As the decentralized finance (DeFi) ecosystem continues to grow, issues of volatility and sustainable yields are increasingly coming under discussion. At this point, protocols backed by real-world assets (RWA) stand out as the building blocks of the next phase of DeFi. Anzen Finance (ANZ) positions itself as a DeFi protocol born precisely from this need, bringing private credit markets on-chain and aiming to redefine the use of stablecoins.

Anzen is a decentralized lending platform developed by credit investment experts, focusing on asset-backed and cash-flow-generating structures. The protocol’s main goal is to create more stable yield mechanisms within DeFi and to expand the use cases of stablecoins beyond speculative returns.

Anzen Finance (ANZ)’s Core Vision

Unlike classic DeFi protocols, Anzen Finance derives its yields not from crypto-native instruments but from tokenized private credit assets. With this approach, the platform aims to produce external and sustainable yields that can operate in both bull and bear markets.

The Anzen team has been conducting research on bringing credit assets on-chain since 2018. The founding team has a combined experience of over a decade in credit and capital allocation. This expertise forms the foundation of the protocol’s risk management and asset selection processes.

What is USDz? How Does It Differ from Classic Stablecoins?

At the center of Anzen Finance is the digital dollar called USDz. Unlike fiat-collateralized stablecoins like USDC or USDT, USDz is backed by tokenized real-world assets (RWA).

The collateral structure of USDz is based on a diversified private credit portfolio. This portfolio consists of cash-flow-generating, collateralized assets that have passed specific underwriting criteria. As a result, USDz has a structure that is relatively independent from sharp price fluctuations in crypto markets.

USDz users:

- Gain access to RWA-based sustainable yields

- Can partially isolate their portfolios from crypto volatility

- Can achieve a more predictable yield profile within DeFi

This structure also differentiates the risk profile of interacting with USDz from classic stablecoins.

sUSDz and the Staking Mechanism

In the Anzen ecosystem, USDz can be staked to obtain sUSDz. sUSDz is a staking token that automatically accrues yields.

Key points:

- sUSDz holders earn rewards without any additional action

- Yields accumulate within the staking contract

- The value of sUSDz increases over time; no direct reward distribution occurs

- Upon unstaking, the user receives the staked USDz + the accumulated value increase

This model aims to provide compound yields on-chain in a simple and efficient way.

Real-World Assets (RWA) and Collateral Structure

The collaterals behind USDz consist of US-based private credit assets. The portfolio design emphasizes the following criteria:

- Assets being located in the US

- Concentration limits to prevent overexposure to a single asset

- Use of only collateralized asset-backed securities (ABS)

These tokenized assets are locked as collateral on-chain and can be tracked transparently.

Percent Partnership and Underwriting Process

Anzen has a special partnership with Percent for underwriting and custody processes. Percent is a licensed and established institution that has completed over $1 billion in private credit transactions to date.

Percent’s management team consists of individuals with experience at institutions such as BlackRock, UBS, Goldman Sachs, and JP Morgan. The platform’s historical performance:

- $1.6 billion in transaction volume

- Average 16% annual yield

- Approximately 2% default rate

This structure is one of the key elements strengthening the risk management of Anzen’s RWA portfolio.

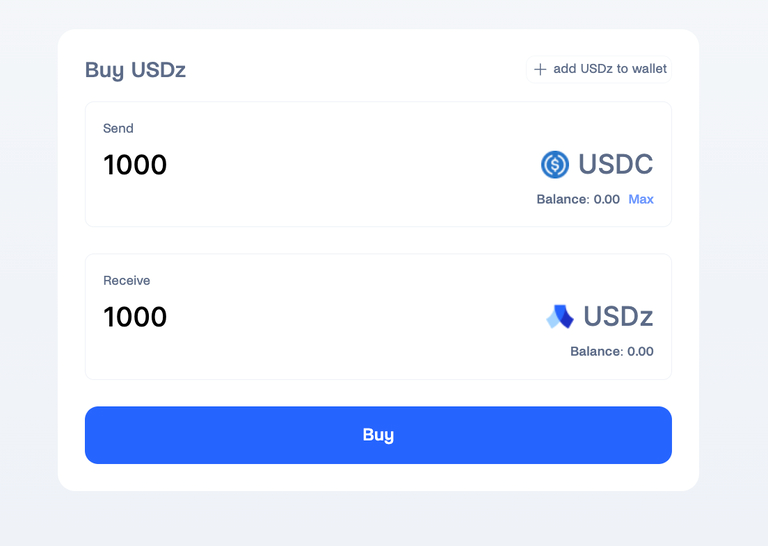

How to Buy USDz?

There are two main ways to acquire USDz:

- Permissionless Liquidity Pools Users can purchase USDz from pools such as USDz–USDC on external AMMs.

- Direct Mint Institutional users who have completed KYC/KYB processes can directly mint USDz by depositing accepted collateral assets.

This structure offers flexibility to both individual and institutional participants.

What is the ANZ Token? What Does It Do?

ANZ is the native token of the Anzen ecosystem and is designed to align incentives within the protocol. ANZ uses a vote-escrow (ve) model. This model draws inspiration from protocols like Curve and Pendle.

When ANZ tokens are locked, veANZ is obtained.

veANZ holders:

- Can direct yield and incentive flows

- Have a say in protocol governance

- Can participate in potential revenue sharing

- Can access certain exclusive products and features

Advantages of the veANZ Model

The veANZ model aims to reward long-term participants:

- Scarcity effect: Locked ANZ reduces circulating supply

- Governance power: Yield direction rights create value

- Revenue sharing: Protocol revenues can be directed to veANZ holders over time

- Resilience to market cycles: RWA-based yields can operate even in bear markets

This structure elevates ANZ beyond being merely a speculative token.

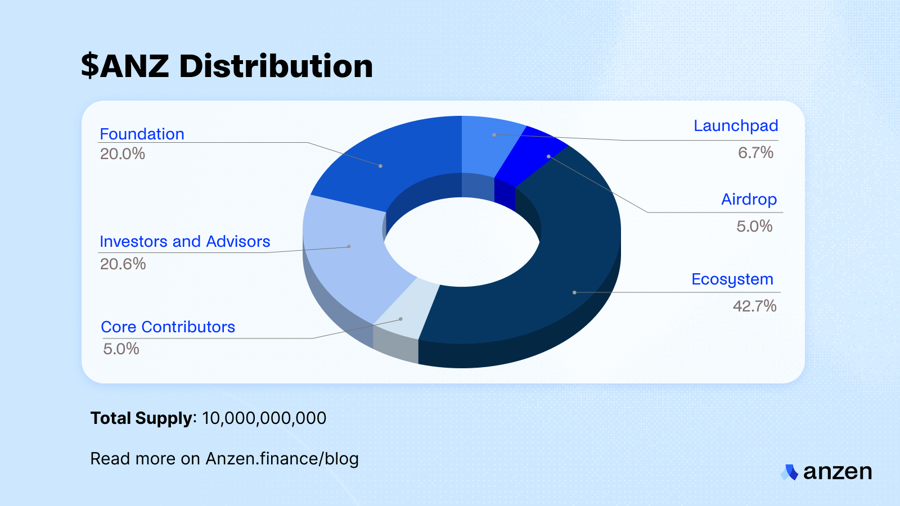

Anzen Finance (ANZ) Tokenomics

The total distribution is as follows:

- Ecosystem: 42.7%

- Foundation: 20%

- Investors: 20.6% (6-month cliff + 24-month vesting)

- Launchpad sale: 6.7% (fully unlocked)

- Community airdrop: 5%

- Core contributors: 5%

ANZ sold out in 7 minutes during the sale held on Fjord Foundry on December 2, 2024.

Market Background: Why is Private Credit Important?

The US private credit market is approximately $8 trillion in size and has historically been fragmented and lacking in transparency. Anzen aims to bring this market on-chain to:

- Increase efficiency

- Enhance transparency

- Bridge DeFi and TradFi

Anzen Finance (ANZ) Backers

Anzen Finance aims to grow its ecosystem with the support of strong and reputable investors in the decentralized finance (DeFi) space. The project has received investments from both crypto-native funds and leading institutions in the sector.

- Mechanism Capital

- Circle

- Frax Finance

- PetRock Capital

- IVC

- Kraynos

- M31

- Arca

- Palmdrive Capital

Anzen Finance (ANZ) Team

Behind Anzen Finance is an experienced team in DeFi and community management. The team prioritizes both the technical development of the protocol and its community-focused growth.

- Ben Shyong – Founder

- Cindy Lin – Community Leader

Official Links

Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels.