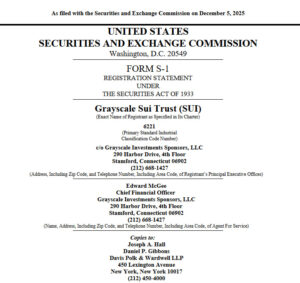

A major surprise has unfolded in the cryptocurrency market. Digital asset management giant Grayscale has taken an unexpected step by filing for a spot ETF for SUI. The filing, made via an S-1 form, is seen as a critical milestone in making SUI more accessible to institutional investors on a larger scale. The move has created strong resonance both within the SUI ecosystem and across the broader altcoin market.

Why Did Grayscale File a Spot ETF for SUI?

Grayscale’s move toward SUI is viewed as a reflection of the company’s recent strategy to increase altcoin diversification. The spot ETF application will not only attract institutional interest, it will also make SUI’s long-term potential more visible to the market. According to analysts, SUI’s technological structure, scalability, and the growth of its developer community make it a strong candidate for institutional products. It is also noted that Grayscale submitted this application at a time when the market is searching for a new altcoin-driven narrative.

The Importance of a Spot ETF for the Market

Spot ETF products are financial instruments in which crypto assets are held directly as collateral, offering investors a physically-backed model. If SUI is included in this category following the approvals of Bitcoin and Ethereum spot ETFs, institutional demand is expected to increase. The ability of large funds to access such products could create a new wave of demand for SUI.

This could be critical in terms of SUI’s price stability and liquidity. Additionally, if the spot ETF is approved, it may lead to more investment in the SUI ecosystem, the development of new applications, and a broader user base. The growth of the ecosystem could support SUI’s long-term position by increasing on-chain activity and developer engagement.

Initial Reactions from the Industry: Rising Expectations

Grayscale’s application quickly drew attention within the crypto community. Some analysts interpret this move as the beginning of a new era in the altcoin market, while others warn that the spot ETF approval process could be challenging. However, the general expectation is that this step will significantly increase SUI’s visibility and institutional profile. Market experts believe this may set a precedent for other altcoin projects, particularly those with expanding use cases, enabling them to attract more institutional capital through ETFs.

A statement from Grayscale reads:

“The growth potential and infrastructural strength of the SUI ecosystem make it an important candidate for the institutional investment world. Our spot ETF application aims to bring this potential to a wider investor base.”

Assessment

Grayscale’s spot ETF application for SUI stands out as both a reflection of the company’s strategy to expand product diversity and a signal of SUI’s increasing institutional appeal. If the application is approved, it could trigger a new period of liquidity for SUI and potentially shift the balance in the altcoin market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.