IXS stands for Institutional eXchange Settlement Layer, providing blockchain and tokenization infrastructure for institutional investors. The platform enables the tokenization, trading, and settlement of real-world assets in full regulatory compliance. As a licensed platform, IXS allows global issuance and trading of compliant assets.

IXS bridges traditional financial markets with blockchain technology, giving institutional investors access to EVM-compatible chains such as Base, Ethereum, Polygon, and Avalanche. Focusing on the Base chain, IXS facilitates the tokenization, compliant issuance, trading, and settlement of real-world assets like real estate, bonds, and private loans.

Team Overview

IXS is led by an experienced team in finance, law, and technology:

-

Julian Kwan – Co-Founder and CEO: Serial entrepreneur, blockchain and security token expert with real estate investment experience.

-

Aaron Ong – Co-Founder and President: 8+ years in capital markets at UBS, DBS, and Bank of Singapore.

-

S. Alice Chen – Co-Founder and COO: 17+ years in corporate law; former experience at DLA Piper and Skadden Arps.

-

Alexander Cucer – CTO: Over 10 years of blockchain and machine learning project leadership.

-

John P. – Advisor: 25+ years of business and technology transformation experience in hospitality, real estate, and financial services.

Investors and Key Partners

IXS is backed by leading institutional investors including:

-

Coinbase Ventures

-

UOB Bank Ventures

-

Spartan Group

-

Abed Group

These partnerships strengthen IXS’s vision of bridging traditional finance with blockchain in a secure and scalable manner.

Project Vision and Mission

Vision: Establish a global infrastructure standard for compliant and liquid trading of tokenized real-world assets.

Mission: Deliver institutional-grade blockchain infrastructure that ensures regulatory compliance, deep liquidity, and seamless integration with global financial systems.

Simplified Example

Buying a small portion of a real-world asset, like 1 percent of an apartment, is usually costly and complex. Banks, notaries, and paperwork are involved. IXS turns such assets into tokens, so a 1 percent share becomes a digital coin. These tokens can be easily traded on IXS’s platform like Bitcoin or Ethereum. The platform is fully licensed in the Bahamas and Singapore, making it secure for banks and institutional investors.

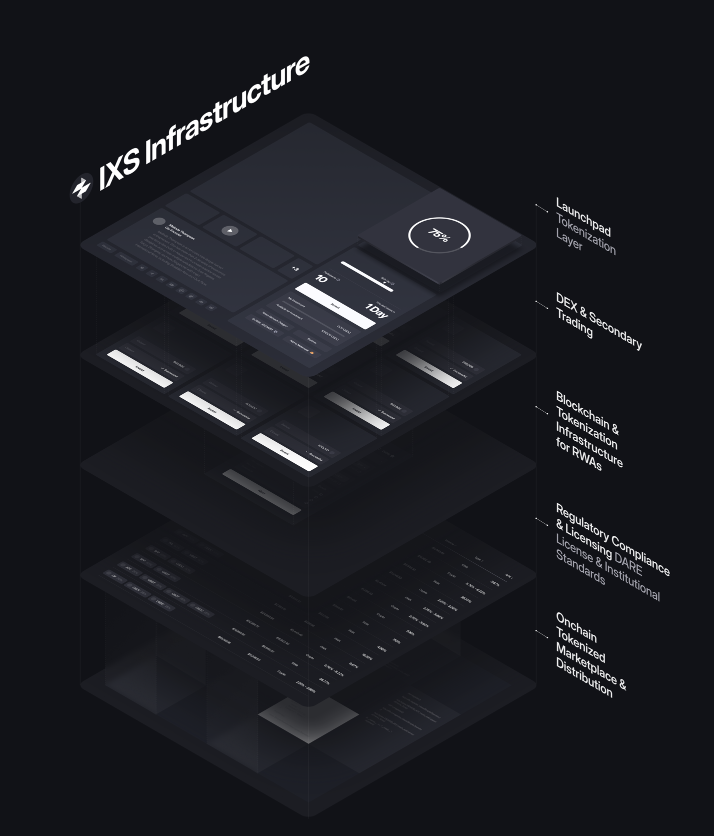

How the Platform Works

-

IXS Launchpad: Primary issuance platform for new tokenized assets (STOs) in full regulatory compliance.

-

IXS DEX: Secondary market for tokenized securities, using an Automated Market Maker (AMM) algorithm.

-

SaaS: Provides corporate clients with infrastructure to create and manage their own RWA tokens.

The platform works alongside InvestaX, which holds Recognized Market Operator (RMO) and Capital Markets Services (CMS) licenses from the Monetary Authority of Singapore.

Governance

IXS operates with a corporate and compliance-first governance structure:

-

All asset issuance and trading is fully licensed and regulated.

-

Provides a transparent and secure governance system.

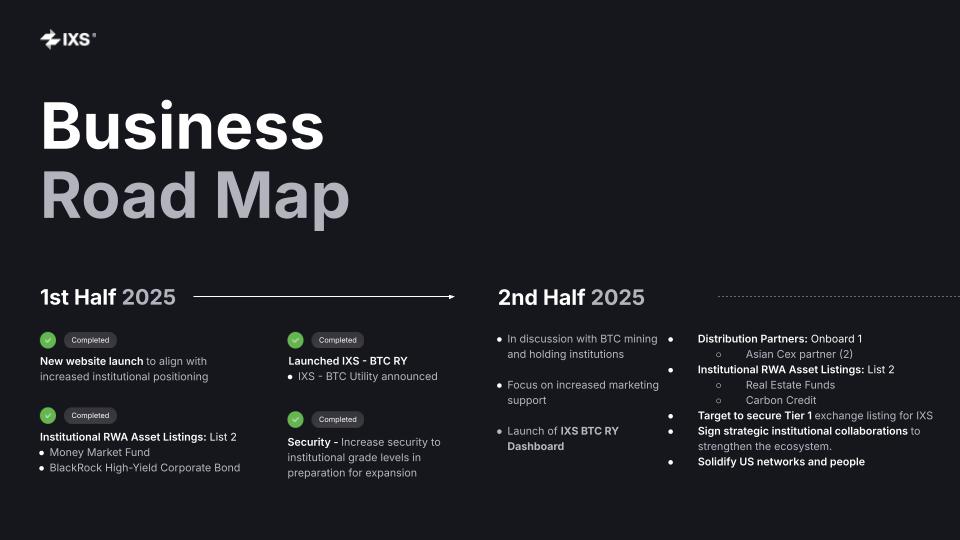

Roadmap Second Half 2025

-

Corporate Meetings: Strategic discussions with BTC mining and BTC holding institutions.

-

Marketing and Tools: Launch of IXS BTC RY Dashboard and marketing support.

-

New RWA Assets: Listing real estate funds and carbon credits.

-

Distribution Partnerships: At least one new partnership; onboarding two Asia-based CEX partners.

-

Exchange Listings: Listing $IXS token on Tier 1 exchanges.

-

Strategic Collaborations: Establish corporate-level strategic partnerships.

-

Market Expansion: Strengthen US network and team presence.

$IXS Token

$IXS is the utility token of the IXS ecosystem, combining DeFi mechanics with institutional-grade RWA incentives. Tokenomics are driven by Moon and Solar Vaults, including a buyback and burn mechanism funded by platform fees for long-term sustainability.

$IXS also offers a staking system, allowing users to earn points redeemable for RWA tokens, creating a bridge between decentralized finance and institutional assets. Beyond IXS Finance, $IXS serves as the InvestaX platform token, extending utility across multiple financial infrastructures.

Token Use Cases

-

Governance: Voting on proposals and protocol decisions.

-

Transaction Fees: Discounts and payment within the platform.

-

Staking: Earn rewards or a share of platform revenue.

-

Liquidity Mining: Incentives for providing RWA liquidity.

-

Buyback and Burn: Platform revenue used to buy and burn IXS tokens.

Token Details

-

Total Supply: 180M IXS

-

Max Supply: 180M IXS

-

Circulating Supply: 180M IXS

Ecosystem and Features

-

Institutional tokenization infrastructure

-

Integrated platform compatible with global financial systems

-

Secure, transparent, and regulatory-compliant operations

-

Deep liquidity for tokenized assets

-

Bridges traditional finance and blockchain for institutional RWA access

Social Media & Official Channels

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.