Last week’s sharp sell-off in the crypto market significantly impacted digital asset funds. The three-week streak of outflows accelerated during the recent downturn, resulting in a total net withdrawal of $2 billion from crypto funds. This level of outflow has not been seen since the tariff crisis in February. Despite the overall bearish sentiment, two altcoin funds attracted substantial investments, standing out as exceptions in a challenging market.

Record Outflows from Major Funds

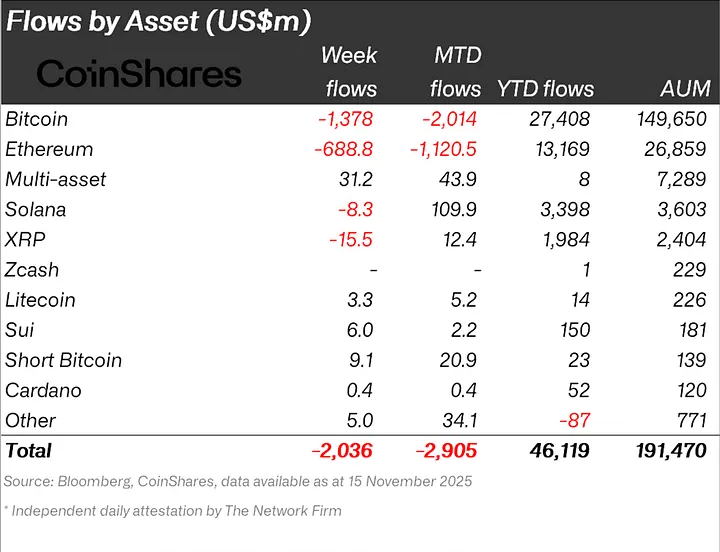

CoinShares’ latest weekly report highlighted heavy withdrawals from Bitcoin and Ethereum funds. Bitcoin-focused funds alone saw $1.3 billion in outflows, while Ethereum funds lost $688 million. Even altcoins that had previously attracted significant capital, such as XRP and Solana, were not immune to the downturn. XRP funds experienced net outflows of $15.5 million, and Solana funds saw $8.3 million withdrawn.

Cumulatively, the past three weeks have resulted in $3.2 billion in fund outflows, indicating a notable decline in investor risk appetite.

Surprising Interest in Litecoin and Sui Funds

Amid this market turbulence, Litecoin and Sui funds recorded remarkable inflows. Litecoin funds received $3.3 million, while Sui funds attracted $6 million in new investments. Cardano funds also saw modest inflows of $400,000.

The influx into these altcoin funds suggests that investors are increasingly looking to diversify their portfolios during downturns. It also reflects confidence in the long-term potential of specific projects, even when broader market conditions are negative.

Rising Short-Bitcoin Positions

Investors anticipating further declines in Bitcoin are also becoming more active. Short-Bitcoin funds, which had seen $12 million in inflows last week, attracted another $9 million this week. These funds are designed to profit from Bitcoin price declines, providing a hedge for risk-averse market participants.

Overall, the current landscape indicates a broad market correction and growing caution among fund investors. However, the notable inflows into Litecoin and Sui funds demonstrate that even in volatile markets, some investors are ready to seize opportunities in selective altcoin projects.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.