U.S. President Donald Trump has strengthened expectations of a leadership change at the Federal Reserve with new remarks. Speaking at the White House, Trump signaled that National Economic Council Director Kevin Hassett is a “potential Fed Chair,” adding that the new chair will be announced at the beginning of 2026. The announcement is being closely monitored by both global markets and the crypto ecosystem.

Trump: “We will announce the new Fed Chair at the beginning of the year”

Referring to Hassett in his speech, Trump said:

“I think we have a potential Fed chairman here. I don’t know if I’m allowed to say that, potential. I can say that he is a respected person. Thank you, Kevin.”

Trump has previously criticized current Fed Chair Jerome Powell, whose term expires in May 2026, and stated that he would announce the successor early in the year. Trump also said that they initially evaluated 10 candidates but have now narrowed it down to “a single person.”

What Would Kevin Hassett’s Fed Policy Look Like?

Kevin Hassett played a central role in economic policymaking during the Trump administration. In economic circles, he is viewed as much more dovish than Powell, favoring faster rate cuts.

Possible policy characteristics:

- Support for lower interest rates

- Preference for loose monetary policy to stimulate growth

- Alignment with Trump’s economic priorities (tariffs, cheap borrowing)

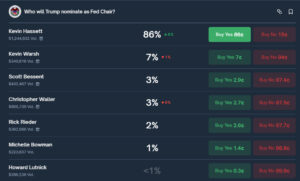

According to prediction markets at Kalshi, the probability of Hassett being appointed jumped from 40% to 86% in a short time. Fed Governor Christopher Waller currently stands at 15%. Analysts believe that if Hassett becomes Fed Chair, he may abandon Powell’s cautious approach and implement faster rate cuts, potentially lowering 10-year yields and boosting market liquidity.

What Would Such an Appointment Mean for Crypto Markets?

Analysts suggest that Hassett becoming Fed Chair would be strongly positive for digital assets:

- Faster rate cuts → weaker dollar

- Higher liquidity → bullish environment for BTC and ETH

- Cheaper credit → return of risk appetite to altcoins

- More capital for new token projects

Historically, Bitcoin and Ethereum perform strongly when real yields fall. Increased liquidity also supports demand for ETFs and tokenized products. Risk appetite shifting toward altcoins could benefit DeFi, Layer-2 projects, and new launches.

But There Are Risks

If the independence of the Fed becomes politicized:

- Bond markets may react negatively

- Crypto volatility could spike

- Short-term shocks may occur

Still, markets broadly view a Hassett-led Fed as likely to deliver an aggressive easing cycle, which would significantly support digital assets. Analysts said:

“Hassett’s potential appointment signals a more aggressive easing policy. This could create a powerful liquidity tailwind for both traditional and digital markets.”

Conclusion

Trump’s remarks reduce uncertainty around Fed leadership and push markets to price in a more dovish monetary policy outlook. If appointed, Kevin Hassett could create a favorable environment for Bitcoin, Ethereum, and the broader altcoin market. The decision, expected in early 2026, remains one of the most closely watched macro developments for the crypto ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.