The crypto market decline accelerated today as Bitcoin slipped below the $90,000 mark. Large investor sell-offs pushed altcoins lower, with over $1 billion in liquidations recorded in the past 24 hours. The Fear & Greed Index fell to extreme fear levels, highlighting investor caution.

Bitcoin Hits $89K as Market-Wide Panic Spreads

Bitcoin fell 6% during Asian trading hours, reaching $89,000. Historical patterns suggest that BTC could potentially correct down to its realized price of $55,000. The selling pressure extended to major altcoins like Ethereum, XRP, BNB, Solana, and Cardano. Ethereum dropped 16% over the week to $2,948, its lowest in five months. Popular tokens such as DOGE, SOL, ADA, and XRP saw losses ranging from 5% to 9%, reflecting the broader market downturn.

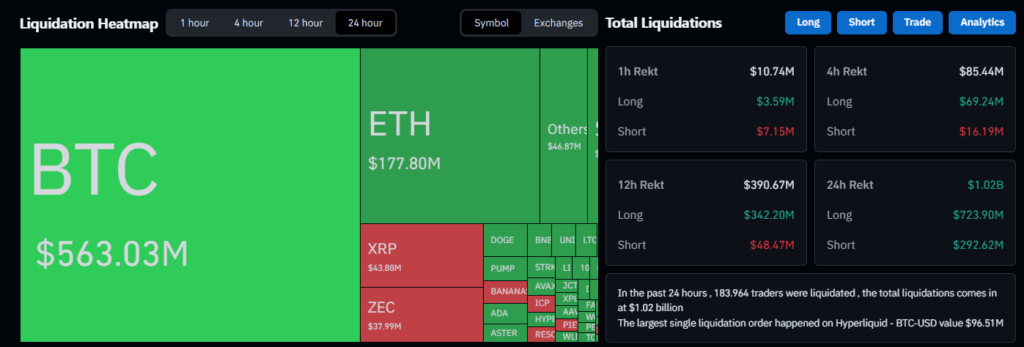

Over $1 Billion Liquidated Across Exchanges

According to Coinglass, more than 180,000 traders were liquidated in the last 24 hours, with total liquidations surpassing $1 billion. The largest single position liquidated was a $96,480 BTCUSD long on Hyperliquid. Trend altcoins like Zcash and Telcoin fell over 10%. The total crypto market cap dropped 1.2 trillion dollars in just over a month, now standing at $3.08 trillion.

Fear & Greed Index fell to 11, signaling extreme market caution. Some investors, however, began buying the dip, seizing opportunities amid the sharp decline. The majority of liquidations came from long positions, with approximately $720 million in longs liquidated and $280 million in shorts.

ETF Outflows Add to Selling Pressure

Spot Bitcoin and Ethereum ETFs continue to see net outflows. Farside Investors data shows $254.6 million withdrawn from Bitcoin ETFs in a single day, including $145.6 million from BlackRock IBIT and $34.5 million from Grayscale Bitcoin Mini Trust. CoinShares reports highlight outflows in BTC, ETH, XRP, and SOL funds. Meanwhile, Solana ETFs saw limited inflows, and Ethereum ETFs recorded $182.7 million in net outflows over five consecutive days. Grayscale ETH products saw minor inflows, reflecting some dip-buying sentiment after a 39% drop from ATH. Overall, the market trend shows that ETF investors are not providing significant support during this crypto market decline.

Exchange Breakdown: Liquidation Rates

Liquidation data reveals differences across exchanges. Hyperliquid led with $35.20 million in liquidations, 96.48% of which were long positions. Bybit saw $22.13 million liquidated, with 87.42% longs. Binance experienced $12.33 million in liquidations with a more balanced long-short ratio. OKX recorded $8.26 million in liquidations, with shorts comprising 52.67%. This indicates that leveraged long positions were most affected by the current market downturn.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.