Ongoing stagnation in Bitcoin’s price continues to have noticeable effects on the altcoin market. Bitcoin’s prolonged sideways movement within the $85,000–$90,000 range has limited investor risk appetite and suppressed momentum across altcoins. Altcoin Season Index data clearly shows that investors are still heavily focused on Bitcoin, with no broad-based uptrend forming in the altcoin market. This picture indicates a generally cautious market environment, where altcoins are waiting for Bitcoin to establish a clear direction.

Current Status of the Altcoin Season Index

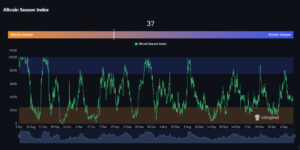

According to the latest readings, the Altcoin Season Index stands at 37/100, clearly signaling that the market remains in a Bitcoin-dominant phase. The index’s failure to gain upward momentum recently highlights a declining appetite for altcoin investments. For context, the index measured 36 yesterday, 41 last week, and 55 last month. This downward trend suggests that investors are reluctant to take short-term risks in altcoins and are instead allocating their portfolios more heavily toward Bitcoin.

From a historical perspective, the index reached its Altcoin Season peak of 78 on September 20, 2025, while its lowest point of 12 on April 26, 2025, clearly reflected a Bitcoin Season. The current level of 37/100 shows that the altcoin market is far removed from its peak periods and that investors remain focused on Bitcoin’s price action.

Positive Divergences in Altcoin Performance

Among the top 100 cryptocurrencies, only 10 altcoins have outperformed Bitcoin over the past 90 days. While Bitcoin declined by -22.85% during this period, the following altcoins showed relative strength:

- BNB: -17.09%

- TRX: -16.47%

- LEO: -17.90%

- NFT: -14.65%

- SKY: -6.28%

Some lower market-cap altcoins recorded sharp gains:

- PIPPIN: +2105%

- BEAT: +2002%

- ZEC: +605%

- DASH: +74%

- XMR: +52%

These figures indicate that although Bitcoin pressure dominates the broader altcoin market, certain projects have managed to stand out positively due to investor interest. Overall, altcoins have delivered limited outperformance relative to Bitcoin, but select projects continue to offer short-term opportunities.

Assessment

Altcoin Season Index data suggests that investors are maintaining a cautious stance and continue to prioritize Bitcoin in their portfolios. Risk aversion remains prevalent across the market, with investors favoring safer and more liquid assets over short-term volatility. Nevertheless, a limited number of altcoins still present short-term opportunities with high return potential.

Projects with lower market capitalization or clearly defined use cases may continue to attract investor interest. However, for a broad altcoin season to return, stronger investor confidence, improved liquidity, and more favorable macroeconomic conditions are required. Without these factors, a sustained rally in altcoins appears unlikely. In short, while overall altcoin market activity remains limited, selective opportunities still exist, making careful and targeted strategies essential for investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.