The Federal Reserve’s (Fed) latest Beige Book has been released, offering a snapshot of economic conditions across the United States. The report paints a picture of stability with pockets of pressure, as most of the twelve Federal Reserve districts reported little to no change in overall activity compared to the previous period. While several districts experienced slight declines, one region noted modest growth, highlighting an economy that is holding steady but not without concerns.

Early Signs of Softening Activity

One of the key takeaways from the report is the growing sense of caution among business contacts. Some respondents highlighted rising risks of a slowdown in economic activity over the coming months. Even so, certain sectors—particularly manufacturing and construction—showed limited but notable optimism. The report also pointed out that wage growth in these areas has edged higher, a sign of continued demand for skilled labor despite broader uncertainty.

Moderate Increases in Prices and Wages

The Beige Book noted that prices increased at a moderate pace throughout the reporting period. Wage gains continued but generally slowed relative to previous reports. Still, several industries reported more pronounced wage pressures. Although companies expect cost challenges to persist in the near term, the survey revealed a more mixed outlook on future price increases, indicating that firms may exercise greater caution in passing costs through to consumers.

Labor Market Cooling and Margin Pressures

Nearly half of the Fed districts reported weaker demand for labor. While overall employment saw a slight decline, the report emphasized that this softness has not become widespread. Tariffs also received significant attention, with many firms indicating that these policies are squeezing profit margins and contributing to operational difficulties. At the same time, some businesses noted falling prices in certain materials, attributing the declines to muted demand, delayed tariff implementations, or recent tariff reductions.

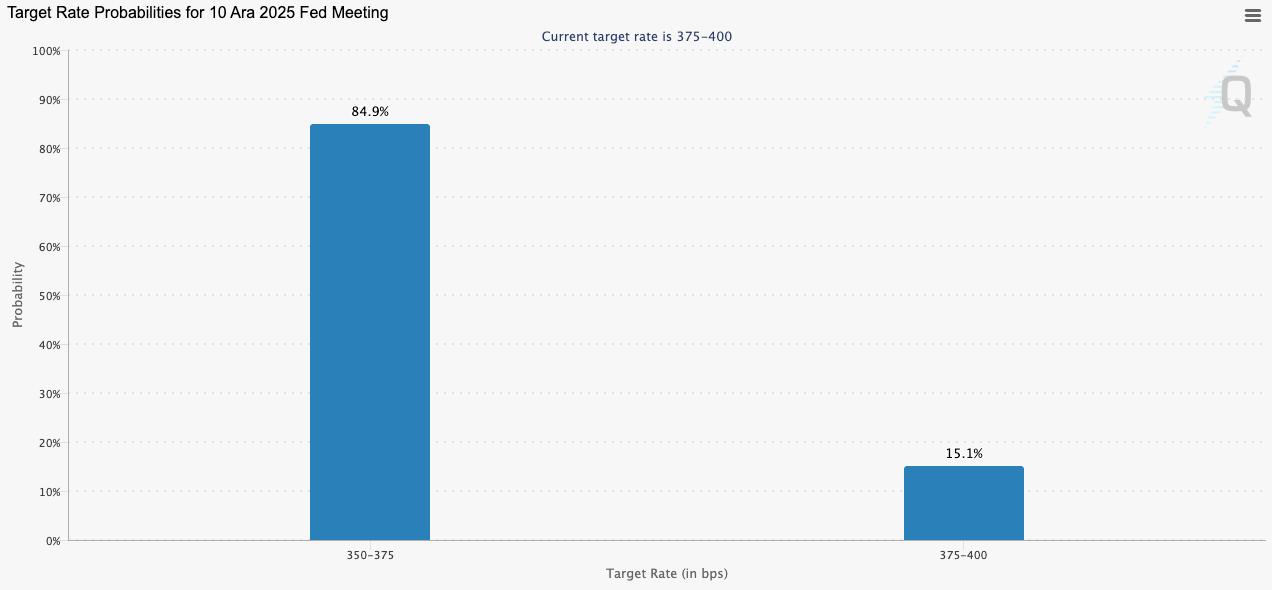

Markets React: Rising Odds of a December Rate Cut

Following the publication of the Beige Book, money markets increased the probability of a 25-basis-point rate cut at the Fed’s upcoming December 10 meeting to 84.9 percent. This shift in expectations fueled a more upbeat tone across financial markets.

U.S. Equities and Bitcoin: A Snapshot of Market Sentiment

Equity markets closed the session on a positive note, supported by improving risk appetite. The Dow Jones Industrial Average climbed 0.67 percent, the S&P 500 gained 0.65 percent, and the Nasdaq outperformed with a 0.82 percent rise—a move seen as investors positioning themselves ahead of potential monetary easing.

Cryptocurrency markets, meanwhile, adopted a more cautious stance. Bitcoin (BTC) is currently trading around the 91,000-dollar level, holding above key psychological thresholds despite elevated volatility, liquidity reductions and ongoing macroeconomic uncertainty. Investors continue to monitor shifts in Fed policy and global risk sentiment, both of which remain influential drivers for digital asset performance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.