Fraxswap, requiring no external oracles or liquidity. Borrowers remain solvent during high volatility.

-

Fraxlend: A permissionless lending market enabling isolated pair-based borrowing and collateral onboarding. Maximum loan-to-value (LTV) ratios are community-determined.

-

AMOs / POL: Algorithmic Market Operations manage collateral and generate revenue, including Fraxlend AMO, Curve AMO, and Uniswap V3 AMO.

-

Fraxtal: An Optimism-based L2 chain using its token as its gas token. Users earn FXTL points through gas spending and pool farming.

-

Frax Bonds (FXB): Zero-coupon bond-like tokens convertible to LFRAX at maturity, aiding peg stabilization.

-

sfrxUSD: An ERC4626-based yielding stablecoin that distributes weekly protocol yields, selecting the best strategy (carry-trade, AMO, or IORB/T-Bill).

-

veFRAX: Locking FRAX tokens grants voting power and enhanced farming weights.

Transaction Process:

-

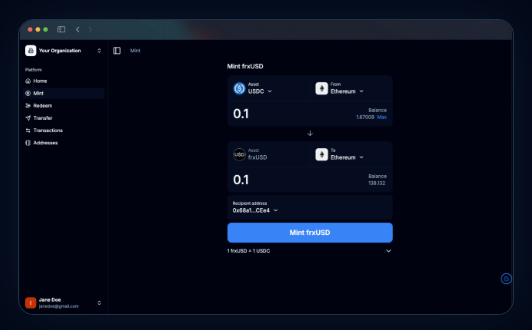

Users deposit fiat or collateral for frxUSD, minted via custodians.

-

Staking in sfrxUSD yields returns.

-

Fraxswap or Fraxlend facilitates liquidity provision or borrowing.

-

FXBs are purchased at a discount and redeemed for LFRAX at maturity.

-

Transactions on Fraxtal using FRAX earn FXTL points.

Use Cases

Project supports:

-

Stablecoin Transactions: frxUSD, FPI, and frxETH for payments, savings, or DeFi operations.

-

Yield Generation: sfrxUSD and sfrxETH for staking returns.

-

Borrowing/Lending: Fraxlend and BAMM for collateral-based transactions.

-

Liquidity Provision: AMM pools on Fraxswap.

-

Governance: veFRAX for protocol decision-making.

-

Fraxtal: Low-cost L2 transactions and FXTL rewards.

Usage Steps:

-

Connect a wallet to the Frax platform.

-

Acquire frxUSD, FPI, or frxETH.

-

Engage with Fraxswap, Fraxlend, or BAMM.

-

Stake sfrxUSD/sfrxETH or purchase FXBs.

-

Transact on Fraxtal to earn FXTL points.

Advantages

-

Stability: Fully collateralized stablecoins.

-

Yield: Competitive APY via sfrxUSD and sfrxETH.

-

Permissionless Access: Fraxswap and Fraxlend allow open participation.

-

Modularity: Fraxtal enables low-cost transactions.

-

Community-Driven: veFRAX and FXTL incentivize engagement.

Risks

-

Market Risk: Stablecoin peg fluctuations.

-

Technical Risk: Smart contract vulnerabilities.

-

Regulatory Risk: Legal challenges for fiat-backed stablecoins.

-

Volatility: Market dependency for frxETH and FXBs.

Frax Tokenomics

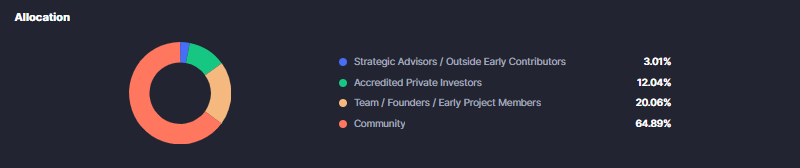

Maximum Supply: 99.68 million FRAX.

-

Distribution:

-

Community: 64.89%

-

Team/Founders/Early Members: 20.06%

-

Accredited Private Investors: 12.04%

-

Strategic Advisors/External Early Contributors: 3.01%

-

Emission Schedule:

-

Initial 8% annual inflation (FIP-428), decreasing 1% yearly, stabilizing at 3% after 6 years.

-

Emissions fund community initiatives, Fraxtal growth, team expansion, and DAO treasury.

-

Frax Burn Engine (FBE) reduces supply by burning FRAX tokens (e.g., via FNS Registrar, Fraxtal EIP1559 fees).

Cross-Chain Strategy:

-

OFT (Omnichain Fungible Token): frxUSD, sfrxUSD, frxETH, sfrxETH, WFRAX, and FPI are transferable via LayerZero.

-

Dual-Lockbox: Liquidity exits on Fraxtal and Ethereum.

-

Hub Model: Fraxtal-centric “Hop” contracts streamline bridging.

-

WFRAX vs. FXS: WFRAX is the LayerZero OFT; FXS is the legacy Ethereum version.

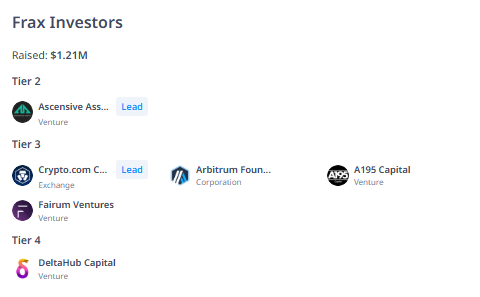

Frax Investors

Project raised $1.21 million from investors including Ascensive Assets, Crypto.com Capital, Arbitrum Foundation, A195 Capital, Fairum Ventures, and DeltaHub Capital.

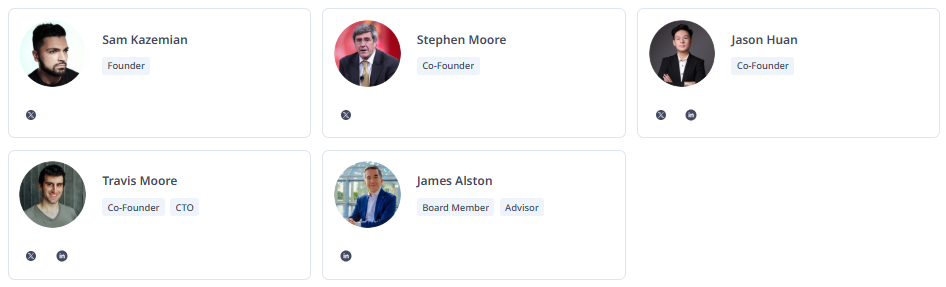

Frax Team

The team, led by Sam Kazemian, includes Stephen Moore, Jason Huan, Travis Moore, and James Alston. Under Kazemian’s guidance, the team focuses on DeFi and stablecoin innovation.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.