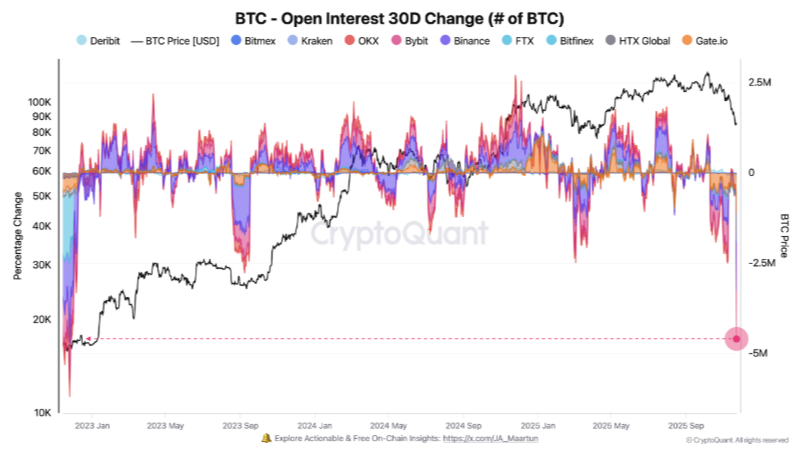

Bitcoin open interest (the total number of outstanding derivative positions) sharply declined in the last week of November, accelerating the market’s search for direction. This movement indicates a notable shift in investor behavior. Analysts also suggest that this rapid decline could serve as a bottom signal preceding a major market cycle reversal.

Bitcoin open positions fall as market reduces risk

Bitcoin open interest has undergone a significant cleansing process amid recent volatility. Futures trading volume has slowed considerably, while liquidations have cleared the market of excessively risky positions. Additionally, traders are reducing leverage, indicating that aggressive appetite in the derivatives market has temporarily diminished. Historically, such periods often preceded strong market bottoms.

“Historically, these cleansing phases have often been essential to forming a solid bottom and setting the stage for a renewed bullish trend. Deleveraging, forced closures of overly optimistic positions, and a gradual decline in speculative exposure help rebalance the market.”

Darkfost noted that the last time Bitcoin open interest fell so quickly over 30 days was during the 2022 bear market, highlighting the significance of the current market cleanup.

Why the market entered a cleansing phase

BTC’s pullback is not only a technical correction but also reflects weakening global risk appetite. Slower ETF flows and panic among short-term traders have accelerated this process. On-chain data shows an increase in large wallet movements, suggesting that mid- and long-term investors are viewing the retracement as a buying opportunity. This dynamic could help restore market balance.

Critical price ranges: Where could the rally be triggered?

Bitcoin’s price can quickly shift market sentiment at certain thresholds, laying the groundwork for new trends.

• $88,000–$90,000: Key buying zone

• Above $94,000: Breakout area where momentum strengthens

• $82,000–$84,000: Support band for reactionary purchases

In addition, rising volatility makes volume distribution in these zones increasingly decisive. With derivatives market activity weakening, spot demand may dominate, leading to sharper price reactions.

Could a new Bitcoin rally happen?

Experts believe that the rapid unwinding of open positions indicates the market has shed overheated leverage levels. If spot buyers regain strength, Bitcoin could quickly gain upward momentum. Furthermore, liquidity accumulated around psychological price levels may accelerate upward moves, allowing BTC to approach key breakout zones again.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.