After 14 years of complete inactivity, a Satoshi-era Bitcoin whale has moved part of its long-dormant holdings. The early miner, who mined around 4,000 BTC in 2009, transferred 150 Bitcoin to a new wallet, sparking fresh curiosity across the crypto community.

Satoshi-Era Wallet Becomes Active After More Than a Decade

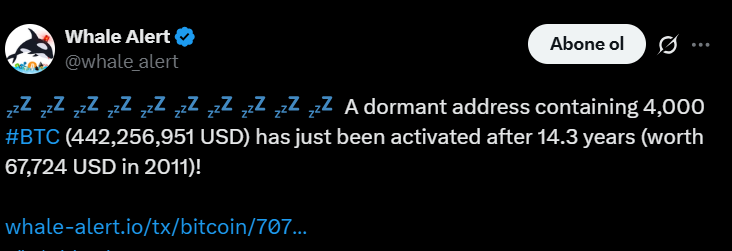

According to Whale Alert, the wallet’s unknown owner mined approximately 4,000 BTC between April and June 2009, just months after the Bitcoin network went live. Data from Nansen shows that the whale sent 150 BTC (worth over $16 million) in a single transaction on Thursday.

On-chain data from Mempool indicates the address may have once held as much as 7,850 BTC. The whale was last active in June 2011, when it consolidated all its Bitcoin into a single wallet. With Bitcoin currently trading around $110,604, the whale’s remaining holdings are estimated to be worth over $442 million.

Analysts Spot Growing Activity Among OG Bitcoin Whales

Independent blockchain analyst Emmett Gallic noted that this particular whale once held over 8,000 BTC across multiple addresses and has been gradually selling portions of its holdings for years.

He commented on X (formerly Twitter):

“A whale that once held 8,000 BTC has reactivated a Satoshi-era wallet. After today’s 150 BTC move, it’s now steadily selling down to 3,850 BTC. God-level DCA strategy.”

Blockchain data confirms that the address now holds roughly 3,850 BTC. Such on-chain movements often trigger speculation among investors about whether early holders are preparing to offload more coins into the market.

What Does This Mean for the Bitcoin Market?

In July, another early Bitcoin address holding 80,201 BTC became active for the first time in 14 years, transferring part of its funds to Galaxy Digital.

Crypto analyst Willy Woo observed in June that whales holding over 10,000 BTC have been consistently reducing their exposure since 2017.

However, experts told Cointelegraph in August that old whales cashing out shouldn’t be seen as a bearish signal. Instead, it often means that new institutional buyers are entering the market — a healthy sign of a maturing Bitcoin ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.