As the decentralized finance (DeFi) ecosystem grows, liquidity fragmentation and inefficient swap transactions have become one of the primary problems for users. While the same asset trades across different chains and dozens of different pools, transactions executed through a single DEX often fail to provide the best price. Odos (ODOS) stands out as an advanced Smart Order Routing (SOR) protocol aimed at solving this structural issue.

What is Odos (ODOS)?

Odos is a multi-chain DeFi infrastructure designed for both individual and institutional users, aiming to provide the best price, the lowest slippage, and the most efficient transaction routing.

In DeFi, liquidity is typically fragmented. Even on a single chain, the same token can exist in dozens of different liquidity pools. This situation results in transactions from a single pool almost never being optimal.

Odos’s core approach is to aggregate this fragmented liquidity structure under a single smart framework, executing transactions through routes involving multiple pools, multiple tokens, and multiple steps in the most efficient way. The system also factors in gas costs to deliver the highest net output to the user.

Smart Order Router (SOR) and Advanced Optimization

At the heart of Odos lies its Smart Order Router (SOR), built on an advanced algorithm capable of analyzing millions of possible transaction routes. Instead of being limited to a single DEX or pool, this system aggregates liquidity from:

- Multiple DEXs and AMMs

- On-chain order books

- Lending protocols

- Private RFQ (Request for Quote) systems

This structure allows Odos to split transactions across different pools, thereby minimizing price impact. For users, this means better rates and lower slippage.

Patented AMM Pathfinding Algorithm

One of Odos’s differentiating features is its patented automated market maker (AMM) pathfinding algorithm. This algorithm analyzes over 500 liquidity sources to determine the most efficient transaction path.

The system does not focus solely on direct token pairs; when necessary, it routes through intermediate tokens to offer more advantageous prices. This approach provides significant advantages, especially in large-volume trades and low-liquidity tokens.

Multi-Token and Atomic Swap Structure

One of Odos’s most innovative solutions is its multi-token atomic swap feature. This allows:

- Multiple tokens to be swapped within the same transaction

- An entire portfolio to be rebalanced in a single transaction

- DAO and protocol treasuries to be managed with fewer transactions

Thanks to the atomic structure, the transaction either fully executes or does not execute at all. This minimizes operational risks while significantly reducing gas costs.

Institutional Usage and DAO-Focused Solutions

Odos caters not only to individual traders but also to DAOs, on-chain treasuries, and professional trading desks.

Especially for DAOs, Odos provides:

- Asset consolidation

- Portfolio rebalancing

- Multi-token liquidation

by optimizing these processes under a single transaction, offering significant operational convenience.

Odos API Ecosystem for Developers

Odos offers an easy-to-integrate API infrastructure for DeFi protocols and Web3 applications. Through these APIs:

- Wallets can add native swap functionality

- DEX interfaces can expand their own pools via Odos routing

- Meta-aggregators can compare different routing engines

Additionally, the free API tier enables user-focused platforms to quickly integrate Odos infrastructure.

Advanced Pricing and Data Tools

Odos provides comprehensive solutions not only for swaps but also for DeFi-native pricing. The system supports:

- Block-level price data

- Cross-chain price pairings

- Long-tail asset prices

providing detailed datasets. Reliable pricing is available even for low-liquidity or lesser-known tokens.

Supported Chains and Scalability

Odos is built on a multi-chain architecture and actively operates on EVM-compatible networks. The system currently calculates millions of routes across many networks, including Ethereum, Arbitrum, Polygon, Optimism, Base, Avalanche, BNB Chain, zkSync, and Fantom.

This structure demonstrates that Odos is compatible with both today’s and future DeFi expansion.

Gas Optimization and Efficiency

The Odos team optimizes transaction efficiency not only through pricing but also through gas costs. The smart routing system deducts gas costs from the transaction output to maximize net benefit for the user.

This approach enables Odos to offer more advantageous rates compared to competitors, especially during periods of high network congestion.

Security, Transparency, and Institutional Standards

Odos is a SOC 2 Type II compliant company. The platform:

- Does not engage in preferential routing

- Does not apply over-quoting

- Offers transparent and verifiable transaction structures

This approach makes Odos a reliable infrastructure for both individual users and institutional actors.

Odos Investors and Strategic Backers

Odos stands out in the DeFi ecosystem not only with its technical infrastructure and product diversity but also with its investor profile. The project has strengthened its long-term growth vision by receiving support from both Web3-native funds and leading institutional players in the sector.

- Uniswap Labs Ventures

- Mantle

- Orbs

- Curved Ventures

- CE Innovation Capital

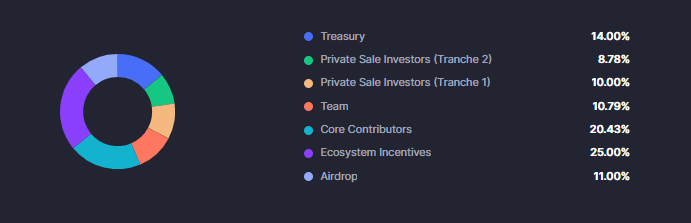

ODOS Tokenomics

The ODOS token is structured for ecosystem incentives, DAO operations, and long-term sustainability. The token distribution offers a balanced structure:

- Ecosystem incentives: 25%

- Core contributors: 20.43%

- Treasury: 14%

- Airdrop: 11%

- Team and private sale investors: remaining distribution

This structure is designed to support both early contributors and long-term ecosystem development.

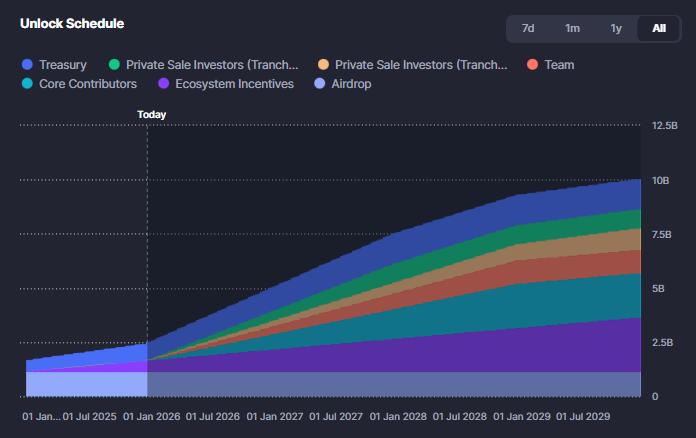

Vesting:

Odos Team

Odos was founded by the Semiotic Labs team. Semiotic Labs is a research center operating at the intersection of artificial intelligence, cryptography, and blockchain, and one of the core developers of The Graph protocol.

The team possesses deep technical expertise in advanced topics such as autonomous decision-making systems, zk-SNARKs, and on-chain data optimization.

The founding team includes:

- Ahmet Özcan (Co-Founder and CEO)

- Matt Deible (Co-Founder and Head of Research)

- Nuria Gutiérrez Prunera (Head of DAO Operations and Governance)

Official Links

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates.