In the 2025 crypto market, Bitcoin experienced a record-breaking year. Altcoins, on the other hand, showed limited performance and lagged behind Bitcoin. Ahead of 2026, while investors anticipate a broad altcoin bull market, analysts remain cautious. Limited liquidity and differing central bank policies suggest that only projects with strong fundamentals are likely to gain value.

CoinEx Analyst Jeff Ko: Altcoin Season Not Expected

Jeff Ko, Chief Analyst at CoinEx Research, stated that a classic “altcoin season” in 2026 is unlikely. According to Ko, market liquidity will favor only “blue-chip” crypto assets with strong fundamentals and real use cases rather than a broad altcoin rally.

Ko emphasized that retail investors’ expectation that all altcoins will rise together may not materialize, saying, “We do not expect a traditional altseason. Liquidity will be extremely selective.” He added that global liquidity conditions in 2026 will provide limited support, though varying central bank policies could mitigate this effect. Ko also noted that Bitcoin’s historical relationship with M2 money supply weakened after the 2024 ETF launches.

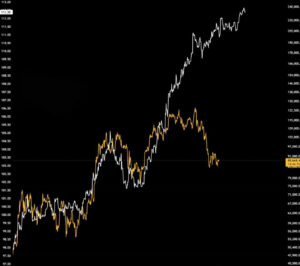

Bitcoin Scenarios for 2026

CoinEx’s base scenario expects Bitcoin to reach $180,000 by the end of 2026. However, opinions remain divided among investors. Veteran trader Peter Brandt presents a more cautious outlook. Brandt reminds that in past cycles, strong Bitcoin rallies were followed by corrections of up to 80%. He points out that the current market cycle is not yet complete, advising long-term investors to remain careful and predicting the next major peak could occur around September 2027.

Brandt notes that Bitcoin’s current volatility offers short-term opportunities but also carries significant risks. Historical cycles, combined with macroeconomic uncertainties and institutional movements, suggest that sharp drops and sudden fluctuations may continue. He emphasizes the importance of closely monitoring both technical indicators and macroeconomic trends.

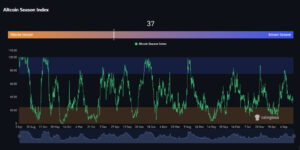

Altcoins Still in Bitcoin Season

Altcoin Season Index data shows that investors are still cautious and largely favor Bitcoin in their portfolios. The current index stands at 37/100, indicating that the market remains clearly in a Bitcoin Season phase.

While a limited number of altcoins still present short-term opportunities and high return potential, a broad altcoin rally will require stronger investor appetite and improved market conditions. Without an increase in overall liquidity and risk appetite, a mass upward movement in altcoins seems unlikely.

Assessment

In 2026, the altcoin market is not expected to experience a broad bull season like previous years. Liquidity will focus only on strong, high-liquidity projects with real use cases. Although Bitcoin may potentially reach $180,000, the risks of decline and selective liquidity conditions require investors to manage their portfolios cautiously. Therefore, rather than expecting a general altcoin rally, it is critical to focus only on strong, liquid projects.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates