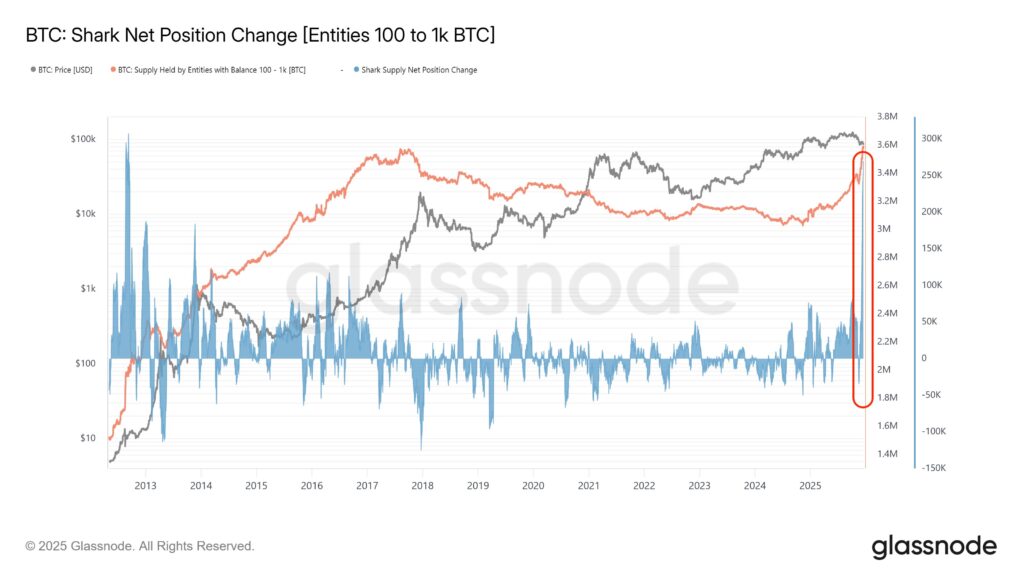

Bitcoin whales executed an aggressive accumulation strategy during the market downturn. On-chain data shows that 269,822 BTC entered whale wallets over the past 30 days. This amount is valued at over $23 billion at current prices, marking the largest monthly whale accumulation in more than 13 years.

Whales Turned The Dip Into Opportunity

While Bitcoin remained volatile, whales did not participate in selling pressure. Instead, they used price pullbacks as buying opportunities. Large wallets holding between 10 and 10,000 BTC added 269,822 BTC to their portfolios in just one month.

This behavior highlights long-term value expectations rather than short-term fluctuations. Historically, whales have applied similar accumulation strategies near market lows.

This accumulation is not merely speculative; it reflects a structural redistribution of supply. In Q4 2025, mid-cycle holders (3–5-year-old coins) liquidated positions. Long-term holders and institutional whales absorbed this selling pressure. As a result, exchange reserves tightened, establishing a de facto price floor. Historical patterns suggest whale-driven accumulation often precedes significant price surges, as seen in 2019 and 2020.

Exchange Withdrawals Increase Supply Shock Risk

During the same period, around 403,000 BTC was withdrawn from exchanges. This reduced Bitcoin’s liquid supply, potentially causing sharper price reactions during sudden demand spikes.

- Whales accumulated over $23 billion worth of BTC.

- A net 269,822 BTC was added to whale holdings.

- 403,000 BTC was withdrawn from exchanges, tightening supply.

This trend indicates a structural shift in market liquidity.

Historical Data Suggests Trend Reversal

Past market cycles show that heavy whale accumulation often precedes trend reversals. On-chain indicators support this observation. The Puell Multiple also remains in the historical “buying zone.”

Financial analysts believe current whale activity could support medium- and long-term Bitcoin price stability. The preference of major investors for cold wallets indicates low selling intent.

Investor Sentiment And Market Psychology

Whale accumulation directly impacts retail investor sentiment. During periods of heavy accumulation, market sentiment typically shifts toward cautious optimism. This reduces selling pressure and encourages bottom-fishing behavior.

Analysts note that while large-scale movements can temporarily strain market stability, they strengthen price discovery over the long term.

Conclusion

Bitcoin whales executed the largest monthly accumulation in 13 years. With over $23 billion in BTC accumulated and 403,000 BTC withdrawn from exchanges, supply shock potential rises. Historical trends and on-chain data suggest the market is seeking a new balance.

This content is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.