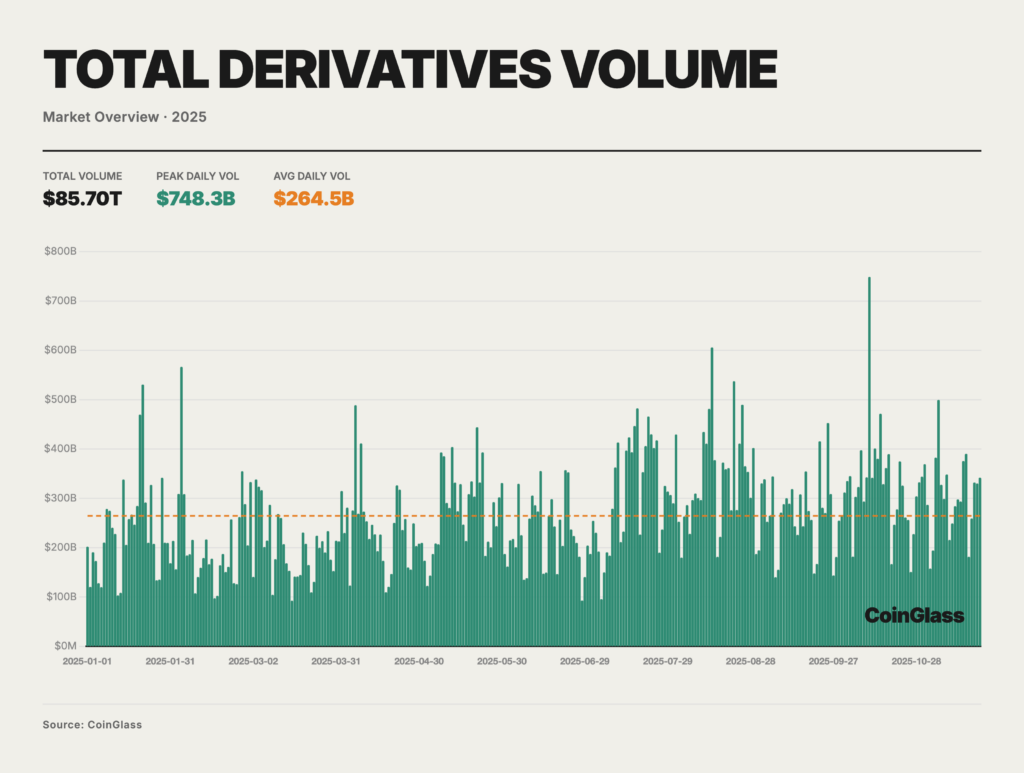

In 2025, total trading volume in the crypto derivatives market reached $85.7 trillion, while average daily turnover stood at approximately $264.5 billion. Trading activity followed a clear “low start, strong finish” pattern, reflecting tight macro liquidity in the early months of the year and a sharp recovery in risk appetite during the second half.

Centralized exchanges remained the primary venue for price discovery and risk management across major crypto assets. At the same time, market structure continued to narrow, with liquidity and leverage increasingly concentrated among a small number of dominant platforms. This shift aligns with the partial easing of global liquidity conditions in the second half of the year, which reignited demand for leveraged trading strategies.

Derivatives Trading Concentrated Among Four Major Exchanges

More than 60% of total derivatives volume in 2025 was executed on just four platforms. Binance, OKX, Bybit, and Bitget emerged as the core drivers of liquidity, leverage, and user asset concentration across the market.

Binance alone accounted for $25.09 trillion in annual derivatives volume, representing over 29% of global market share. Behind Binance, second-tier competition remained relatively balanced. OKX, Bybit, and Bitget recorded annual trading volumes ranging between $8.2 trillion and $10.8 trillion, with average daily volumes between $25 billion and $33 billion. Together with Binance, these platforms controlled approximately 62.3% of total market activity.

OKX ranked second with a 12.5% market share, followed by Bybit at 11%, and Bitget at roughly 9.5%.

Why It Matters

This level of concentration indicates that pricing power in the crypto derivatives market is increasingly controlled by a limited number of exchanges. While deeper liquidity benefits large platforms during high-volatility periods, smaller exchanges face a greater risk of price dislocations and thin order books.

High-volume trading days consistently exceeded annual averages throughout the year. On October 10, single-day derivatives volume peaked at approximately $748 billion, far above normal levels. Monthly averages hovered near $200 billion in the first quarter before accelerating in the second half, surpassing $300 billion during July–August and October.

Open Interest Hits Record Highs Before Q4 Shakeout

Open interest (OI) data highlighted the fragility of the market’s high-leverage structure. Aggressive deleveraging in the first quarter pushed total OI down to $87 billion. This was followed by a rapid rebuild in leverage, with OI reaching an all-time high of $235.9 billion in early October.

During the fourth quarter, roughly $70 billion in positions were wiped out. Despite this drawdown, year-end open interest still closed 17% higher than at the start of the year. Binance continued to dominate leverage concentration, holding nearly 28% of daily average OI, while the top five exchanges controlled more than 80% overall.

Liquidity and Custody Power Centralized

Liquidity depth data confirmed that dominance extended beyond raw volume. Binance’s Bitcoin order book depth far exceeded all competitors, while OKX ranked a clear second, particularly for institutional-sized trades.

Custodial concentration proved even more pronounced. Binance held over 72% of total custodial assets, pushing the Herfindahl-Hirschman Index (HHI) to 5,352, a level signaling extreme oligopoly conditions. Other platforms shared a significantly smaller portion of user-held assets.

Liquidations and Systemic Risk Peak in October

Total liquidations in 2025 approached $150 billion, most of which reflected routine market activity. However, systemic stress was heavily concentrated around October 10–11.

Following a major macro shock linked to new U.S. tariffs on China, combined liquidations exceeded $19 billion in a single day. Elevated leverage, crowded long positioning, and strained liquidation mechanisms amplified volatility, particularly across altcoins. While Bitcoin and Ethereum experienced relatively contained drawdowns, many smaller assets suffered sharp collapses.

Outlook

The 2025 data confirms that growth in crypto derivatives continues, but with risk increasingly centralized across a handful of platforms. As liquidity, custody, and leverage concentrate further, the potential for cascading effects during macro or regulatory shocks rises. If this structure persists, 2026 may bring heightened regulatory scrutiny and more frequent platform-level stress testing.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.